The Current State of NFT 2023

In the dynamic and often unpredictable world of digital assets, Non-Fungible Tokens (NFTs) have been a subject of intense debate. Once hailed as the next big revolution in the art and collectibles market, NFTs have seen a drastic shift in public perception.

With many being very adamant in declaring NFTs dead, this article delves into the current state of NFTs, backed by analytics and market trends.

I hope no one here relies on them for their NFT news — looks like a bottom signal to me.

While the crypto market seems to have rebounded lately, fueled by the Bitcoin ETF and Bitcoin Halving expectations, the NFT market seems to lagging, given the lack of a strong catalyst.

Perhaps the only necessary catalyst is making sure that NFTs are not dead anymore, and will, eventually, come back to hype.

NFT = Not Fun Times

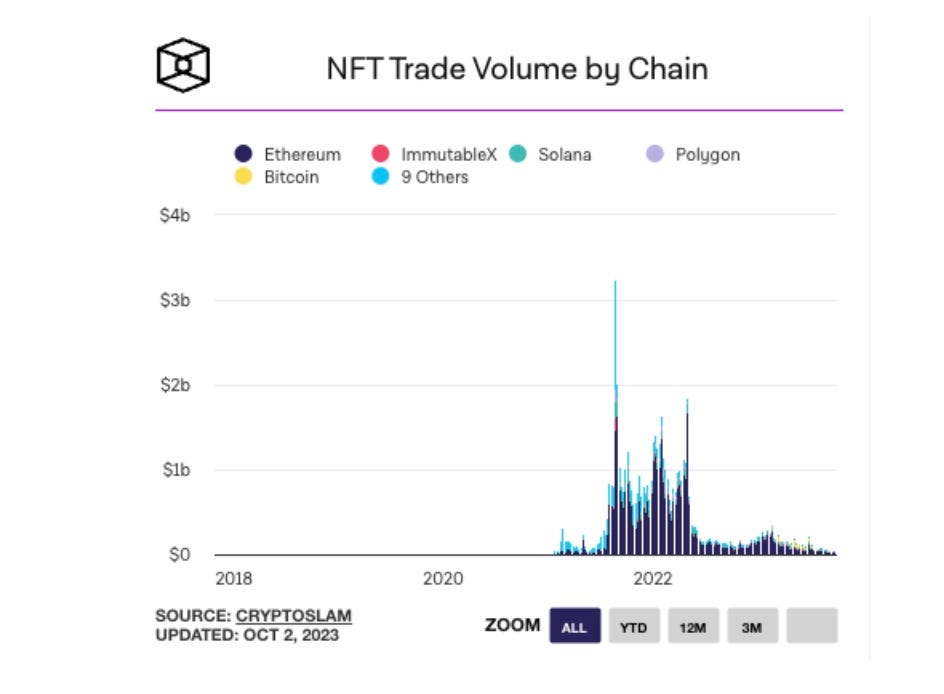

I mean - are NFTs drastically traded less compared to 2022? YES.

Are they dead? Probably that’s a bit of a stretch.

By definition, NFTs are on-chain and therefore live forever.

You just can’t kill them bruv.

Nonetheless, it would be intellectually dishonest not to mention that we are far from the glory days of NFTs and we have to acknowledge the significant downturn in sales volume and public interest of the past year.

The NFT decline is undeniable: during this time NFT high-profile sales have dwindled, and the market saturation (with countless new NFT projects deploying) has led to consumer fatigue.

What are the main issues with NFTs?

At the heart of the NFT downturn are a few core issues:

Empty Promises of new projects: 99% of new projects deploying in the market were doing so trying to capture the NFT hype. Much like the "shitcoins" of 2018, a large number of NFT projects were built on hype with little substance or long-term vision, leading to their inevitable decline.

Blue-chip projects are having a hard time reinventing themselves into global brands: following the success of their NFT collections, several blue-chips are now struggling to reinvent themselves and deliver value to holders.

The comparison between NFTs and the “shitcoin craze” of 2018 is not unfounded. Many NFT projects lacked clear use cases or utilities, functioning more as speculative assets than sustainable digital goods.

This led to a bubble that, when burst, left many investors with worthless assets.

Another Crowd

While the line was often blurred, the NFT people are another crowd compared to crypto degens. They have different ethos and different reasons to be in the sector.

Generally, NFT people are much less involved in the ideological aspect of the sector and much more focused on the artistic and economic one.

Furthermore, many scammers found NFTs to be the hype of the moment, and just like previous trends (multilevel marketing, dropshipping, etc.), they were jumping on the wagon.

This is also proven by the myriad of influencers who have started to promote scams (or make their own) just to make a quick buck, notably Kim Kardashian, Mayweather, Paul Logan, and more.

As such, the standpoint is that we can’t consider NFT people to be part of the crypto community, but to be an external sub-set with different reasons to join the sector.

Nonetheless, we also must acknowledge how NFTs have indeed empowered artists worldwide — which is a positive.

Challenges for Blue Chip Projects

Even the so-called "blue-chip" NFT projects have struggled. These projects, once at the forefront of the NFT boom, are now grappling with an uncertain future.

The challenges they face are multi-faceted:

Uncharted Territory: Many of these projects are in uncharted waters, trying to navigate a market that is constantly evolving and whose future is unpredictable.

Evolution Challenges: Evolving from a simple NFT project to something more substantial, like integrating gaming or other utilities, has proven difficult. Where should the focus lie?

Complexity and Loss of Interest: Some projects, like Otherside and DeGods, have made the process overly complicated, leading to a waning interest from the public.

A couple of examples that we can use to exemplify this dilemma are the Bored Ape Yacht Club (BAYC) and the DeGods.

Bored Ape Yacht Club (BAYC)

BAYC needs no introduction, together with Cryptopunks, Apes are one of the most iconic and representative NFT collections.

The BAYC started with a collection of 10000 Bored Apes.

Then, the project airdropped a Mutant Ape (MAYC) and a little dog companion to BAYC holders — essentially giving thousands of $$$ in airdrops to holders.

However, the airdrop strategy does not work forever. In fact, by launching a new collection you are effectively diluting the total supply of the whole collection.

While BAYC was a collection of only 10000 NFTs- now there are 10000 dogs and 20000 MAYC. Furthermore, each of them is now airdropped an Otherside plot (with a total supply of over 100k). Each Otherside plot, now also creates fragments. And let’s not forget about the HV-MTL collection (of 30000 units).

The post-NFT direction taken by BAYC is focused on two main verticals:

Gaming

Lifestyle (as a global lifestyle brand e.g. BAPE, Supreme)

However, with this division comes increasing difficulty and efforts required by holders to be up to date and follow everything.

For instance, users were expected to develop their Otherside plots through daily efforts — personally, as a holder, I gave up and simply haven’t been following.

What was then a simple community is now evolving into an increasingly complex and fragmented ecosystem.

Furthermore, an issue was raised with the gaming competitions created by BAYC: is this really community-focused if they expect us to hire pro players only to be able to win these internal competitions? What about the normal people who didn’t make it with NFTs and have a normal life to deal with? Are they going to be permanently excluded from any win?

It feels like the project is moving away from its origins, and neglecting its core community.

Another example is the Legends of Mara, yet another stand-alone experience connected to the Otherside.

Furthermore, users have been waiting for more than a year for news on the Otherside, with many eventually giving up and leaving the community.

When is too much too much? going to stop?

Expanding their cinematic universe is on the one hand a great tool to expand participation from a broader public. However, it can also have the opposite effect, weakening the core values of the initial and main collections of BAYC and thus threatening the very community foundations of the project.

With projects not having a clear idea of how to move forward, and with important investments from VCs (a16z invested $1b in BAYC) many have expressed worries that the BAYC will never be what it used to be and that it will eventually turn into Mr. Hyde: a Web2 Behemoth.

DeGods

Things are even worse from DeGods, in this case, less due to ecosystem expansion and more so because of strategic decisions by the team.

What was once one the best and most promising projects on Solana is now a project synonym with confusion and incompetence.

Here’s more or less a summary of what happened:

DeGods released their second collection, y00ts, promising a revolutionary system of points, citing Steve Jobs and positioning themselves as somewhat like the new Apple of NFTs;

DeGods eventually left Solana (their home base), after the FTX collapse and moved DeGods to Ethereum and y00t to Polygon (because they got a grant);

This was honestly a big betrayal to the community who had supported them since the beginning and drove their price from 3 SOL to over 10 ETH;

This was the top for DeGods, everyone was talking about how they were the new BAYC, and how DUST, their token (and the company behind it) would have been precious in the future;

Fast forward a few months, and nothing even remotely valuable has come off Dust Labs, with a reflection in the DUST price

DeGods announced a plan for an aesthetic revamp: DeGods season 3, due August 9th, 2023.

As part of their marketing, DeGods leveraged their preferred strategy: overpromise, delay, and underdeliver.

Season 3 was highly anticipated and drove DeGods volumes to new highs.

However, things quickly turned out dire.

What would season 3 entail?

The migration of y00ts from Polygon back to Ethereum (admitting a big L - who tf would host their NFTs on Polygon - aside from doing so because of a grant?)

The Art downgrade of DeGods: greater simplicity, removal of unwanted traits. However, coming with a twist, users had to pay 333 DUST (about $450 at the time) to downgrade their DeGods (some might say, finally some utility to the DUST token).

However, in reality, this is like saying “This is our third attempt to make the DeGods” art right because we didn’t manage to convince our community with our previous attempts”

They also introduced a Point Parlor, where users could stake their Season III DeGods to get points and win rewards and prizes.

Here’s some prized for the Point Parlor: sure those are nice but I am not sure 10,000 DeGods holders will be happy for a few dozen good prizes.

Like many other collections, DeGods holders elevated Frank, their founders, up to a mystic figure with business acumen and Steve Jobs-like potential for the brand.

This is also evident from the Messiah way that Frank spoke.

Nonetheless, we’ve already seen how overly reliance on a god-like founder has never delivered anything good.

Season III sparked a lot of debates and controversy.

What the team promised was never really achieved in reality, leaving a big gap between promises and execution.

As a result, they eventually lost over 50% of their value in just over a week.

Anyway, the DeGods example teaches us the importance of underpromising and overdelivering and not the other way around.

If you act like a messiah and then don’t deliver, the cards will eventually turn. The DeGods team has shown more than once that they were all over the place with their roadmap and plans. They went back and forth on the art, and never really crafted a long-term way forward.

Every new update would in some way touch back some of the art of dynamics of the collection. Furthermore, they failed to capitalize on Dust Labs and DUST - a big missed opportunity.

Last but not least, this IMHO was exacerbated by the behavior of their founder, who reluctantly ever acknowledged their fuck up.

While I might sound biased I am not really - I had high expectations for DeGods and even hold some DUST, and I am in first person very disappointed with what happened with the execution.

Both of these blue-chip examples highlight how sometimes, the simpler way is the best.

Overcomplicating often makes things.. well.. too complicated.

On NFT Marketplaces

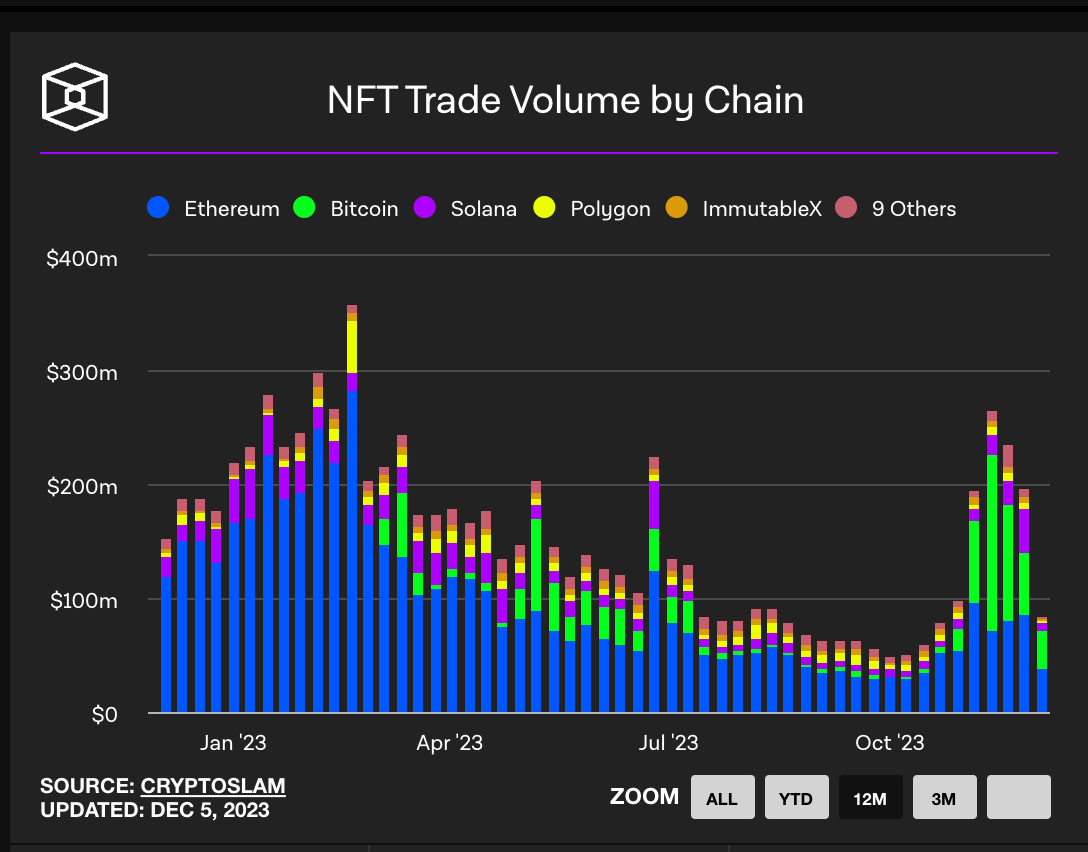

After discussing how blue-chips projects are struggling to create the next wave of development for their projects, let’s dive into the marketplace data.

Are NFT volumes declining?

Is anyone even buying NFTs at the moment?

We do so by analyzing both Ethereum and Solana NFT marketplaces.

Starting from the monopoly of OpenSea, the leading platform for NFTs, Ethereum has had its own set of challenges and developments concerning NFTs.

Marketplaces on Ethereum are adapting to changing consumer preferences and the evolving nature of NFTs. These platforms are working to address issues of accessibility, scalability, and environmental concerns.

In particular, marketplaces have been involved in two major trends:

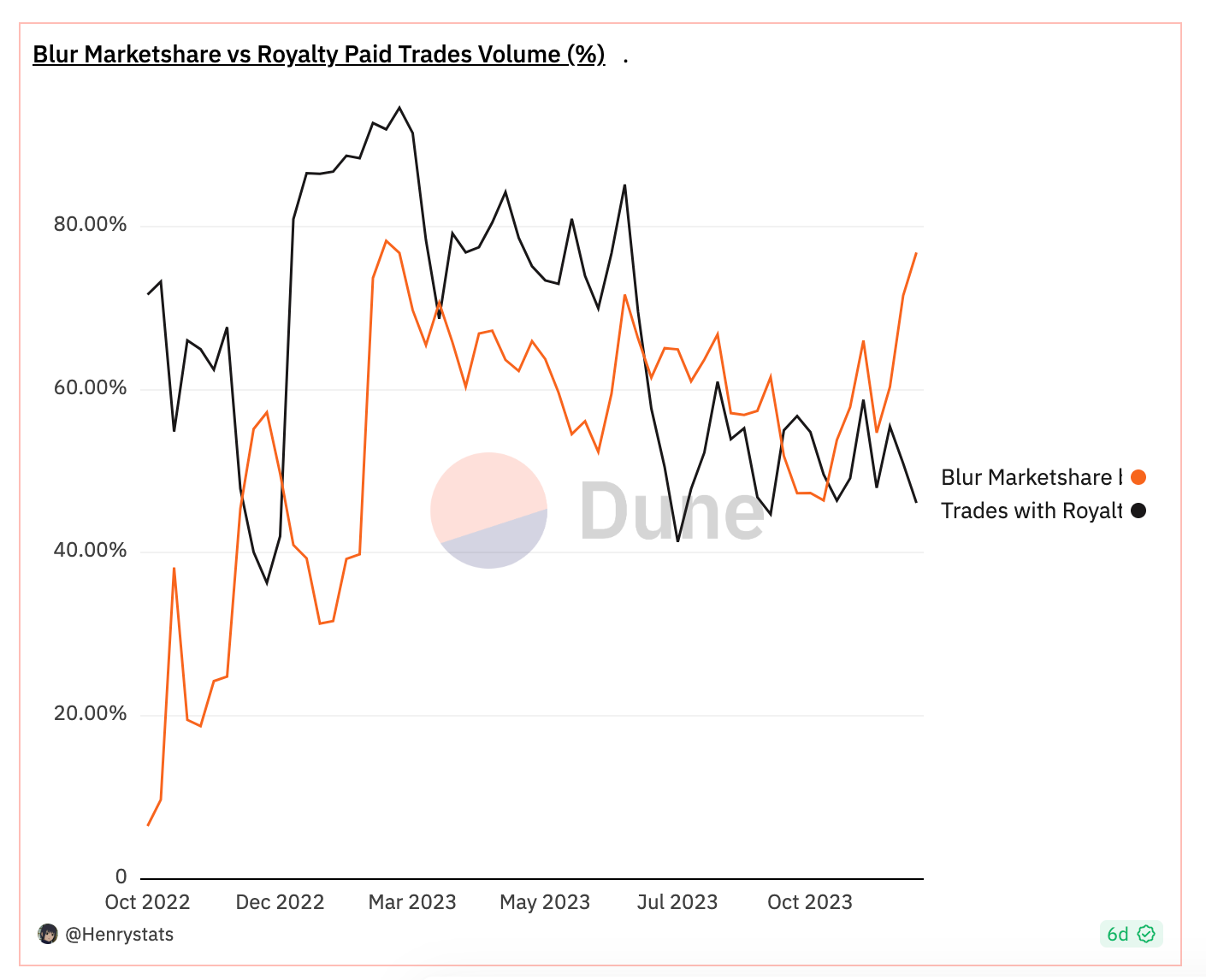

From OpenSea monopoly to Blur dominance

Royalties vs Non-royalties debate: Should users buying and selling NFTs pay royalties to artists or NFT marketplaces? More and more marketplaces have eventually shifted to no royalties. This thread provides a short overview.

Ever since Blur announced its launch and airdrop, NFTs haven’t been the same. Many have accused the platform to single single-handedly bringing the NFT market down, due to whales farming Blur points by offering and listing NFTs.

Currently, over 78% of the total volume for NFTs happens on Blur, with Opensea capturing less than 18% of the total.

Regardless, even though it is far-fetched to argue that Blur is responsible for the demise of NFTs, they introduced new dynamics affecting both buyers and sellers.

What about royalties?

Initially, NFT marketplaces enforced royalties, either compensating artists of the team behind the NFT. This eventually sparked an industry-wide debate involving the main marketplaces.

As the chart below shows, March 2023 marked a pivotal point when marketplaces started introducing optional royalties.

Currently, only a bit more than 45% of total NFT trades paid royalties.

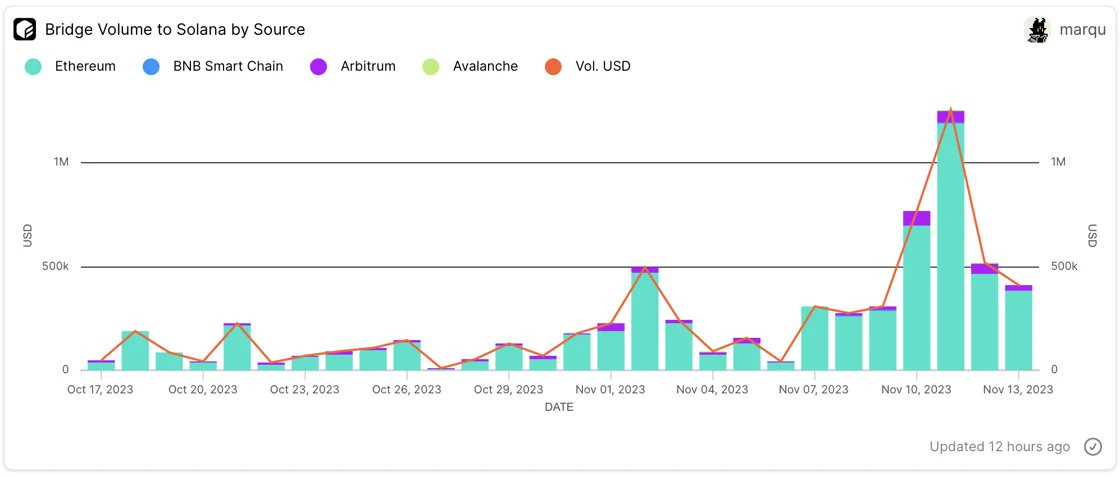

What about Solana NFT?

Solana has emerged as a noteworthy competitor in the NFT space, praised for its high transaction speed and lower costs. Solana-based NFT projects offer an alternative to Ethereum's high gas fees, but they too face the overarching challenges of maintaining relevance and public interest.

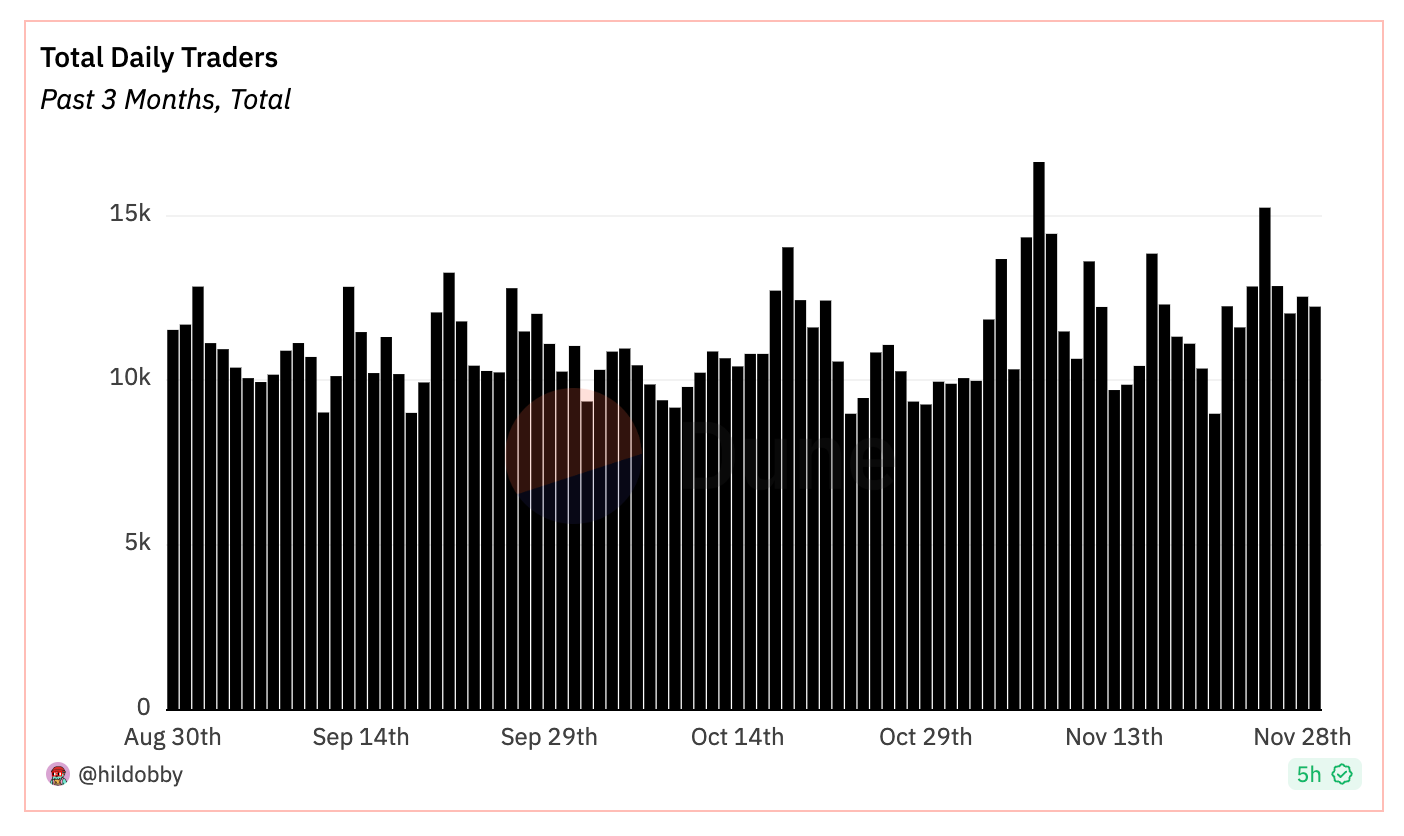

Especially during the past could weeks, following Solana's most-hated rally to $60, NFT activity on the chain has been picking up, with increased volume bridge to Solana from Ethereum and Arbitrum in particular.

It is evident from the chart above how daily volumes on Solana have been up only since the beginning of November 2023.

But not only, since September NFT trades and active traders are up 300%.

But is this a Solana-only trend?

State of NFTs

NFT numbers are up across the board.

In fact, since October, the NFT sector has experienced a small volume revival.

Of course, if we contextualize this jump in the bigger picture much more is needed to argue that NFTs are back. Nonetheless, we can observe how sales are slowly coming back from oblivion, together with buyers and sellers (probably happy to see there’s some demand for their bull market NFTs now almost worthless).

Here are the top NFT sales during the last week:

Here’s a top 11 of NFT collections (the surviv000rs) by sales volume:

Interestingly enough, Mad Lads (from Solana) rose to prominence and are now worth over 4 ETH (170 SOL).

Last but not least, we are finally seeing some big bids again (probably some dude who made it with memecoins?).

More primitives: NFT Perpetuals

Another very important development that will boost the next (if any) leg up of NFTs is the development of more NFT-based primitives. There was little or nothing you could do with your NFTs in 2021. Well, things are about to change with the developments of new primitives, such as NFTperp V2, which allows users to long or short their favorite NFTs.

If you are interested in learning more about NFTperp, here’s an article on it.

How to make NFTs Liquid and Tradable using NFTperp V2

What do a hater and a lover of NFTs have in common? Both can take advantage of them using NFT perps.

Food for Thought

The world of NFTs is at a crossroads. While the current state may seem bleak, the potential for innovation and adaptation remains.

The future of NFTs will depend on the ability of creators and platforms to evolve, offering genuine value and utility beyond mere speculation. Whether NFTs will make a triumphant return or fade into the background of digital history is a question only time can answer.

In particular, we expect the most successful company to finally delineate a clear path forward from a PFP collection.

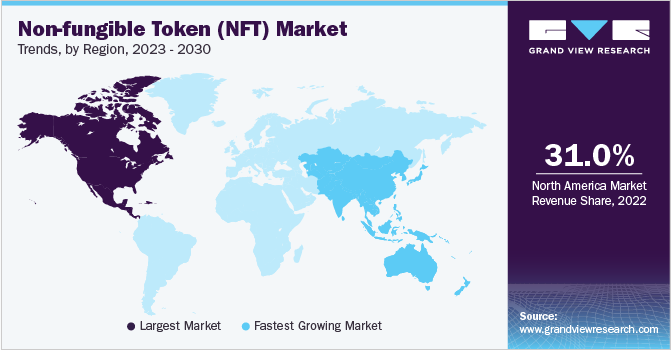

Notwithstanding the 3-year-long bear market we are living in, the size of the NFT market is projected to expand by an average of 30% from 2023-2030.

In particular, the next wave will have the opportunity to decentralize the sector geographically, as the USA (plus Canada and Mexico) currently make up over 30% of the total revenue share.

Another foreseeable trend in the future is the development of more and more NFTs tailored for commercial use, rather than personal.

Judging the whole sector based on this initial wave would be comparable to declaring crypto dead in the 2018 bear market.

We all know how that went.

Unfortunately due to the scope of this paper, I could not focus on touching upon Ordinals and xNFTs, two very interesting developments in the space, especially given the recent volume uptick in Bitcoin NFTs.

More to come on those.

Great review. If you look at the trading volumes, the picture is really depressing. But what do you think about NFT as a technology for tokenization, derivatives and other financial tools? Our market review shows that there are a lot of projects being built in this area right now.