The Interest Rates of DeFi Just got a Hike

This is the DeFi equivalent of the FED adjusting the interest rate for the US Dollar.

Maker DAO is a key DeFi protocol where users provide liquidity and in turn can borrow DAI, a decentralized stablecoin.

This article in particular is not to be intended as an introduction to the protocol, but rather it focuses on Maker DAO's recent announcement about raising the Dai Saving Rate (DSR) from 1% to 3%.

For most people, this is nonsense jargon, but this simple change will have faraway consequences and a ripple effect all over DeFi.

In fact, this is the DeFi equivalent of the FED adjusting the interest rate for the US Dollar.

WTF is the DSR?

The DSR is to be intended as a monetary policy tool, that allows Maker DAO to shift the rate to reach a balance between the demand and supply of DAI.

The DSR is the Savings Rate that Maker DAO pays users that deposit and lock DAI in the protocol. It is a fundamental component of the protocol as it allows DAI holders to deposit their tokens and earn a consistent interest rate.

The rate increase aims to incentivize more users to lock their DAI to take advantage of the better rate.

The DSR has the role of bolstering demand and paying users for yields that other providers are keeping for themselves.

How can Maker DAO pay this % to Users?

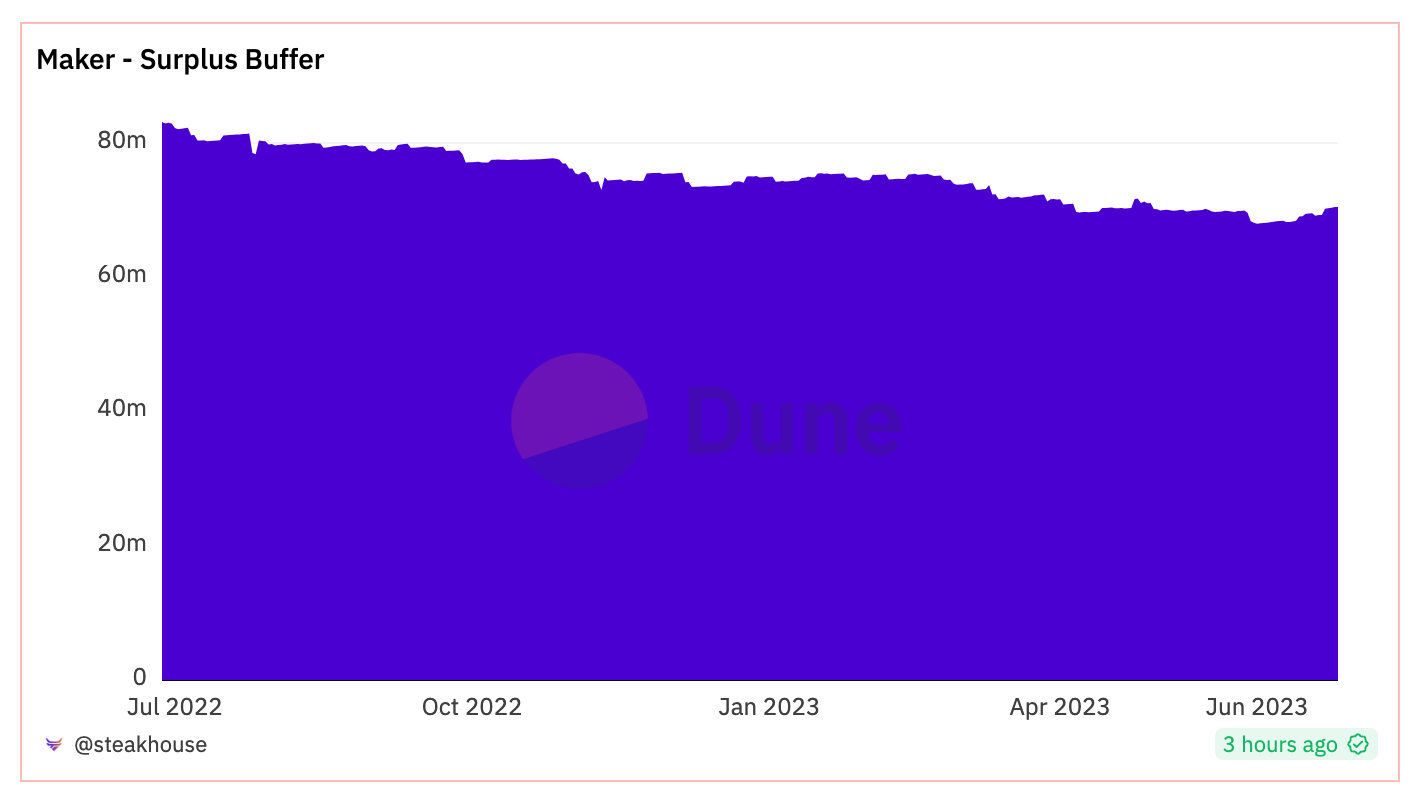

The protocol generates yield on assets, that lead to a so-called “buffer surplus”

This buffer surplus is then used to compensate users providing liquidity in the DSR.

How can Users Deposit DAI in the DSR?

To deposit liquidity in the DSR users mint sDAI (Savings DAI), burning their DAI.

sDAI is an ERC-4626 with better gas efficiency, that yields the DSR rate.

As a result, the Stability Fee of MakerDAO will also increase accordingly, making it more expensive to borrow DAI.

The stability fees are paid by users who borrow DAI against collateralized assets such as Ether (ETH) and Wrapped Bitcoin (WBTC), and fund the DSR.

Why is this a big deal?

The proposed increase will not be limited to the Maker DAO ecosystem, as DAI is a fundamental component of DeFi.

As such, it is expected to have a ripple effect and consequences on the overall interest rates for the whole of DeFi.

What is the point of adjusting the DSR?

Adjusting the DSR helps to reach a delicate equilibrium between the demand and supply of DAI. In this case, the aim is to incentivize users to lock up their DAI in the DSR - which is considered the safest DeFi stablecoin yield.

Other platforms such as Aave and Compound will have to adapt accordingly: for instance, they allow users to earn between 2 and 2.5% yield on stablecoins.

With the DSR increase we can expect more capital to flow into DAI DSR, thus pushing the overall DeFi supply rates to 3.5% or even higher.

Borrow rates will also rise accordingly, with a ripple effect that will have a strong impact on the different investment strategies across DeFi.

Up until now a lot of people were able to borrow DAI at a lower rate and leverage it all over the crypto economy, even with NFT lending, if you will.

The DSR Increase leads to an overall shift in the strategies and leverage all over DeFi.

Nonetheless, this is not the first time that MakerDAO has increased the DSR to attract more deposits.

In the past Maker DAO even had a positive DSR, where there was an oversupply of crypto leverage (contrary to what happened since 2022, when demand-side outpaced the supply side).

Why was this?

Before, users were more interested in leverage than holding DAI (the peg was breaking down). Eventually, in December 2022, the community moved the DSR from 0% to 1%

What’s going to happen then?

The higher interest rate will inevitably attract more DAI holders in the DSR

More deposits mean that users will also incentivize stability and liquidity within the ecosystem

Increased DAI adoption

Positive impact on overall growth and stability of DeFi

As mentioned in a podcast, the Maker DAO team also envisions the DSR rate to get eventually being close to tracking the rates of traditional finance.

It will be interesting to observe these dynamics, as Maker DAO also expressed interest in developing sustainable fixed-yield products to satisfy the appetites of long-term investors in DeFi - which are currently underserved given the volatility and price movements.

As part of this plan, they are also diversifying the assets they are holding.

Crypto-backed collateral is hard to scale hence why RWA assets are one of the future developments on the balance sheet for Maker DAO, whose focus is on onboarding more assets.

This is also reflected in the composition of Maker DAO assets, with stablecoins being reduced in favor of other assets such as RWA.

Food for Thought

Maker DAO is not doing incredibly well.

Aside from internal governance issues, the protocol has seen the Market Cap of DAI almost get halved, from over $8b to the current $4.5b.

The current struggles include further governance rebalancing, with Sub-dao now handling most of the decisions, as well as finding new assets to include as collateral on the balance sheet. The ultimate scope of Maker DAO is to establish DAI as the key decentralized stablecoin in the sector, treated as a public good.

Nonetheless, as we have mentioned above, crypto collateral is very hard to scale, hence why Maker DAO is further looking to differentiate its collateral.

This news has been overlooked by most outlets these days, BUT it is quite important as it will have wide consequences for all DeFi protocols.

The shift in the DSR rate it’s already effective since the 19th of June.

We can observe in the chart below that the mechanism is working as designed:

OTHER STUFF AND SOURCES

45:44) The DSRs Equilibrium Rate

https://cointelegraph.com/news/makerdao-proposal-seeks-to-hike-dai-savings-rate-to-3-33

https://kb.oasis.app/help/dsr

https://blog.makerdao.com › dai-savings-rate

https://twitter.com/MakerDAO/status/1669710346003808256

With the latest 3-Month T-bill (May 19) yield at 5.29% and the average yield earned on all Cash Stablecoins at 0.97%, this implies a Base Rate of 3.93%.

Therefore, the proposed Dai Savings Rate (DSR) is set to increase to 3.33% (Base Rate — 0.6%).

Which increases the Stability Fee (SF) on several vaults: