Introducing Hermes Protocol: The Leading AMM DEX on Metis

What is Hermes Protocol?

Hermes Protocol is the main AMM DEX of Metis, based on a Solidly Fork.

It launched in March 2022, allowing Metis users to provide liquidity, add new gauges, boost gauge yields, vote on token emissions, and receive bribes.

The main purpose of Hermes is to allow Metis users to exchange cryptocurrency assets and stablecoin, with low fees and slippage.

Introducing a new stable swap curve (x3y+y3x) it makes stablecoin swaps efficient, making Hermes one of the best places for stablecoin swaps.

Hermes is based on Andre Cronje's “Fee Incentive Mechanism”: every time a trade happens, LP gets HERMES from emissions, and FEES go instead to Stakers and Lockers who voted for that pool — thus explaining the high APR.

How is Hermes Providing Value in the Metis Ecosystem?

Some of Hermes’ features include:

Native support of swaps between uncorrelated assets

Native support for third-party tokens: projects can reward LPs with their coins, on top of HERMES emissions;

Only 0.01% fee, paid out in base asset;

Compatible with Uniswap V2;

ve (3,3) Token model with veHermes: emission directly related to locked tokens;

Permissionless support for Gauges & Bribes;

Emission incentivizes fees instead of liquidity.

The HERMES Token

To incentivize liquidity providers, and involve as many users in governance.

The HERMES token has three main uses:

Voting,

Staking;

Boosting Rewards.

In order to get these benefits, users must lock HERMES as veHERMES (escrowed Hermes). Rewards are increased according to the length of the lock period.

veHERMES holders are not diluted, as their HERMES balance “grows proportionally to inflation (emissions)”

Staking: users can stake HERMES to receive 100% of trading fees and bribes from the pools they vote;

Boosting: users can lock HERMES to acquire voting power in the DAO and earn up to a 2.5x boost in the liquidity provided;

Voting: veHERMES holders can start voting gauges and whitelisting tokens.

Why are gauge weights so important?

Hermes leverages inflation as a reward to users who provide liquidity. The usage of liquidity is measured with “gauges” (e.g. how much liquidity a user is providing in a pool). Each gauge is then assigned a weight, representing how much of the total weekly inflation each liquidity gauge is receiving.

The liquidity gauge measures how much you have provided in a Hermes pool. Each Hermes pool has its own liquidity gauge where you can stake your liquidity provider tokens. This system allows users to vote and effectively decide where the HERMES inflation goes, to balance liquidity.

Trade-offs between locking Hermes and providing liquidity:

Hermes V2

Hermes is soon going to launch its V2, introducing several improvements: notably omnichain liquidity, renting liquidity, and a marketplace for yields.

The main issue with Hermes V1 is that users had to compound their rewards manually and re-adjust their positions weekly — imagine the hassle as a large bag holder. To solve this problem Hermes V2 introduces bHERMES, an auto-compounding version of Hermes that maximizes voting power and boosted rewards allowing users to collect fees in perpetuity.

New Gauge System:

Hermes V1 featured a gauge incentive system similar to the one used by Curve Finance. That’s how it works in practice:

Traders swap on the pools and pay fees, the LPs deepen liquidity on these pools and earn the fees paid, voters vote on pools to determine where more emissions from the gauged should be directed, protocols bribe the voters to incentivise a higher direction of emissions towards their pool.

V2 improves the gauges in terms of Customizability & Improved Efficiency.

It introduces the Yield and Liquidity Marketplace governed by bHERMES.

Potential custom gauges that can be created include:

· Money Market gauges – where users can trade their lending yield on their deposited assets;

· Yearn vaults – creating gauges for single token deposits;

· vlCVX – a gauge system to earn revenue from bribes.

Food for Thought

V2 is Launching soon - in about a month;

Hermes will soon deploy on Arbitrum too and in the next future on zkSync;

Hermes is a very interesting project from a tokenomics and game theory perspective. Their mechanisms could really start to take off once more liquidity and TVL will be bridged to Metis;

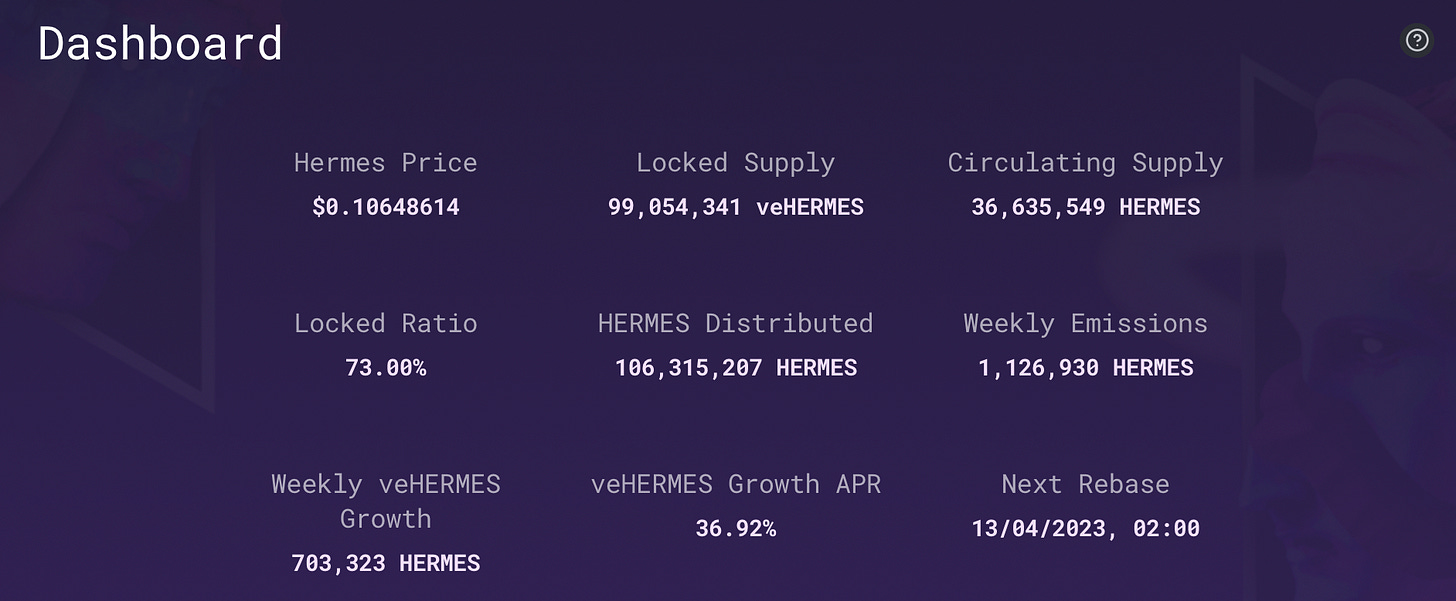

Currently, more than 70% of the total supply is locked, proof that users are really enthusiastic about the token model and would rather lock their HERMES to access voting power, rewards, and yield boosts;

The Metis ecosystem is set to benefit from the deployment of Aave, to happen sometime in April or May, which will provide more liquidity to the chain and further composability for its protocols;

More Metis Catalysts.