Making DeFi great Again with RWA: the case of sFRAX

More DAOs are gravitating towards Real World Assets (RWA) to diversify their yields.

Following the Luna-USDT crash, DeFi yields have plummeted, making it increasingly challenging to secure sustainable fixed-income yields.

With macroeconomic challenges pushing US Treasury Rates to approximately 5%, why would anyone hold any speculative token or stablecoin, when US BIlls, a historically secure asset, offer such competitive rates?

Platforms like MakerDAO and FRAX are taking steps to Make DeFi Great Again by integrating RWA directly into their treasuries.

Maker, for instance, boosted its Dai Saving Rate (DSR) to about 8%.

What is the DSR?

The DSR is to be intended as a monetary policy instrument, that allows Maker DAO to strike a balance between DAI’s demand and supply.

It’s the Savings Rate offered to users that deposit and lock DAI in the protocol and earn a consistent interest rate. The DSR increase aims to incentivize more users to lock their DAI to take advantage of the better rate.

More on this topic is available in the following article.

This move poses a direct challenge to Frax and other protocols involved in the same niche as MakerDAO. Notably, Frax lost significant market share to Maker after they started to offer a 5-8% yield on the DSR.

How does Frax plan to counteract this?

Enters the Frax Improvement Proposal 285:

The Frax Savings Rate

The proposal introduces a new token, Staked Frax (sFRAX) in the ecosystem.

Users can deposit FRAX and receive sFRAX in return. Each week Frax will distribute the accrued interest on their token holdings. sFRAX tokens won’t be locked and users will be able to trade and transfer them as they please, making it “akin to a yield-bearing FRAX stablecoin token” (Gary Gensler you haven’t read anything).

Drawing parallels with the DSR concept, sFRAX focuses on addressing the near-zero duration yield curve of FRAX, providing users with an opportunity to earn passive FRAX stablecoins while contributing to the growth of FRAX supply.

sFRAX offers an enticing low-duration savings option, not just for retail users, but also for any protocol, bridge, or cross-chain app holding sFRAX, which now can earn more FRAX passively thanks to the “Frax Staking Rate” (FSR), without the risk of exposing themselves to longer on-chain strategies.

The primary objective of this token is to become “the best place for single-side stablecoin yield on-chain”.

By depositing their FRAX tokens in sFRAX, holders also contribute to:

Stabilize the protocol supply

Provide greater liquidity in FRAX

Where does the Yield come from?

As wise degens always say: “if you don’t know the source of the yield, you are the source of the yield”.

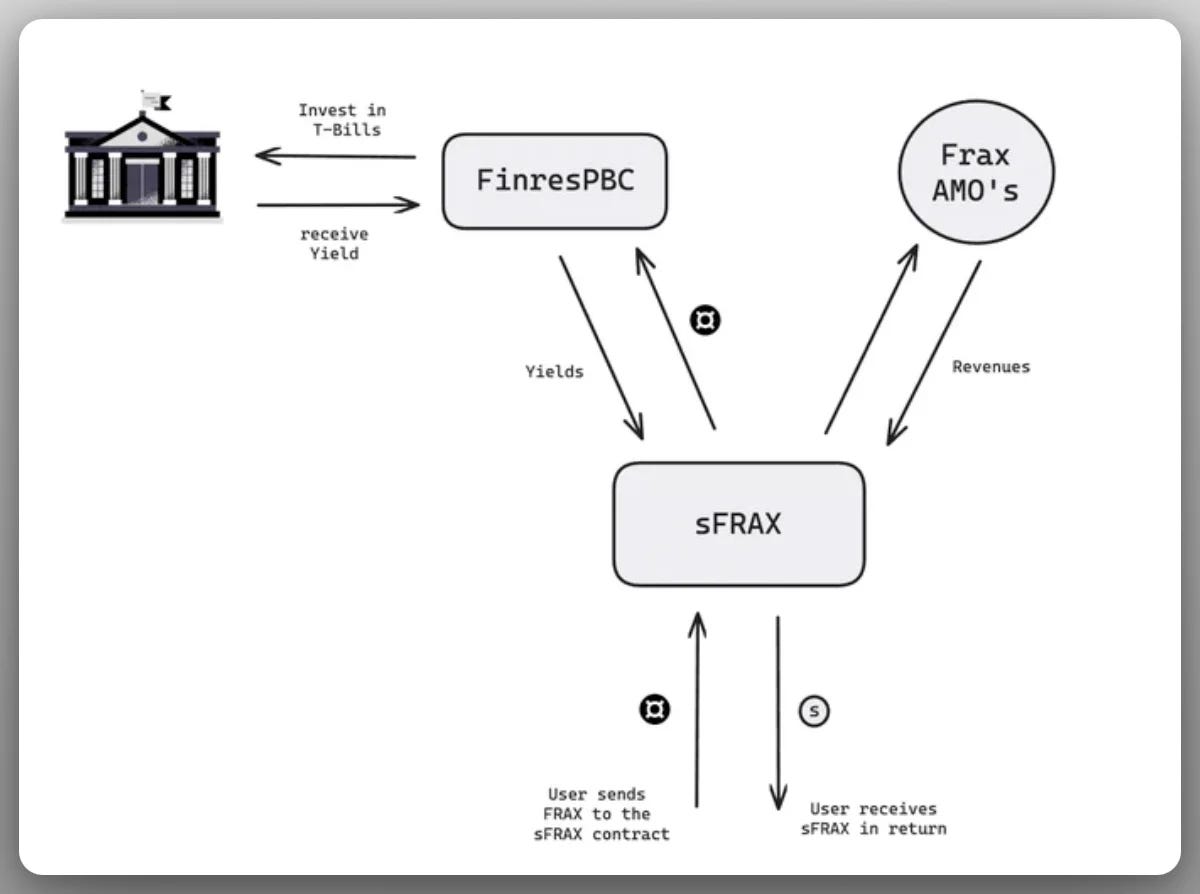

In the case of Frax, sFRAX yield is not static nor coming from a single strategy, as it might come from Frax AMOs and RWA strategies.

Initially, Frax aims to have a similar rate to the Federal Reserve Interest on Reserve Deposit Rate (IORB).

In this pursuit, the primary mission of Frax remains to maintain FRAX 100% collateralization. Surplus revenues will be distributed to sFRAX holders at a similar rate to the IORB.

Exceeding this, any extra revenue will benefit FXS holders.

Initially, Sam Kazemian envisions the FSR to be at 10% and go down with utilization. This is higher than the DSR and incredibly attractive given TradFi's 5% rates.

However, it is estimated that such APR will only be held until $50m has been deposited in sFRAX.

The design of sFRAX is similar to Frax LSD token sfrxETH.

In the comment below, Sam highlights how the main difference with sDAI is that Maker uses a utilization system while Frax will base its rates on open market supply and demand.

How will Frax tap into RWA?

Analogous to MakerDAO’s approach with sub-entities holding T-bills and other RWA, Frax has appointed FinresPBC as its RWA custodian.

FinresPBC maintains US dollar deposits in FDIC Insured IntraFi savings accounts and earns interest on them. Without seeking profits or collecting fees, it passes all yield it earns back to the Frax DAO.

To access these yields, Frax has created sFRAX and Frax Bonds (FXB).

Both products are interconnected, with sFRAX “as the zero duration part of the yield curve and FXBs as further out”.

More on FXB in an upcoming article, for now, I’ll link you Mughal's post on it.

Food for Thought

DeFi powerhouses are looking to incorporate RWA in their balance sheet.

sFRAX in particular is a DSR-like product, with a 0 duration yield curve, which will initially have a higher rate than the DST

The aim of sFRAX is to offer the best yield with the least amount of overhead for token holders.

The product per se is not technically crazy or a major breakthrough, nonetheless, its impact and implications will be all over DeFi.

With DeFi yields getting pulverized after the bear market, protocols are now looking at off-chain sources of revenues to make their treasuries more sustainable.

How will this evolve?

Will this finally mean the birth of a hybrid off-chain/on-chain system fully integrated with the “real world”?

All of these are interesting questions which I am sure we’ll get answers to.

For now, I’ll be closely watching how sFRAX will perform once launched, and generally a close eye on Frax, as a beacon of innovation in DeFi.

More insights are available below:

https://twitter.com/0xMughal/status/1703095003789017415

https://twitter.com/FlywheelDeFi/status/1702404626170126635

https://twitter.com/FlywheelDeFi/status/1701624884932325729

https://flywheeldefi.com/article/what-we-now-know-about-fraxs-rwa-strategy

And of course in the Frax telegram chat, you can simply search for sFRAX and enjoy Sam’s comments and replies to questions.

Really interesting!