This is the third piece in my series about Restaking, which started with a focus on EigenLayer, to then dive deeper into the landscape of Restaking Finance.

Since then, we have seen the emergence of new players in the space, such as Kelp DAO, Renzo, and $RSTK, which have attracted increasing attention.

Restaking seems to be positioned to be one of the main narratives driving 2024. However, while many talk about how restaking works, and its benefits, it’s not all rosy.

This article aims to take a step back and analyze Restaking at a higher level, highlighting risks and answering the question: is it really worth it?

Let’s start with a quick intro to the subject.

What is restaking?

Ethereum’s Proof of Stake (PoS) serves as a decentralized trust mechanism, where participants commit their stake to secure the Ethereum network.

Restaking is the idea that the same stake used to secure the Ethereum PoS can now be used to secure many other networks.

Restaking can be interpreted as programmable staking, where users opt-in to any positive or negative incentives to secure other infrastructure.

In practice, EigenLayer restakers supply economic trust (in the form of staked eth), so that anything objectively verifiable can be slashed.

Would you, Eth staker, like to opt into additional

slashing conditions on other chains?

EigenLayer is “modularizing” the decentralized trust of Ethereum so that AVS services can leverage it without the need to bootstrap their validator set, effectively lowering the barriers to entry in this market.

Typically, such modules require actively validated services that have their own distributed validation semantics to do verification. Usually, these actively validated services (“AVS”) are either secured by their own native token, or are permissioned in nature.

Why would anyone do this?

Simply put it, is because of economic incentives and yields.

If Ethereum staking yields hover around 5% annually, restaking could offer an enticing additional yield.

It’s not currently possible to provide an estimate of these rewards, as they will depend on demand and supply dynamics on the Eigen Marketplace.

However, this translates into additional risks for stakers.

Aside from the inherent risk of leveraging their staked ETH, when users opt-in to restake your tokens, they are essentially entrusting to the EigenLayer contracts the authority to slash their stake in case of errors, double signing, etc. on any of the AVS they secure.

As such, restaking adds a layer of risk, as restakers could get slashed on ETH, on the restaking layer, or both.

Is the extra yield worth restaking?

R(isk)-Staking

For stakers, restaking means that you can decide to opt-in to as many networks as you wish, and boost your yields, hence why EigenLayer refers to itself as “the Airbnb of decentralized trust”.

It’s not all roses though.. as restaking adds some notable risks:

ETH must be staked (or LSTs - hence not liquid)

EigenLayer smart contract risk

Protocol-specific Slashing conditions

Liquidity risks

Concentration risks

De-facto, by restaking users are leveraging a token that is already exposed to risks (due to staking), and adding additional risks on top of it, ending up with layered risks looking like:

Furthermore, any additional development of primitives on top of those would add even more complexity and additional risk.

Aside from the individual risk of restakers, the Ethereum Developer community has also raised issues concerning Restaking, notably in the famous Vitalik article about not overloading Ethereum consensus. The issue with restaking is that it opens up new avenues of risk for staked Eth that secures the mainnet, it destines a part of it to secure other chains (as opted-in by stakers).

Consequently, if they misbehave according to other protocol rules (which could have bugs or weak security), their deposit gets slashed.

The debate is very actual with the devs and EigenLayer trying to find a way to coordinate efforts and make sure that Ethereum is not weakened by these technical advancements.

Repurposing the most important “layer”, securing Ethereum, is indeed not an easy feat.

Furthermore, a key aspect in this regard is the level of risk management allowed for restakers.

Many Restaking projects give the whitelisting process for AVS into the hands of their DAOs. However, as a restaker I would want to personally vet and decide which AVS to restake to, to avoid being slashed by malicious networks and reduce the possibilities of new vectors of attack.

All in all, restaking is an interesting new primitive worth researching.

Nonetheless, the concerns of Vitalik and others are not to be minimized. When talking about restaking it’s important to bear in mind how this affects the security model of Ethereum mainnet.

It is, however, fair to contextualize restaking as offering an extra level of risk on top of one of the most important mechanisms securing Ethereum.

In the end, whether restaking is worth it or not is an individual choice.

Restaking Risks:

Collusion risk, many operators could attack a set of AVS at the same time and compromise security

Slashing risk: users restaking are subject to slashing penalties from both ETH and AVS

Single point of failure: receives withdraw credentials from eth credentials (systemic risk for mainnet)

Centralization risk for validators

Adds additional risks to the stake securing Ethereum

Institutional Appeal

Perhaps surprisingly, many institutions have signaled their interest in restaking as an additional reward on top of staked Eth.

Nonetheless, they will probably carry out restaking through their custodians rather than joining any other service which might expose them to additional risks of slashing.

Given the risk highlighted before, whether the highest interest for restaking will come from retail or institutions will be interesting.

An additional yield on top of the native Eth staking is appealing for those already involved in it but it’s not a life-changing yield for degens, given the risks.

This opens up new use cases for Ethereum as a financial instrument.

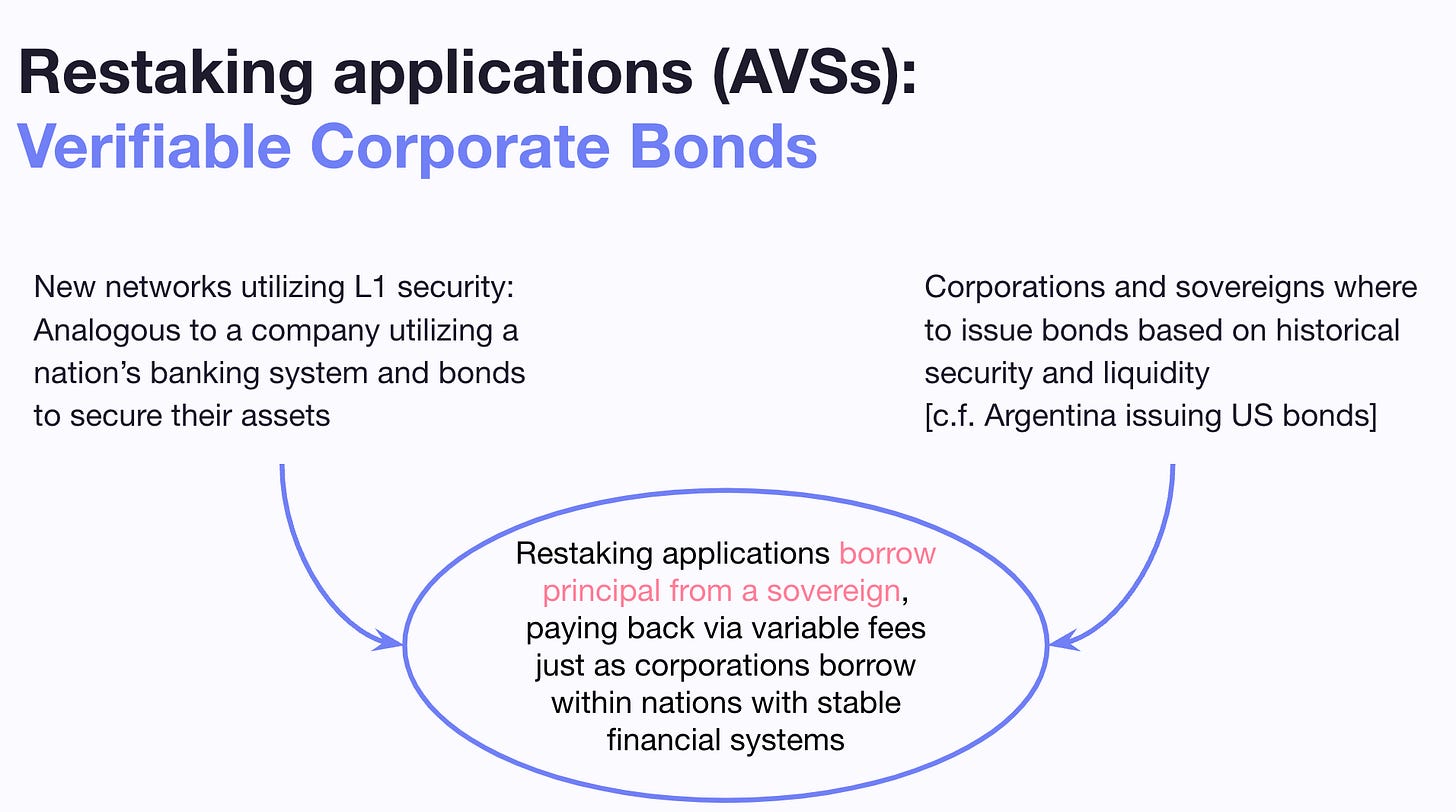

A particularly interesting comparison is made, comparing restaking applications to “corporate bonds”.

New networks want to get L1 security, similar to how companies or nation-states use their financial systems to create bonds and secure their assets.

In crypto, Ethereum is the widest and most liquid network and probably the only one that could sustain this type of market — and the most secure from a similar point of view of nations states in the TradFi economy.

Those interested in getting deeper into this can refer to:

For now, most interest in restaking seems to be driven by speculations on the EigenLayer airdrop, which might just be the biggest airdrop ever in the history of crypto.

How the dynamics will change after the airdrop?

Perhaps a practical r/r analysis might then push some to other avenues which might be more fruitful.

I would go as far as to argue that a high % of capital deposited in restaking is mercenary capital, which might then leave post-airdrop.

Separating the speculative component will be fundamental to assessing the real interest that users have in this new primitive.

Personally, the restaking narrative is a bit oversold IMHO, with very present risks that have to be evaluated carefully.

Key Takeaways

Thanks to restaking AVS have lower cost barriers to kick-start when they can leverage Ethereum’s highly robust security layer

Users benefit from increased capital efficiency by having the option to restake their ETH, in turn receiving more staking rewards

Restaking adds additional risk on top of other risks

Restaking is an exciting primitive that can spur a novelty of use cases.

While full development of the Eigen marketplace will take place in about a year, there are already a few interesting restaking experiments being explored.

Some concerns raised by Vitalik are related to the centralization of staking power, at the expense of solo staking.

It will be interesting to observe how EigenLayer will team up with the Ethereum Foundation to address those.

But aside from those, other issues remain.

What can we do to mitigate these risks?

Some of the solutions to mitigate the risks of restaking involve the optimization of the parameters of restaking (TVL caps, slashing amounts, fee distribution, min TVL, etc.) as well as ensuring the diversification of the funds across AVSs.

An immediate step that restaking protocols can take into consideration is to allow users to select different risk profiles when depositing for restaking.

Ideally, each user should be able to assess and select which AVS to restake to, without having to delegate the process to a DAO.

This needs to be the product of joint efforts across AVSs and EigenLayer, to make sure there is a roadmap in process to minimize those risks.

The EigenLayer team is already working with the Ethereum Foundation on further alignment and making sure that restaking does not add system risks to Ethereum, Liquid Staking Tokens, or AVSs leveraging it.

More on Restaking:

https://twitter.com/ChainLinkGod/status/1736897325820457018

https://twitter.com/francescoweb3/status/1706238268898177139

https://twitter.com/francescoweb3/status/1708776352898527489