An Ecosystem Guide to MetisDAO

Boosted by a $400m fund, Metis is poised to be one of the most active ecosystem for the beginning of 2024

On December 18, MetisDAO announced the creation of the Metis Ecosystem Development Fund (Metis EDF).

The EDF is a 4.6 million METIS fund with the purpose of bootstrapping development, and attracting liquidity, activity, and adoption in the Metis ecosystem.

The primary aim of the EDF will be to:

Fund grants for new project deployment

Product development for existing dApps: supporting builders via grants

Builder Mining rewards: supporting builders with up to 4000 $METIS monthly based on transactions generated

Sequencer mining: locking tokens in the Metis POS to help block production and bootstrap the sequencer.

Liquidity for new Launches: to bootstrap liquidity and ecosystem composability

Supporting audits to maximize security

Liquidity Mining: for dApps with upcoming campaigns or deployments

As part of their 2024 roadmap, Metis will be the first Optimistic Rollup to launch a decentralized sequencer, starting on January 3rd.

The creation of the EDF also boosts Metis’ token value proposition, with $METIS holders having governance power on the fund's management, and the decentralized sequencer.

The EDF is designed to be a mechanism to fund public goods development in the ecosystem, with a long-term view to secure Metis’ future.

This is by no means the first experiment of this kind, with many Layer 1 using ecosystem funds to boost development and gain market share.

Notable examples include XXXXX

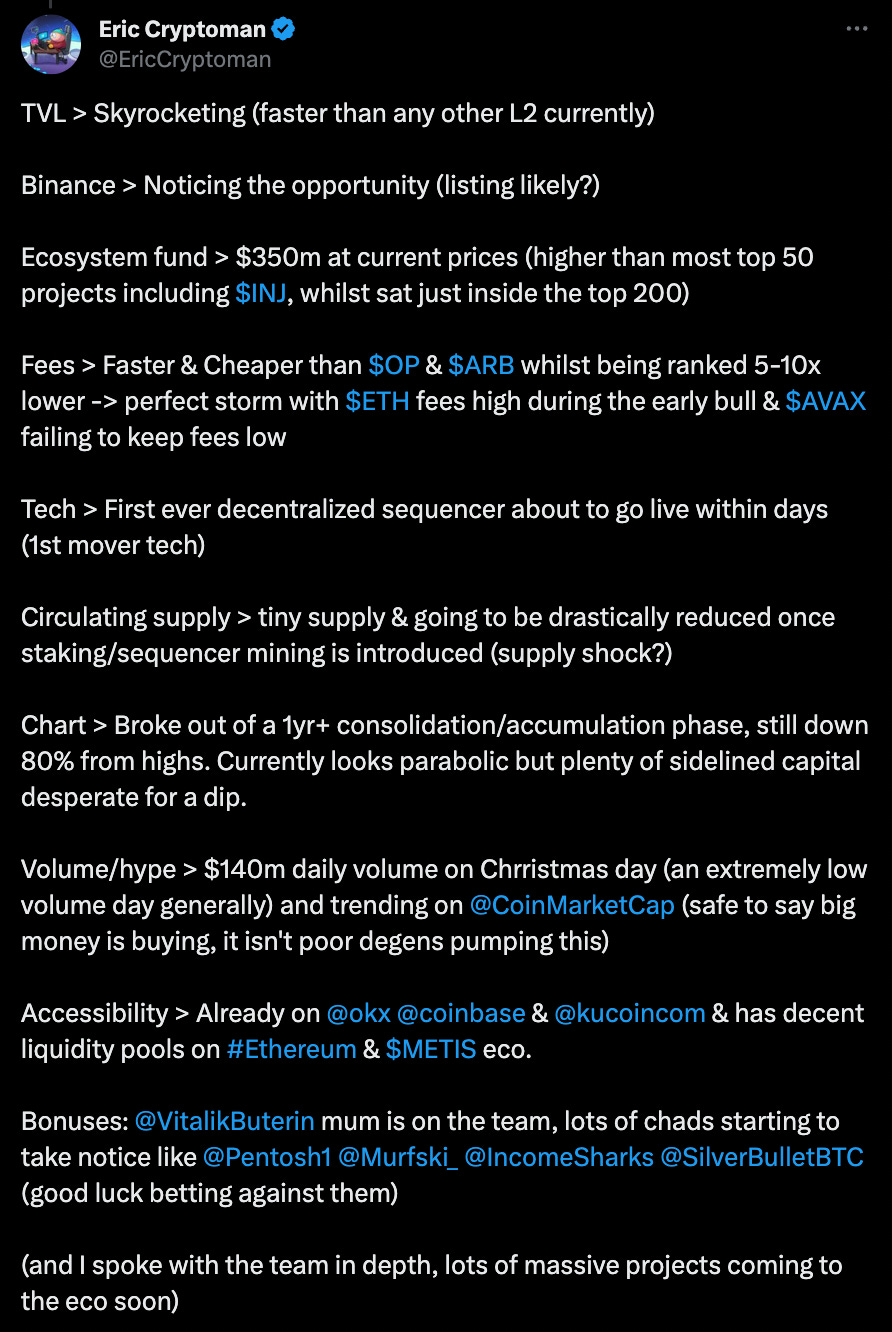

As intended, the fund has sparked new interest in Metis, with many rotating from the saturated plays on Solana to venture on new paths.

Contrary to what many are conveniently forgetting to share, 65% of the fund will be used for Sequencer Mining, incentivizing liquidity depth and participation on the network, in the path to make the sequencer self-sustainable through transaction fees.

“Only” 35% of the EDF, or 1.6m $METIS will be allocated towards funding the ecosystem.

When announced, the 4.6m $METIS EDF fund was worth $125m.

Thanks to the “EDF effect” the fund is worth over $420m.

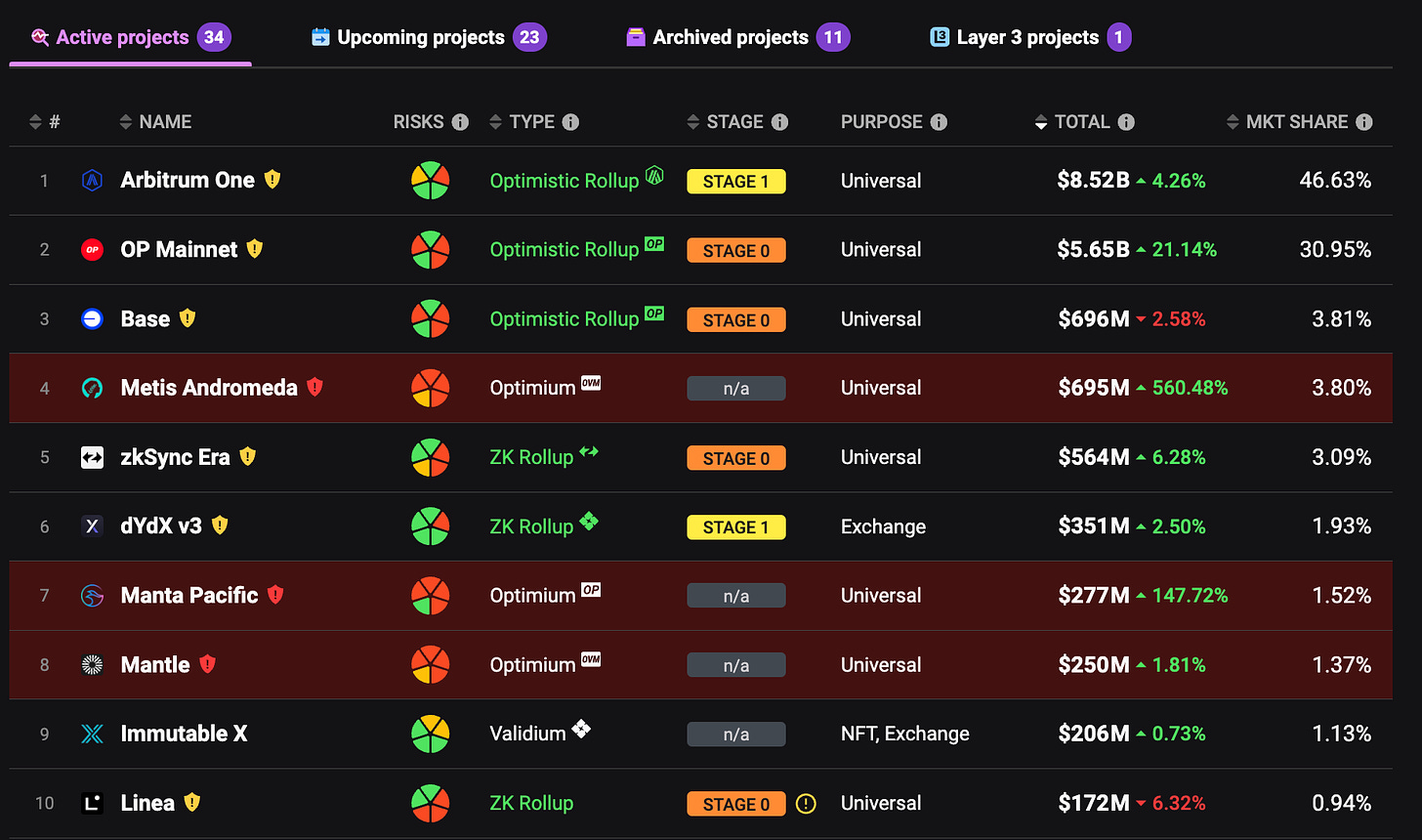

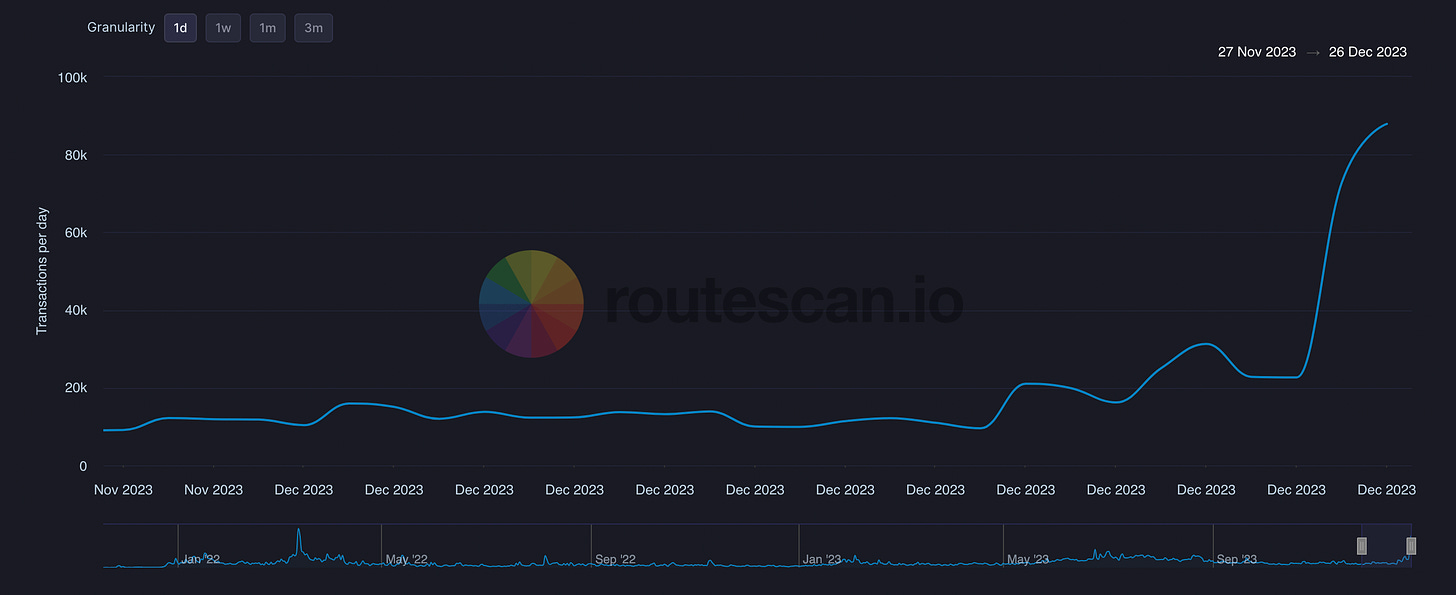

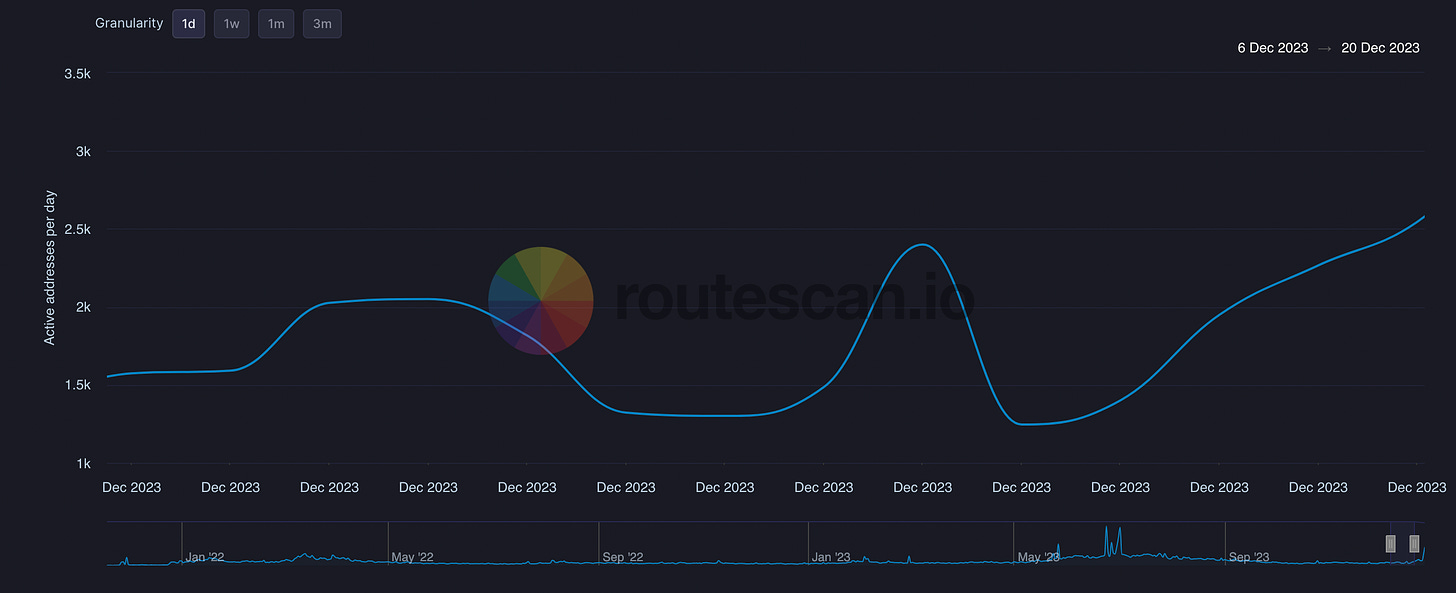

The price increase is reflected in some key on-chain indicators, showing that interest in Metis is picking up greatly:

Number of Transactions

Daily Active Addresses

With Metis projects going up all over the place, let’s look at the Top 5 protocols that might benefit from the EDF. But first, some extra hopium:

Hermes

Hermes is one of the most prominent protocols on Metis.

I have written extensively about Hermes before, so feel free to refer to my article for an introduction:

Hermes Protocol is the main AMM DEX of Metis, based on a Solidly Fork.

It launched in March 2022, allowing Metis users to provide liquidity, add new gauges, boost gauge yields, vote on token emissions, and receive bribes.

Hermes is based on Andre Cronje's “Fee Incentive Mechanism”: every time a trade happens, LP gets HERMES from emissions, and FEES go instead to Stakers and Lockers who voted for that pool — thus explaining the high APR.

The protocol is set to benefit from the EDF fund, as well as its upcoming V2 launch introducing several improvements: notably omnichain liquidity, renting liquidity, and a marketplace for yields.

These expectations are reflected in the chart behavior lately.

However, at $10m market capitalization, Hermes is still a relatively low cap.

Hummus

Hummus is a highly efficient single-sided AMM, also featuring pools leveraging Balancer’s weighted-pools mechanism

What makes Hummus special?

Hummus' flexible single-sided staking mechanism allows for maximum capital efficiency and minimum slippage.

Their novel approach to LP tokens follows a more flexible architecture.

Instead of being a share of the total liquidity, LPs are recorded as the exact token amounts, making it easier to handle withdrawals.

Just like Hermes, Hummus is benefiting from the EDF news.

As the Metis ecosystem will attract a new wave of capital, DEXs are well-positioned to capture these volumes and benefit from ramped-up activity and fees.

Netswap

Netswap is a DEX with constant product liquidity pools, a launchpad, and integrated staking mechanisms for $NETT, its governance token.

Netswap supports:

Low transaction fees

High-speed transactions for optimized trades.

Scalability by design

Extensive token support

Governance token $NETT

With the Metis narrative growing stronger in 2024, Neswap is primed to be one of the main beneficiaries of it.

While this has been widely reflected in the token price, future upsides shouldn’t be ruled out given the early stage of the Metis ecosystem.

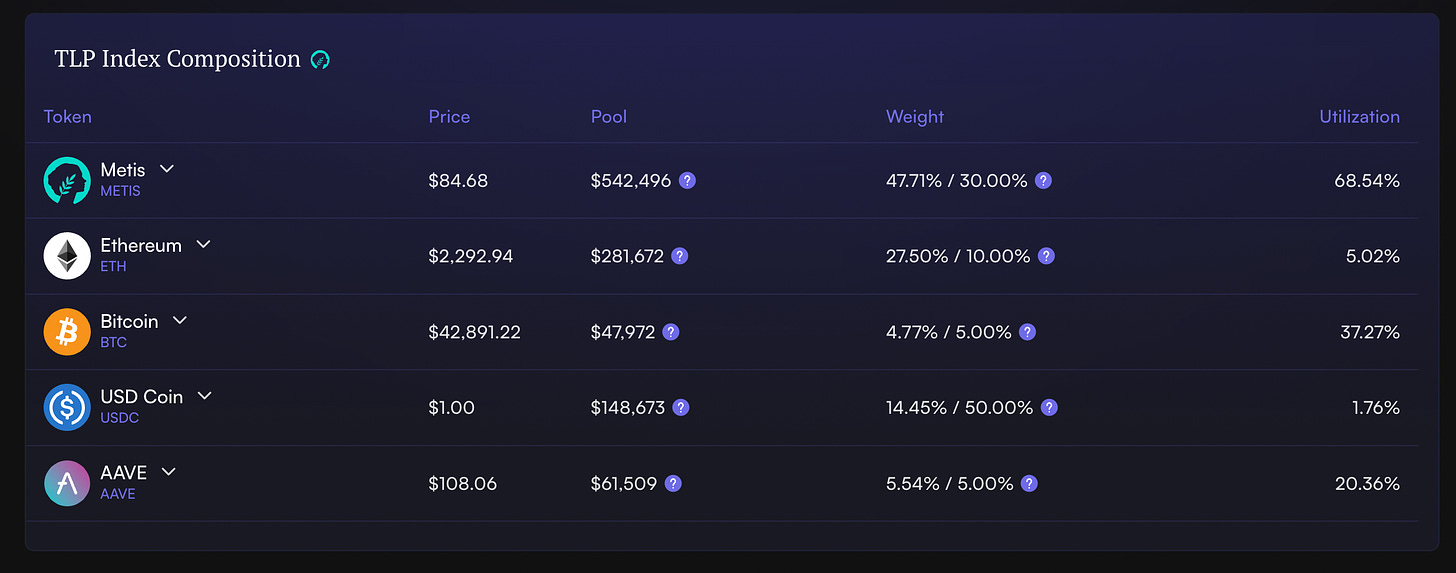

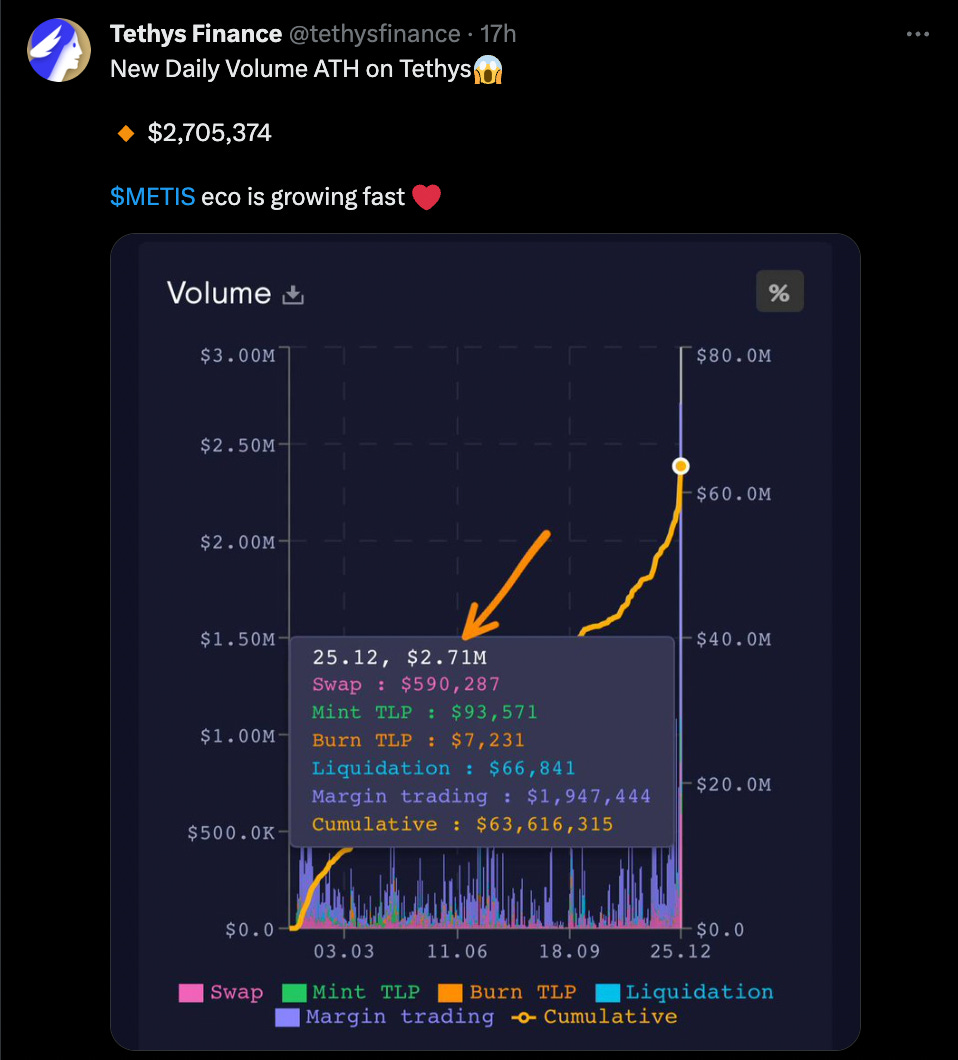

Tethys Finance

Tethys is a perp DEX on Metis, allowing users up to 50x leverage.

Tethys has a dual-token model based on the GMX model, allowing users to open positions themselves against other traders.

The TLP index follows the GLP blueprint, but doesn’t feature many stablecoins within its index:

Boosted by the EDF, Tethys is experiencing an ATH in terms of daily volumes.

Tethys is well positioned to become the de facto perpetual protocol of Metis.

This has been reflected abundantly in the form of a price increase; nonetheless, Tethys remains an interesting protocol to observe closely.

Revenant

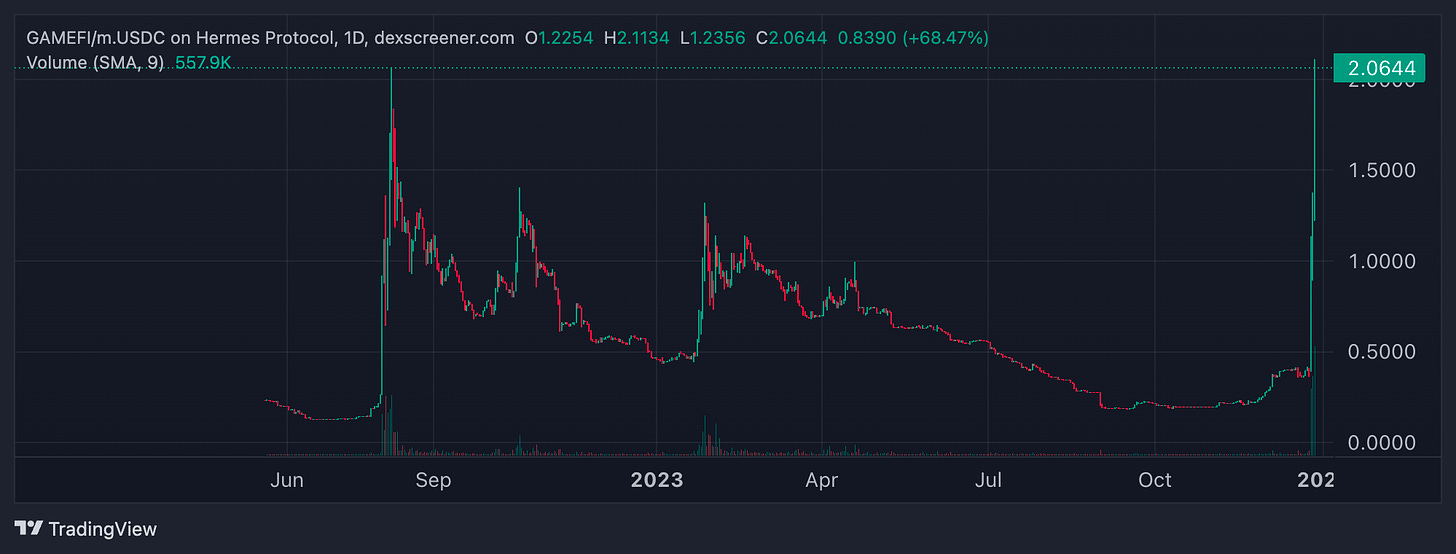

Special mention to a GameFi project: Revenant.

Revenant is developing a decentralized gaming ecosystem powered by $GAMEFI, to launch a series of play-to-earn games.

The Revenant team is currently building a blockchain fighting game, with a player-driven economy where users can buy and sell objects in-game.

Here’s a screenshot taken from their demo:

Seems that the EDF effect has touched $GAMEFI too.

For once, this is not a DeFi project. As 2024 seems to be the year where more and more gaming platforms will launch their product, Revenant is leading the charge on Metis.

What’s to come?

What to expect from Metis and what is the general thesis?

Sure it probably won’t be vertical, and entering now after the major run from last week can be not so attractive. However, previous examples of development funds deployed by Layer 1 have shown how they are a sound tool (at least in the short term) to bootstrap liquidity and activity on-chain.

Whether Metis will manage to retain the stimulus, that’s a whole other story.

Nonetheless, the EDF narrative coupled with Metis being one of the first Layer 2 with a decentralized sequencer could mean that attention will be focused on Metis at least for the first couple months of the year.

More on Metis:

https://twitter.com/ThorHartvigsen/status/1739584960044892492

https://twitter.com/Kaffchad/status/1739921228494971206

https://twitter.com/MetisDAO/status/1736769131565682827

https://twitter.com/TheDeFinvestor/status/1739653735201071577