How to make NFTs Liquid and Tradable using NFTperp V2

What do a hater and a lover of NFTs have in common?

Both can take advantage of them using NFT perps.

I assume most readers are familiar with the concept of perpetual contracts.

In essence, they let you long or short an asset without actually holding it.

NFTperp is pioneering the creation of a new primitive: NFT perps.

You can already use their platform to trade on future price movements of the main NFT collections, and they have just released their V2!

Currently, you can only engage in paper trading, but their final product will be released in the near future.

Why NFTperp V2?

NFTperp V2 addresses challenges encountered with V1.

V1 had scalability issues, primarily due to the lack of counter-parties.

Trades in V1 were matched on-chain due to the absence of an order book.

You may have to be patient if you are looking to short those Bored Apes.

Not many people out there are willing to go long on them.

Clearly, this setup was not sustainable nor scalable, resulting in a poor user experience and trade execution.

In trading, timing is paramount — especially for NFTs.

For this reason, NFTperp V2 introduces FusionAMM, a hybrid model blending AMM liquidity with a Decentralized Limit Order Book (DLOB).

Every positions against the AMM and/ or DLOB has a direct counterparty on the other side, addressing the V1 counterparty issue.

This hybrid approach combines:

Constant liquidity AMMs: able to offer a high level of liquidity and capital efficiency, thanks to its approach similar to an order book for liquidity

Liquidity always available

Easy to bootstrap new pairs

Anyone can be a market-maker with an automated strategy

Limit Orderbook: grants traders more control and flexibility over their trades.

The way this works technically is by “superimposing” the limit order liquidity to the concentrated liquidity curve - sort of “merging” the liquidity of both.

By doing so NFTperp V2 achieves several benefits:

Limit orders can be implemented

Scalability and reduced price impact for large orders

Minimized slippage as two types of liquidity are available

Optimal pricing from dual liquidity

Automated order execution

Guaranteed order fill

Transparent trade records

The Fusion AMM crafts a hybrid model on the strenghts of both systems, increasing market depth around the price and diminishing large order price impact via the DLOB and using the AMM as an independent market makers inside the DLOB that is providing liquidity on both tails of the curve.

For users, this translates into more liquidity, better transparency, and superior order execution.

Indeed, transparency plays an important role, allowing users to view the order book for insights on price action and liquidity.

Three types of orders:

In NFTperp V2 Limit Orders are fully on-chain and automatically go to the orderbook.

Market Orders may be executed through the order book, the AMM, or both — based on market size and liquidity.

Conditional orders (take-profit or stop-loss) are submitted on-chain and executed by keepers. To ensure prompt execution, keepers earn a larger fee as the market price approaches the trigger price of the order.

Providing Liquidity

Given the AMM model, users can provide liquidity on NFTperp V2.

However, the exact design of the mechanism is not decided yet but could take the shape of either of the following (or a mix of both):

NLP - Adding Liquidity to the AMM: LPs will take the reverse position compared to the traders, similar to how GLP worked in GMX.

They will be exposed to a form of impermanent loss (IL) and in return receive funding (most of the time) and protocol fees.NDLP Adding Liquidity to the Limit Orderbook: LPs liquidity is automatically put in both sides of the order book; LPs will be exposed to a form of IL and receive funding and the protocol fee.

Among the options considered, NFTperp is also considering using protocols such as Elixer, where users can utilize automated market-making strategies by depositing funds into an LP pool that executes market-making on the DLOB.

How to determine the NFT price?

NFTperp V1, employed the “True Floor Price”, a time-weighted average price (TWAP) “of NFT trade data after filtering outliers using statistical methodologies and volatility scoring”.

However, using this average often led to floor price disparities with NFT platforms such as OpenSea and Blur, creating strong arbitrage opportunities.

V2 averages the TWAP of the best bid and ask across markets, removes outliers, and then compares it to the V1 average to remove bias!

This is currently done in partnership with MetaQuants.

How to participate in NFTperp V2?

First, you have to sign up for a whitelist (not a referral): https://tally.so/r/wvepj8

Getting your hands dirty with NFTperp V2 might be worth it, in anticipation of their paper trading competition.

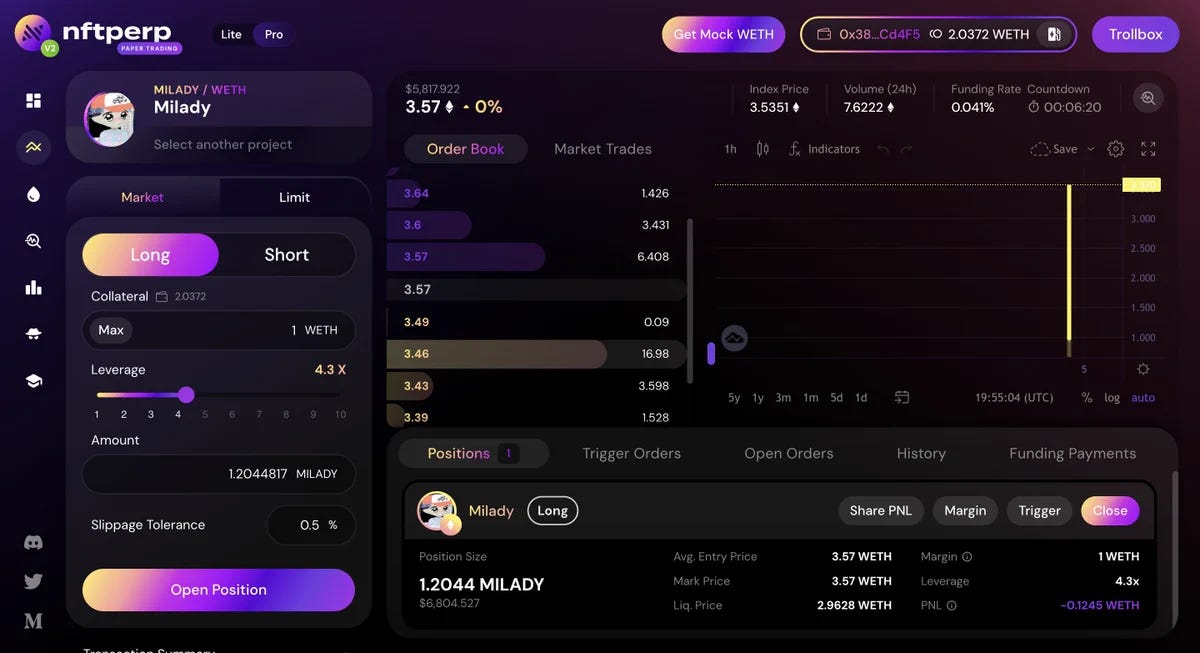

If you want to participate in the V2 paper trading, you can go to testnet.nftperp.xyz - and get some mock WETH for your wallet.

From there, you can start getting familiarised with the platform.

For the moment, NFTperp supports only four main collections, but the new hybrid model will undoubtedly make it easier to list new collections.

Food for thought

I’ve already talked extensively about NFTfi in a couple of previous articles.

NFT perpetuals are a new paradigm, set to play a massive role in NFTs infrastructure.

The high cost of blue chips NFT collections and their illiquidity are strong deterrents for many.

This is the challenge NFTperp aims to address, by making NFTs liquid and easily tradable without holding them.

Though the current times might be dire for users and activity, watch how many will want to trade NFT perpetuals during a potential NFT renaissance.

This quiet period might also be the best time for NTFperp to try out and hone the platform with no pressure to perform - contrary to what most NFT platforms had, as they were pretty much all forged in battle.

This is not sponsored content nor financial advice, I am genuinely excited about enhancing NFTs liquidity and reach thanks to perpetuals.

Still, I caution against not trading perpetuals, especially if you are new to crypto or just in general unless you really are into them.