The development of restaking as a new paradigm has opened the doors for innovative use cases. One such innovation is the “Liquid Restaking Tokens” or LRTs.

In essence, LRTs are to restaking what LSTs are for staking.

In my previous article from last week, I introduced the concept of Restaking:

To recap briefly, restaking allows funds that secure Ethereum’s Proof-of-Stake (PoS) to be repurposed to simultaneously secure other networks.

This presents dual benefits:

Protocols can benefit from enhanced and cheaper security from Ethereum’s decentralized trust layer, without bootstrapping their validation set from scratch. Restaking also offers them full flexibility on the way they want to develop their architecture.

Users can benefit from increased capital efficiency and yields on their stack (to compromise for the increased risk of slashing). Additionally, by opting in to secure other networks, they could reap benefits like possible airdrops.

However, there’s a catch: securing other networks requires users to lock their staking collateral (either ETH or LSTs). This renders them non-liquid and non-tradable, leading to opportunity costs for stakers.

How do LRTs help solve this problem?

At their core, LRTs act as proxies for assets staked via the EigenLayer restaking contract.

What are their benefits?

Liquidity: they convert restaked positions into liquid tokens that are tradable and can be used as composability blocks in other DeFi protocols

Flexibility: users can exit their restaking positions at their discretion.

Exposure: users can be exposed to multiple protocols, multiplying yields.

Simplicity: the management requirements to opt-in manually and monitor positions are streamlined and simplified.

Possible Airdrops: for protocols leveraging restaking (bridges, oracles, DA protocols)

Modules leveraging restaking will have to compete to incentivize restakers through incentives. We could witness a similar dynamic to what's currently observed with LSTs, accompanied by the emergence of new tokenomics models.

LRTs could significantly influence DeFi TVL and Ethereum's stake utilization across numerous networks.

There are several reasons to be enthusiastic about LRTs.

First and foremost, yield is king.

After a long period of drought, the prospects of a new source of yield are appealing. LRT is one of the first primitives for Restaking, built on top of it to further streamline and simplify it.

Many are willing to compromise the increased risk for the prospected yields while having their stake liquid.

LRT Protocols

Let’s get more practical, and focus on protocols that are already carving out their niche in the LRT domain:

Stader Labs (rsETH)

InceptionLST

Astrid Finance

RestakeFi

Stader Labs

rsETH represents “underlying assets staked with Stader’s LRT contracts”.

https://twitter.com/staderlabs_eth/status/1693645959480348857

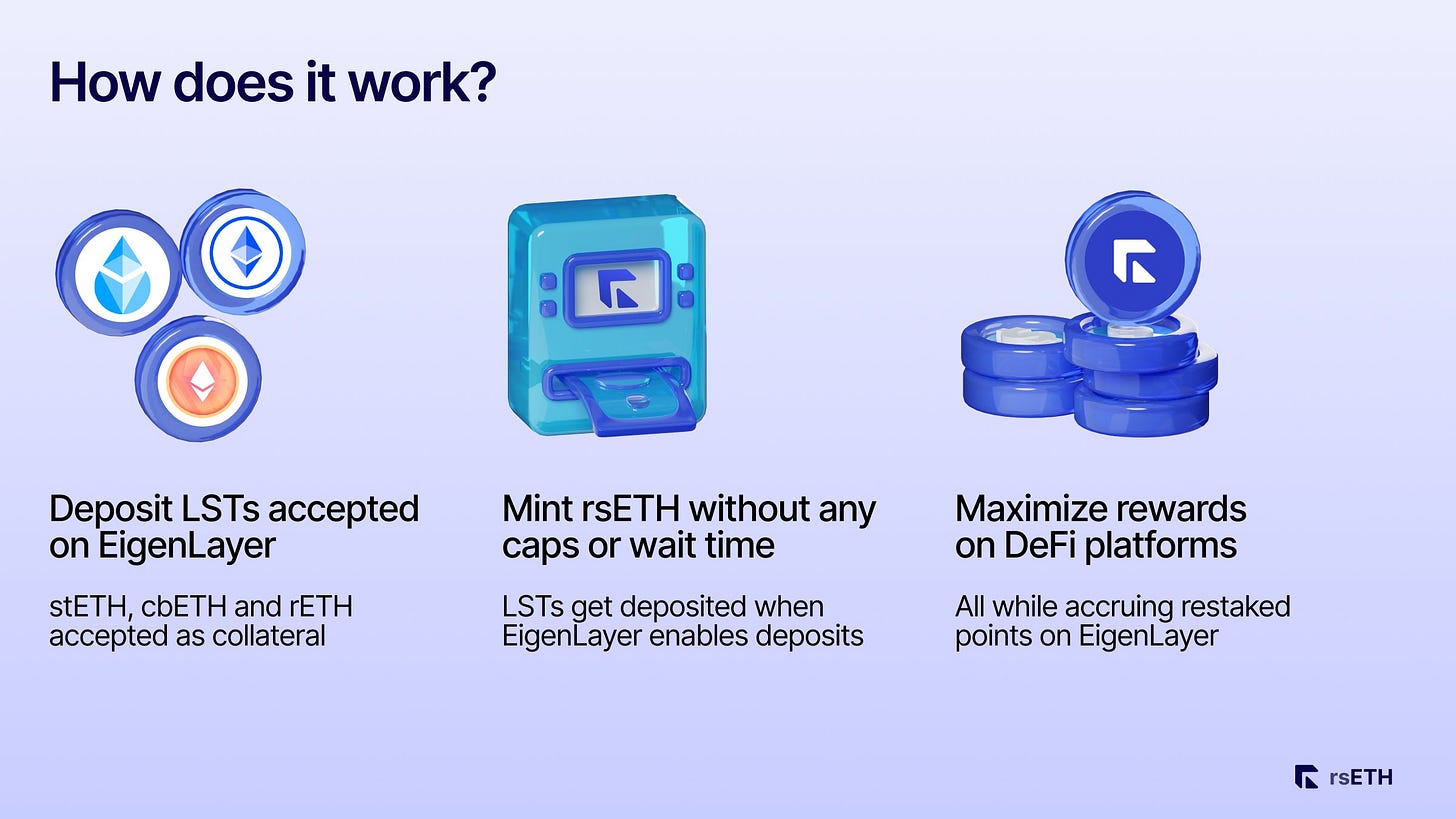

How will rsETH work?

rsETH is explicitly designed for LSTs.

Users can simply deposit their LST compatible on EigenLayer (currently stETH, rETH, or cbETH) and mint rsETH.

The deposited LSTs are then deployed on EigenLayer

Users can trade/redeem/leverage their rsETH tokens to maximize rewards across DeFi (while also accruing EigenLayer restaking points) using a single token.

rsETH is currently live on testnet and the contracts are being audited.

Who is the main user of $rsETH?

Each LRT protocol will support different networks.

For the case of StaderLabs, the process of selecting validators and services for restaking ETH will be championed by the LRT DAO.

Stader has also mentioned their interest in eventually making this process permissionless. Currently, the process relies on trusting the LRT DAO to make the best decision for users as well as adopting a thorough due diligence process when selecting which networks to support.

Stader already carried out a call-to-action on their governance forum for restaking operators and services.

https://forum.staderlabs.com/t/stader-s-lrt-rseth-call-to-action-for-restaking-operators-and-restaking-services/875

InceptionLST

InceptionLST is a protocol built on top of EigenLayer that allows users to restake their LST on L1s and L2s.

https://twitter.com/InceptionLST/status/1704516211311304843

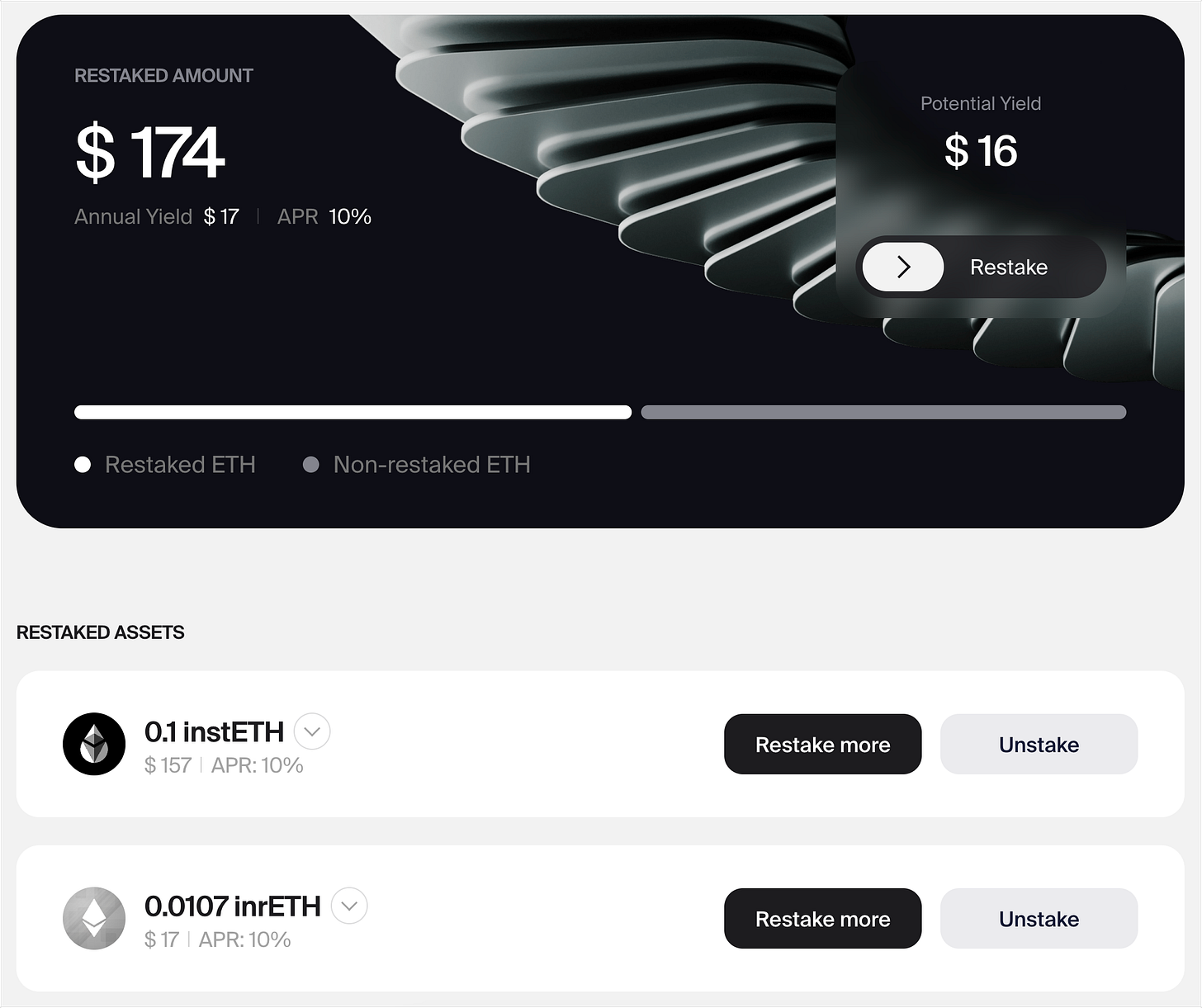

Inception has developed a solution tailored to the different LST preferences of users, with their instETH and inrETH tokens.

The LSTs deposited will be deployed across different pools, periodically rebalanced to streamline returns.

They are currently working around the best criteria to guide them on the decision-making of which Node Operators or Actively Validated Service to restake to.

In their own words, they also put a strong focus on security and their final goal to “align with the Ethereum Foundation's vision of a secure and decentralized future”.

This is exemplified in their commitment to share a portion of their AVS rewards to incentivize solo validators.

Inception is also planning to launch its native token ING.

The token will serve as:

Governance layer to participate in the selection of node operators to boost LRT rewards.

Incentives via liquidity mining, gauges, referrals, airdrops, and gauges.

InceptionLST is particularly wary of slashing risk for users, focusing on having the best restaking yields and slashing protection, while allowing users to be liquid within DeFi, thus increasing capital efficiency.

Inception is currently live on testnet, here’s a look at their UI:

Astrid Finance

Astrid protocol is live on testnet and currently supports stETH and rETH.

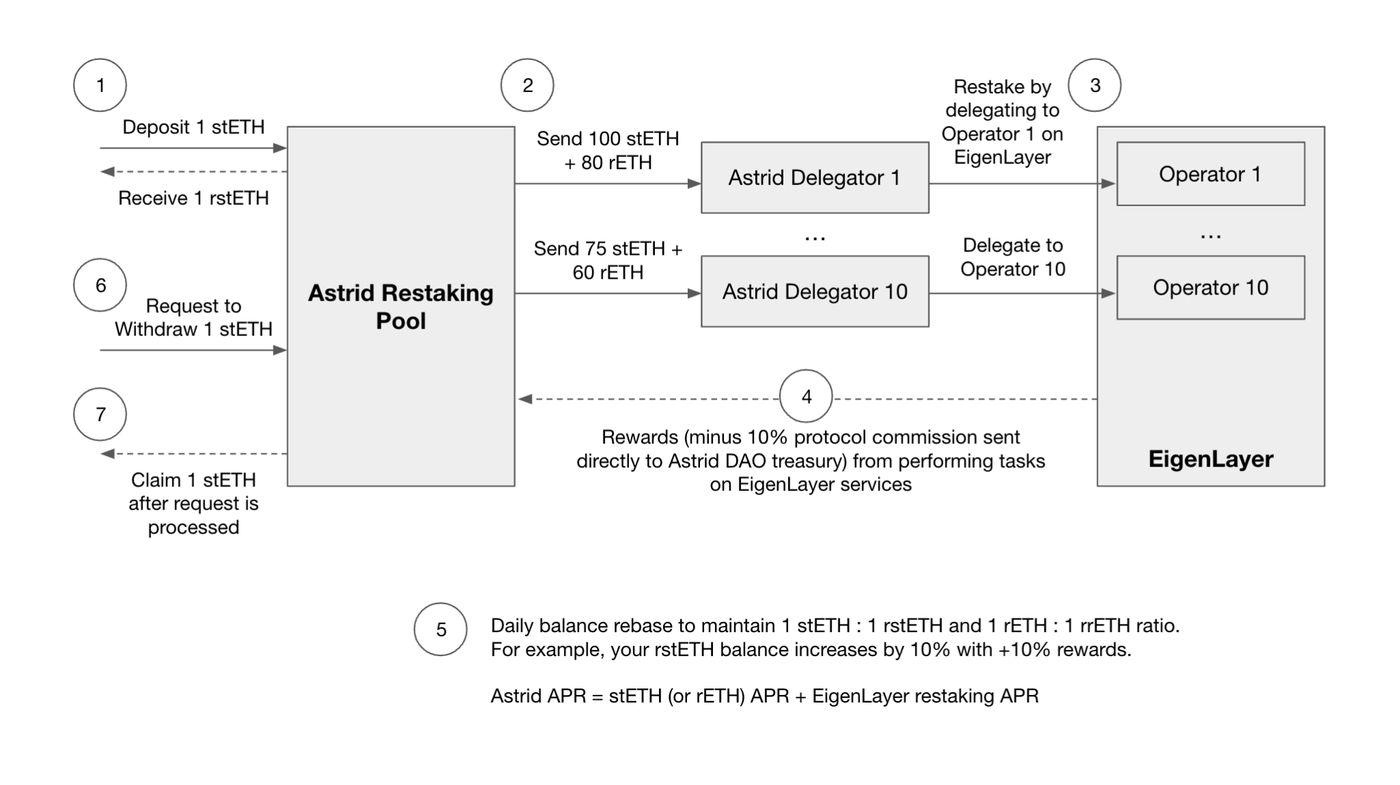

Users can deposit LSTs in the restaking pool and receive Astrid liquid restaked tokens: rstETH or rrETH.

The pooled LSTs are “delegated across multiple operators for diversification and rewards” maximization.

The rewards are then compounded and distributed through a rebase so that users will see their balances adjusted automatically.

Here’s a sneak peek of their architecture:

Astrid’s value proposition is similar to other LRT protocols: to allow users to obtain instant liquidity and diversify their rewards across multiple protocols.

As the protocol is already live on testnet, Astrid has about 1312.9056 stETH and 300.7143 rETH in TVL, with 930 total rstETH holders and 366 rrETH holders.

Currently, their focus is on undergoing audits on their product before launching on mainnet.

To incentivize beta testers they are currently running two guild.xyz campaigns.

Restake Finance

Restake Finance is a protocol that offers modular liquid staking for EigenLayer.

Users can deposit LST (stETH) into Restake Finance in exchange for rstETH, Restake Finance's tokenized version of restaked Ethereum.

Similar to what we have seen before, it is a yield-bearing rebasing token, allowing holders to earn EigenLayer native rewards.

Behind the hood, the LSTs are sent to EigenLayer through a smart contract controlled by the Restake Finance DAO.

The DAO aims to ensure that the project remains decentralized and steward it in the long term. As such, rstETH will also have governance power over the future course of the protocol.

The current TVL of Restake Finance is 354.27 stETH, over $550k.

Users of Restake Finance will be able to decide which modules they want to opt-in for their Restaking, after an initial phase where rstETH will validate all EigenLayer modules by default.

Although this is positive as it allows user to manage their own risk, it sort of counters the value proposition of ReFi protocols, which is to allow users to have a more passive management of their deposits.

Is Liquid Restaking Worth?

Restaking can be a complex endeavor, which requires the active management of multiple assets across networks.

While all of these protocols can provide value for restakers, in terms of rewards, costs involved, and active management, users should be aware of some additional risks:

Security Risks: overall restaking itself increases the surface for slashing and other potential bugs.

Counterparty risk: opting in to secure other networks carries an inherent risk of exposure to third parties

LSTs already incur some third-party risk, restaking them will only leverage that and increase the risk surface.

Smart contract risks: every new network secured increases the smart contract risks to which a user stake is subject. Different networks will have different slashing logic and some of the contracts might also have bugs or other issues.

Leaving to a third party (in this case an LRT protocol) the choice of which protocols to secure with restaking also raises concerns over their due diligence process about which protocols to support as well as their security processes. How do these protocols select which networks to include in their restaking? Inevitably some of these processes will start centralized and progressively move towards decentralization Some LRTs protocols have mentioned delegating this process to their DAO.

De-pegging risk: this is valid both for LST and for LRT.

Slashing risks: it’s once again important to select trusted providers to avoid slashing.

At least some of these concerns are similar to those of LSTs: given LSTs' current TVL of over $20b, it seems many are willing to navigate these risks.

Even if users deposit LSTs and not native staked Eth, they are still securing other networks with different slashing conditions which could impact their stack.

For LST restakers, the slash will happen on the rewards coming from node operators and not on the LSTs themselves. So they only have fewer rewards, but nothing happens to the LSTs.

Node Operators could get slashed, and if an LST restaker chooses that Node Operator, consequently he will also get a small slash.

As always, whether those risks are worth it or not, depends on the end user.

What’s sure is that more Restaking solutions will be developed, and I’ll be watching with interest.

I am particularly interested in how those risks will be mitigated and how restaking can align with Ethereum to reduce the concerns associated with it.

.