Understanding Trader Joe's Liquidity Book and AMM Design: A Comprehensive Guide

Is Trader Joe set to displace Uniswap as the best DEX?

Trader Joe is a Top 5 DEX by volumes, and the main DEX on Avalanche.

They recently moved to Arbitrum, where they have been doing most of their recent volumes.

In fact, the ARB airdrop has greatly contributed to a 30% increase in their volumes.

Trader Joe uses an innovative AMM design called the Liquidity Book.

This article will provide an in-depth look about how the Liquidity Book design works and the advantages compared to a traditional AMM design.

Not all DEXs are the Same

Most DEX’s trading algorithm is based on the popular automated market maker (AMM) formula:

x*y=k

This formula “establishes a range of prices for two tokens according to the available quantities (liquidity) of each token. When the supply of token X increases, the token supply of Y must decrease, and vice-versa, to maintain the constant product K”.

However, operating an AMM using this formula leads to issues with regard to:

Impermanent Loss;

Capital Inefficiency;

Low Composability;

What is special about Trader Joe?

Since their V2 Update, Trader Joe is using a different design for its AMM, based on a Liquidity Book (LB).

The LB design is a concentrated liquidity AMM that combines elements of traditional order books and DeFi AMMs. It was introduced to help liquidity providers (LP) eliminate impermanent loss and high slippage on the platform.

How does the Liquidity Book design work?

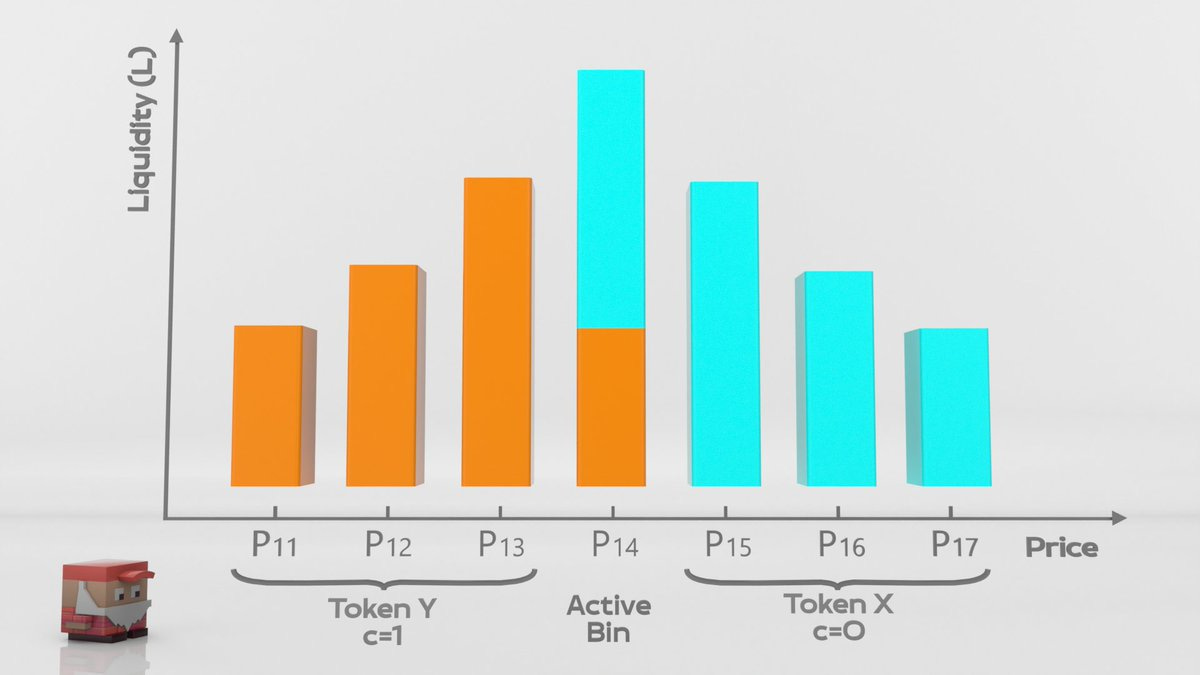

In order to avoid the problem of having “lazy liquidity” sitting idle, LP on Trader Joe can select at what prices they want to provide liquidity. Each price point is referred as a “bin.” The LB aggregates all the bins into a sort of “Order Book.”

Another difference between traditional AMM and a Liquidity Book is with regard to how liquidity is stacked inside liquidity pools. In the LB, liquidity is aggregated vertically inside the different bins rather than horizontally.

Fees are then paid out to specific bins compared to what happens in traditional AMM, where anyone whose range is touched by the price gets a share.

How does a Liquidity Book Design help with Composability and Flexibility?

The LB design also allows for higher composability for LP, who are given fungible token receipts for depositing liquidity.

Trader Joe foresees that LP will be able to use these receipts on other DeFi protocols.

LB design also offers unprecedented flexibility for LP, as it provides four different “liquidity shape pre-sets” to suit all different strategies.

Users will be able to select their preferred price range and liquidity shape as well as the number of bins they want to deposit liquidity into.

From the set-ups users can then develop up to 6 basic strategies, each with different advantages and drawbacks:

To provide an example, let’s focus on the Curve strategy and the Bid-Ask strategy:

Curve Strategy:

✅ Perfect in calm markets, Capital efficient;

❌ Increased risk of impermanent loss;

❓ Requires re-balancing around current price for maximum effectiveness.

Bid-Ask Strategy:

✅ Captures market volatility, allows to DCA;

❌ Riskier than other strategies;

❓ Requires re-balancing to stay effective

How does a Liquidity Book Design help with Impermanent Loss?

The fee structure on Trader Joe has two components:

Base Fee: minimum fee rate;

Variable Fee: adjusted for volatility.

Trader Joe is able to calculate instant volatility for each liquidity pool, thanks to “The Volatility Accumulator,” a sort of in-house oracle. This enables the “Surge Pricing” feature, that increases the variable fee based on the volatility of each pool.

The variable fee is used to compensate LPs for the impermanent loss they might have suffered as a result of market volatility.

How does a Liquidity Book Design reduces Slippage?

In Trader Joe LB, each bin is representing a single price point.

If a trade occurs using the liquidity stacked within a single price bin, the trade will have zero slippage. However, there might be a case where the liquidity reserves in a single bin might not be enough to fulfil the trade, and thus require a “bin change,” in this case the closest bin will be used — leading to a small price impact.

Food For Thought

Trader Joe builds on the current AMM model using an innovative Liquidity Book design;

The main purpose is to have more efficient trades, protection against impermanent loss, reduced slippage and maximum composability;

The model has proven to be particularly well received given the volume surge during the ARB airdrop;

The current AMM designs have shown its limitations, as the market seems increasingly uncertain the Liquidity Book model could gain traction due to the different strategies that LPs can decide when depositing liquidity;

Sources and more about Trader Joe:

https://avaxholic.com/liquidity-book-trader-joe/

https://traderjoexyz.com/arbitrum/pool/v2/0x912ce59144191c1204e64559fe8253a0e49e6548/ETH/20

https://chain.link/education-hub/what-is-an-automated-market-maker-amm

https://docs.traderjoexyz.com/

https://medium.com/avalancheavax/trader-joe-presents-liquidity-book-a-new-amm-design-for-defi-39abf87e0d7f