Uniswap v4 is live

Uniswap v4 just went live on the 30th of January 2025, a historical date for the future of DEXs and AMMs, which becomes modular with the introduction of hooks.

https://x.com/haydenzadams/status/1885394502208118844

Hooks were the most awaited development introduced by v4, allowing anyone to create custom logic and plug them into Uniswap as modular plugins.

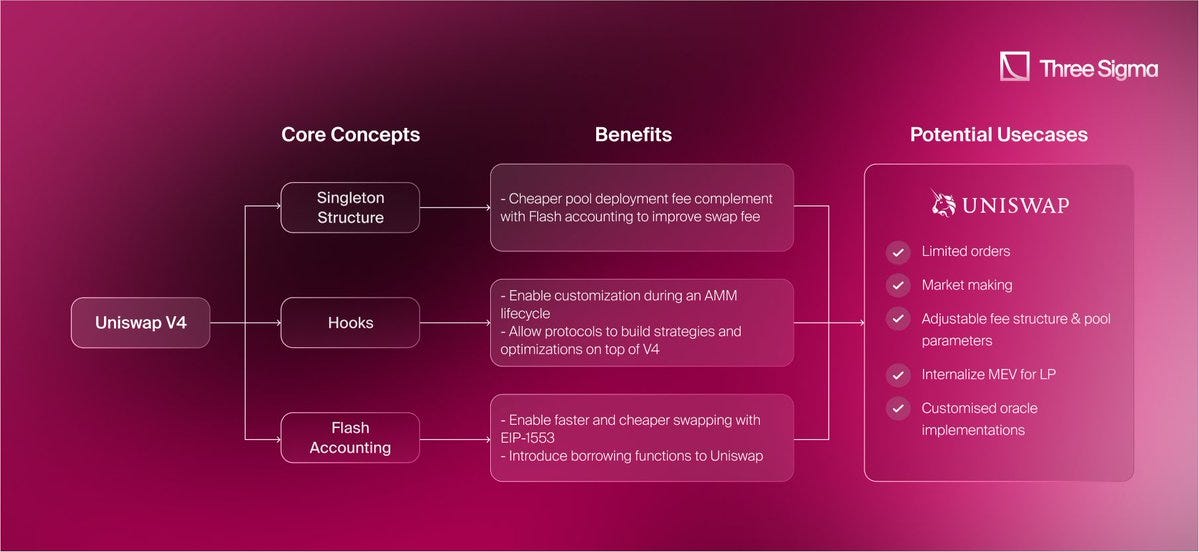

Before focusing on Hooks, let’s explore two more key concepts introduced by Uni v4:

Singleton structure

Flash accounting

Native ETH Support

Singleton Contract for Pool Deployment

The Singleton structure impacts the cost of deploying the liquidity pools, which in v4 is reduced by 99.99%.

The singleton also works as an immutable settlement layer for all the pools.

Before: pools deployed each with new smart contracts (factory model)

V4: all pools are created within the same contract, reducing costs

Flash Accounting

With flash accounting, anyone can lock the pool to access tokens as long as he does not owe any token by the end of the lock.

Using the EIP-1153 standards, users can stack multiple actions in a transaction, benefiting from faster and cheaper transactions.

In fact, EIP-1153 refers to “transient storage,” where data is erased at the end of every transaction. This way, more information can be added to transactions, which does not impact the storage burden.

Before (factory model): with pools developed over multiple contracts, all operations ended by settling token balances.

V4: Singleton and flash accounting means that one single contract ensures that the balances correspond. Each operation updates an internal balance, and external transfers are made at the end of the lock.

The new take() and settle() functions can be used to borrow or deposit funds to the pool, respectively. By requiring that no tokens are owed to the pool manager or to the caller by the end of the call, the pool’s solvency is enforced.

Hooks

With hooks, anyone can launch a liquidity pool with customized and flexible execution or new functionalities.

Hooks are for everyone:

Chains: boost ecosystem growth with new functionalities

Protocols: improve the UX and differentiate yourself

Developers: a new way to build applications plugging into the liquidity of Uniswap

With direct grants and investments, the Uniswap foundation has already stimulated the creation of 150+ new hooks.

Making sure there are enough hooks is one of the key priorities of the Foundation, focusing on hooks that are open-source, production-ready, and fit a wide range of use cases beyond what’s been traditionally done within DeFi.

Hooks can also manage the fees generated by themselves. They can set them to be either static or dynamic, and can even reallocate all fees to incentivize their use (e.g., to liquidity providers, users who swap, apps integrating, etc.).

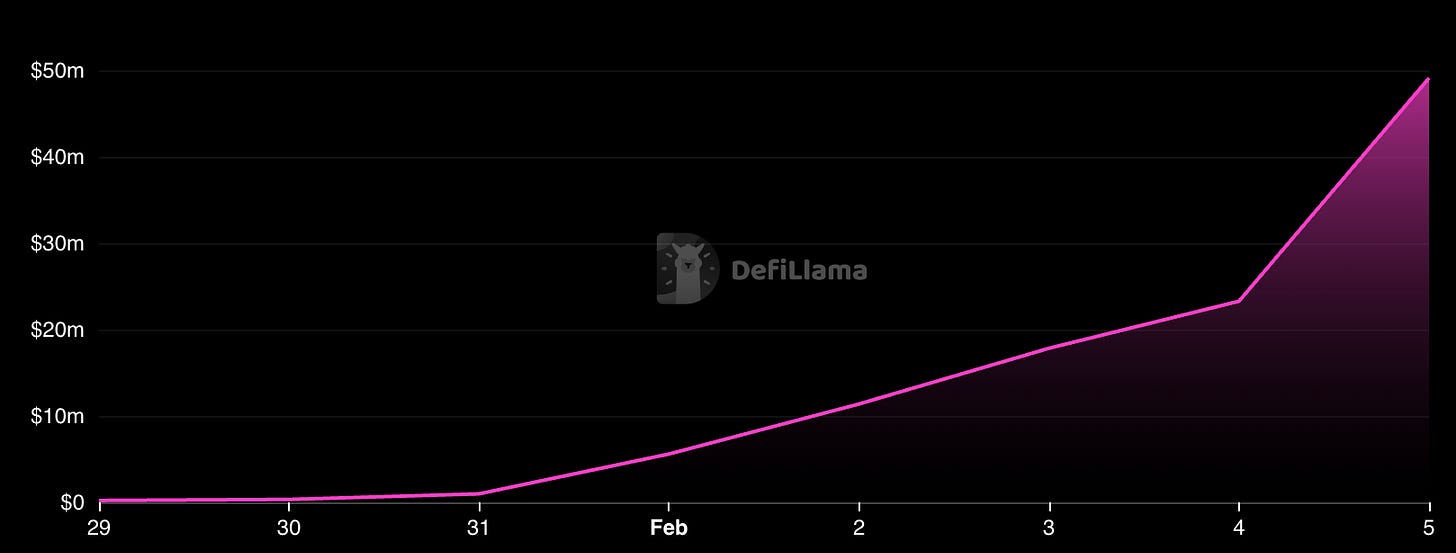

Uniswap V4 has already accrued almost $50m in TVL:

More Features:

Native ETH support is back making ETH pairs 15% cheaper to swap:

Uni V1: only ETH pairs

Uni V2: ETH was removed due to the complexity of the integration and liquidity fragmentation with WETH.

Uni V3: WETH

Uni V4: ETH, WETH

Custom Accounting: Devs can introduce new accounting logic using hooks.

Some examples include:

Introduce custom fee models: Add fees on top of LP positions

Create custom curves away from concentrated liquidity (e.g. hooks can replicate Uniswap V2 constant product market maker)

Interface composability: hooks adapt to the swap parameters defined in the smart contract of each integration

Using ERC-6909 for token accounting, keeping tokens inside the contract instead of doing transfers from and to.

Governance does not control the fee tiers or ticks spacing, but can take up a % of the swap fees of pools

Reducing Gas Costs: combined, the singleton and flash accounting model reduce gas costs for deploying LP pools and introduces other optimizations. For instance, Uni V2-V3 had an integrated price-oracle which is now redundant (saving the oracle costs).

Users can also use the donate() function to tip liquidity providers from the tokens in the pool directly

Combined, these features mean Uniswap V4 is a much more customizable integration, with several optimization mechanisms translating into practical benefits for developers and users alike:

Cheaper multi-routs swaps

Easier integrations and customization

Secure and audited code base

The beauty of hooks is that they allow permissionless development on top of Uniswap V4.

In just a few days, there have already been 20 external hooks released, with over $56m in volume:

Some of the most interesting projects building on V4 include:

Bunni

Flaunch

Sorella

Doppler

Bunni

Bunni focuses on boosting LP returns with a combination of unique features:

Liquidity Density Functions (LDFs), to create complex liquidity distributions according to market conditions or strategies

Liquidity shapeshifting: liquidity shapes can be modified at any time without removing positions

Automatic position rebalancing & auto-compounding of fees back into liquidity

Improved Swaps: constant gas costs regardless of “ticks” crossed improving efficiency for large trades

Rehypothecation Hook: pools can deposit idle assets in external protocols and earn an additional yield.

These include ost of the biggest DeFi protocols: https://x.com/bunni_xyz/status/1885489587541385231

Auction mechanism allowing MEV recapture and optimized fee revenue

Surge fees: volatiliy based swap fees

Why deploy on Bunni?

https://x.com/Psaul26ix/status/1876802362427535679

Flaunch

Flaunch is a memecoin-focused launchpad that integrates several sustainability mechanisms.

100% of revenues go back to devs, which can decide how much to give back to holders. All the fees not taken are used for buy backs.

It natively integrates automated token buybacks using fees generated (a buy back is activated every 0.1 ETH of fees. generated).

Shielded launch: after launch, the price of tokens is artificially fixed for 30 minutes, giving everyone the same entry.

Memestream: creators can give NFTs granting right to the trading fees to any wallet of their choice, creating a secondary market for the coin’s trading fees.

https://x.com/mydegendiary/status/1885598442329956362

Since about a week from launch, Flaunch has already returned over $622k:

How do they use Uniswap V4 hooks?

No need to repeat, Poopman explains it really well here:

https://x.com/poopmandefi/status/1885554104002633739

Here’s more thoughts on Flaunch and its innovative design for more community-focused memecoins:

https://x.com/TrustlessState/status/1885768579640910281

Sorella Labs

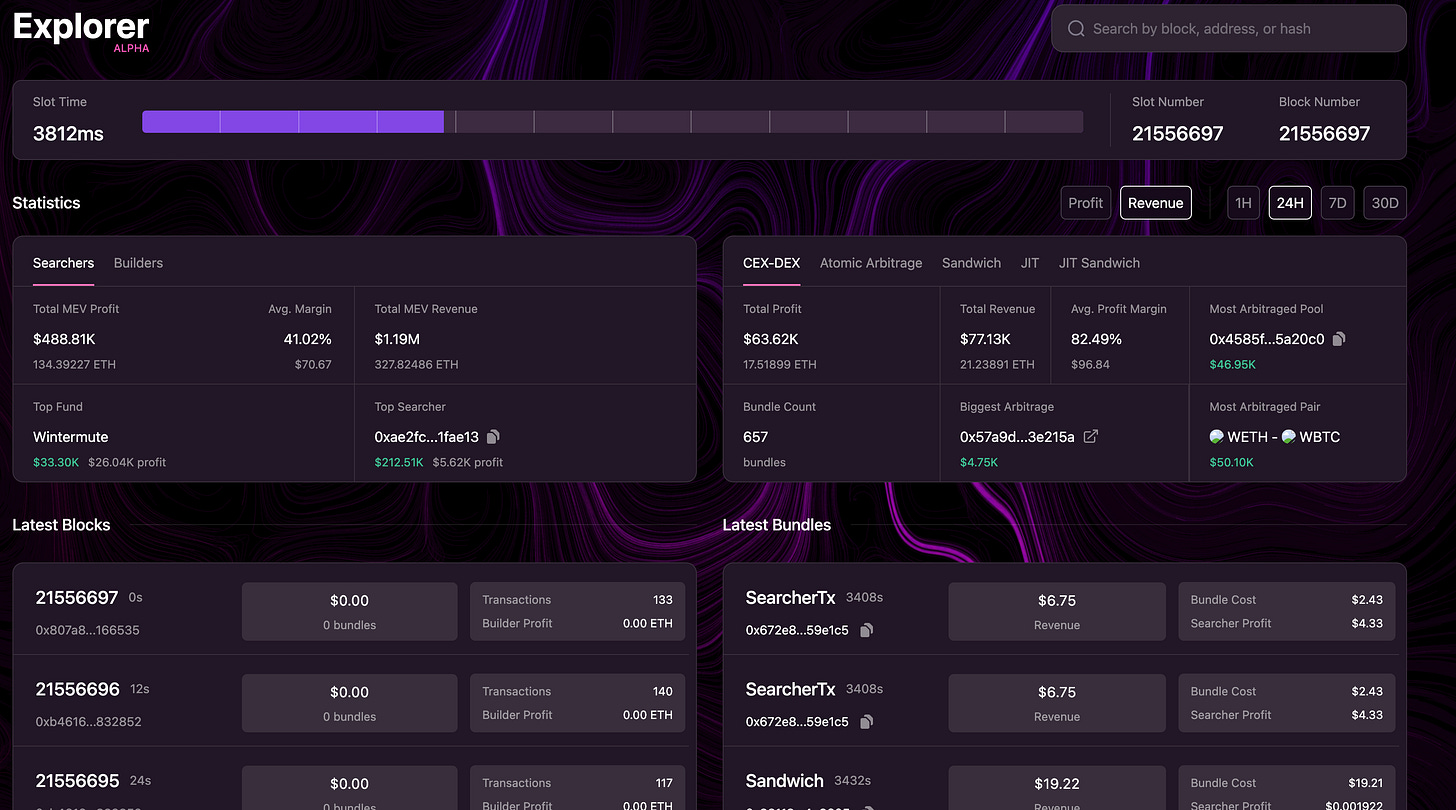

Sorella Labs focuses on solving the problem of MEV for LPs by providing tools to generate unique insights:

A blockchain explorer providing MEV information and statistics on the latest blocks, including:

Statistics on searchers and builders: MEV revenues and profits, top fund, top searcher

MEV events: CEX-DEX arbitrage, atomic arbitrage, sandwich attacks, JIT

More info on latest blocks and bundles

A dashboard to monitor MEV events in real-time:

Highlights on the mempool and all the builders bids:

Overall statistics of MEV over time, with segregated stats for each category:

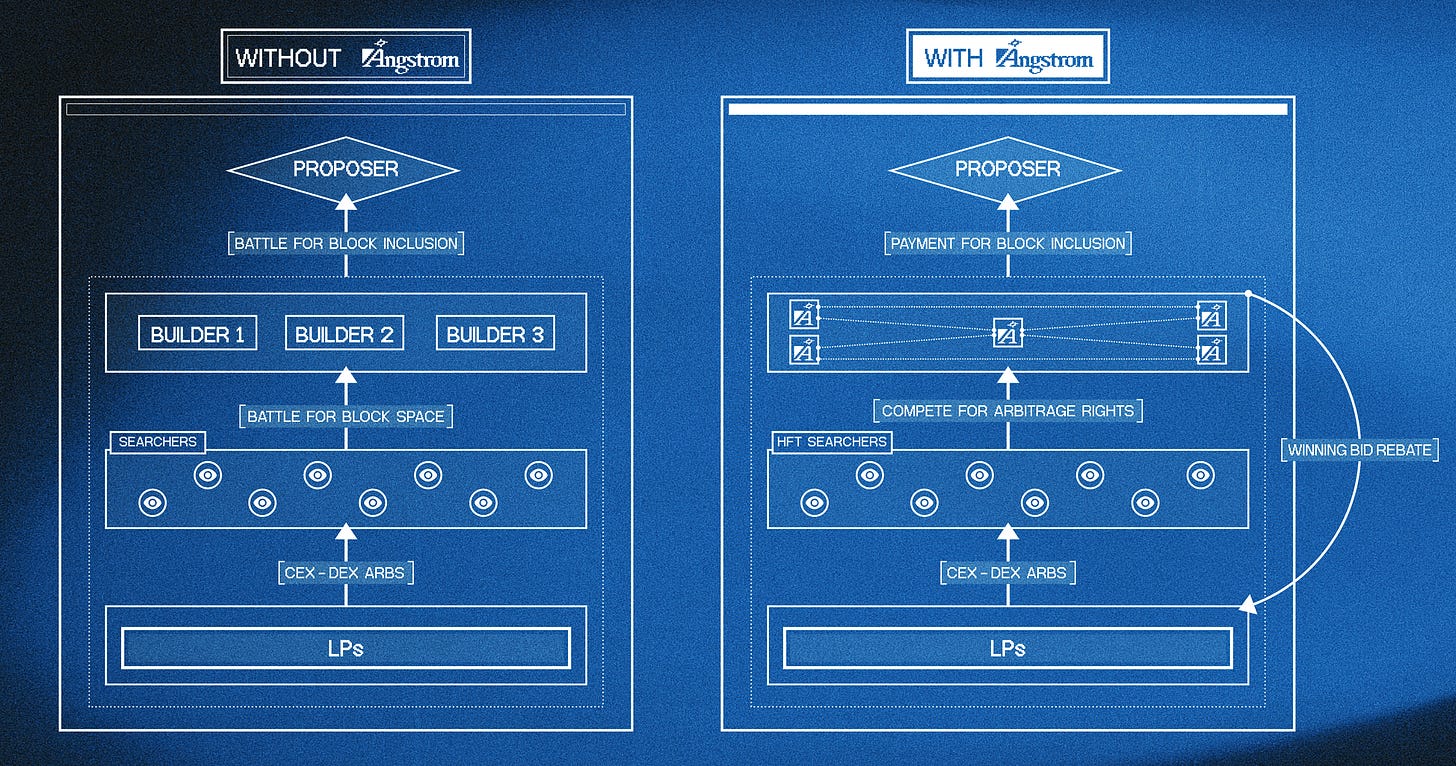

Sorella Labs also launched Angstrom, a new DEX iteration with a focus on reducing MEV. https://x.com/angstromxyz/status/1885011801991242104

Angstrom’s proposed solution gives application the power to:

Ensure a fair price for transaction ordering and execution: all trades in a block are executed at the same price, removing priority fees.

Distribute back to LPs the rebates from the winning bids to include transactions in a block

How does it do so?

The MEV auctions happen in a mempool within the app

Instead of paying for priority, arbitrageurs “must bid directly to LPs for the right to arbitrage”.

All trades are executed equally in the same block, reducing sandwich attacks, gas fees can be paid in any token

Angstrom uses a network of “staked validators”, using consensus to enforce specific rules for sequencing: validators use EigenLayer to stake ETH, and have skin in the game by facing slashing penalties in case they break the rules.

The benefits provided by LPs are in tun reflected into lower trading fees and lower cost to incentivize liquidity.

Doppler

Doppler is a protocol focused on improving liquidity bootstrapping and price discovery.

It introduces the concept “liquidity auctions”, executing the liquidity bootstrapping within the hook contract. These complex operations are completely abstracted on the UI.

Auctions can either:

Be successful: if they end according to user parameters, liquidity is sent to an AMM

Fail: all contributions are refunded

Auctions aim to allow projects to price liquidity more accurately and minimize the possibility of initializing liquidity at an incorrect price.

This process also greatly simplified the integrator’s challenges, taking away the burden of having to think about liquidity and allowing teams to focus on other priorities. At the same time a decentralized set of integrators are incentivized through an “integrator fee”, allowing integrators to set a fee they can capture once liquidity is successfully boostrapped.

Doppler is also launching a second product, Pure Markets, a front-end based on Doppler.

These are just a few protocols building on Uniswap V4, with others including: @ArrakisFinance

Uniswap V4 is set to inject a new wave of dynamism in DeFi, allowing many new use cases for the Ethereum ecosystem.

This is just the start, as Uniswap V4 just went live - we can continue expecting new innovative hooks to come in the upcoming weeks.