The Solana Renaissance

Solana for everyone: seamlessly build dApps using Solidity or simply move your Ethereum dApps to SOL

Following the debacle of FTX, Solana has been slowly growing up as a puppy tiger left alone in the forest.

Some projects left, notably the DeGods, while others have remained, declaring their loyalty to the chain.

Nowadays seems that Solana is having a bit of a renaissance and most are getting ready for what they call “the most hated rally ever”.

On-chain Tour

Let’s have a quick on-chain tour - what’s happening in Solana behind the curtains?

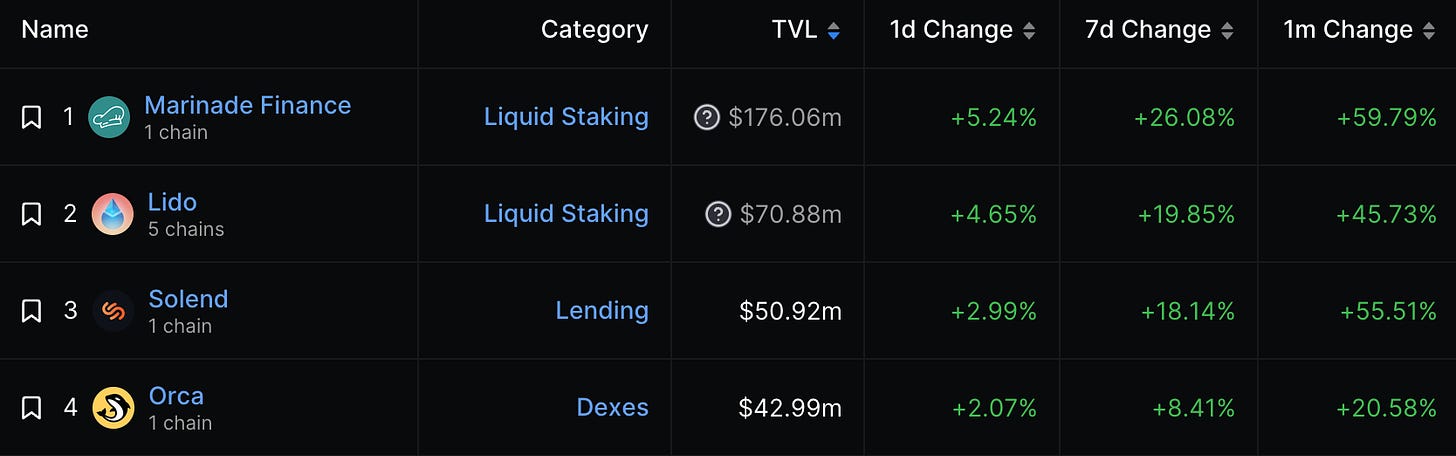

For once, the TVL has been steadily growing in 2023, up 50% YoY.

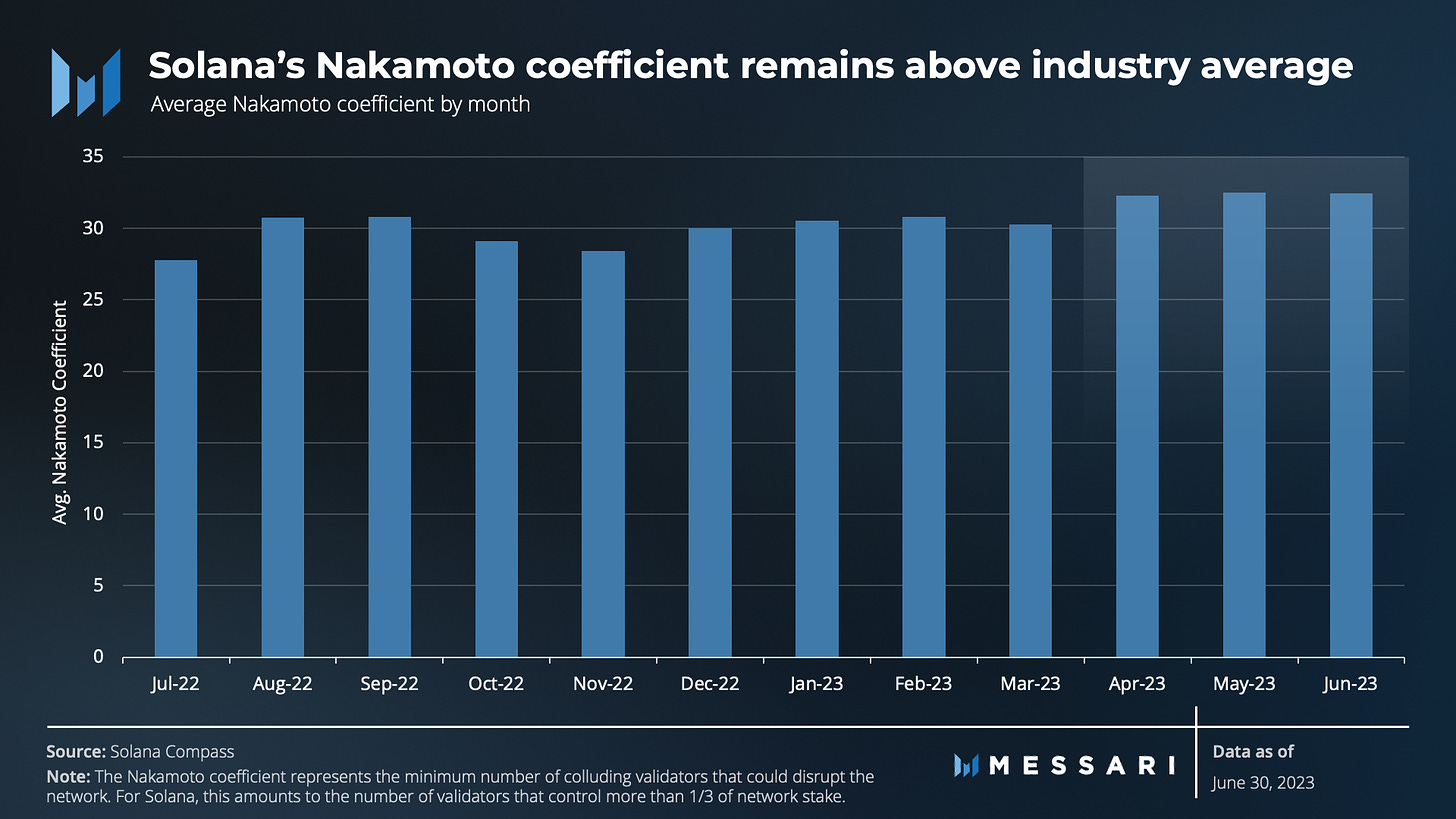

Validators on Solana remain stable, and contrary to its reputation, the Solana Nakamoto Coefficient remains above the industry average.

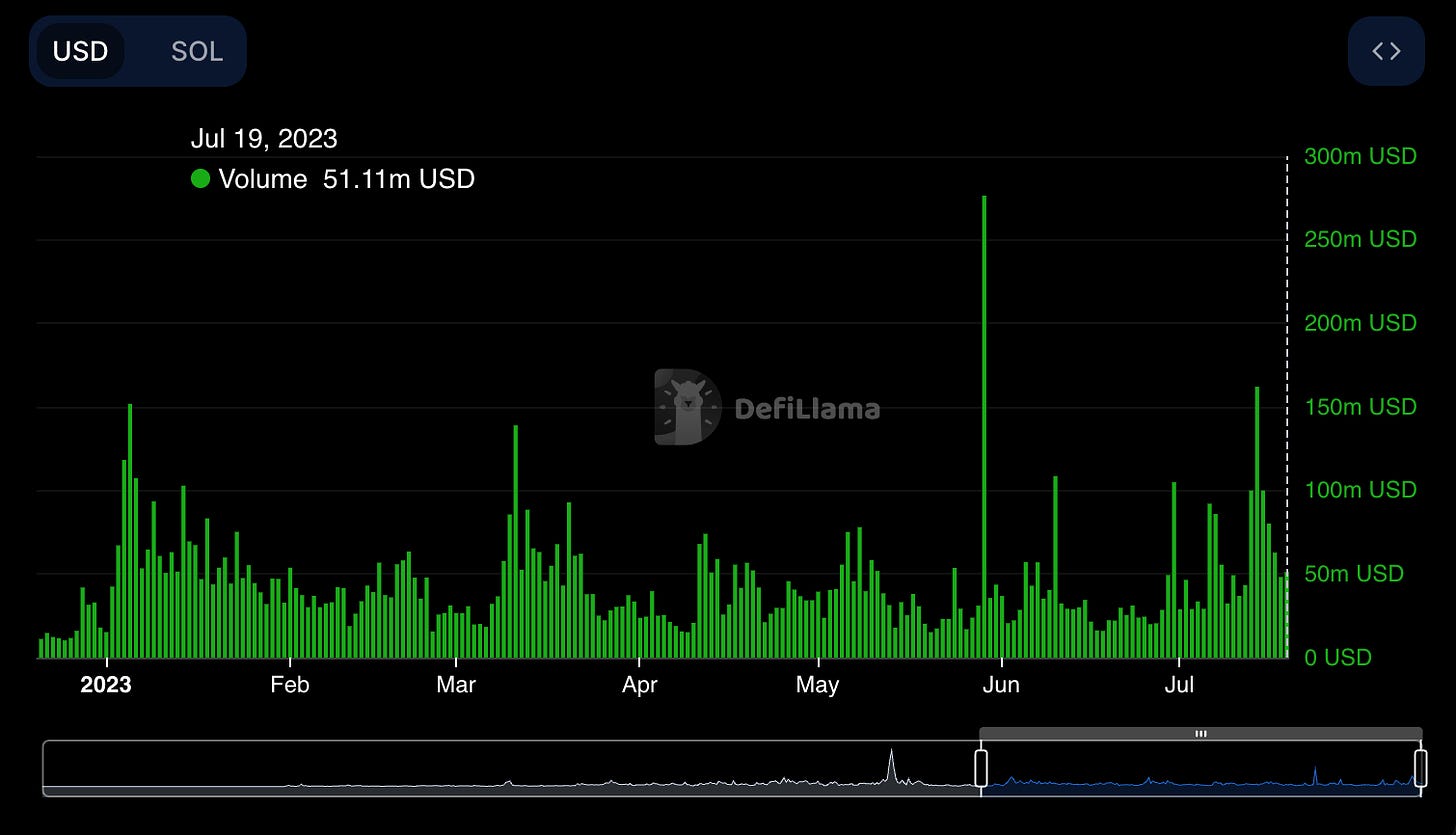

Volumes are also experiencing a revival.

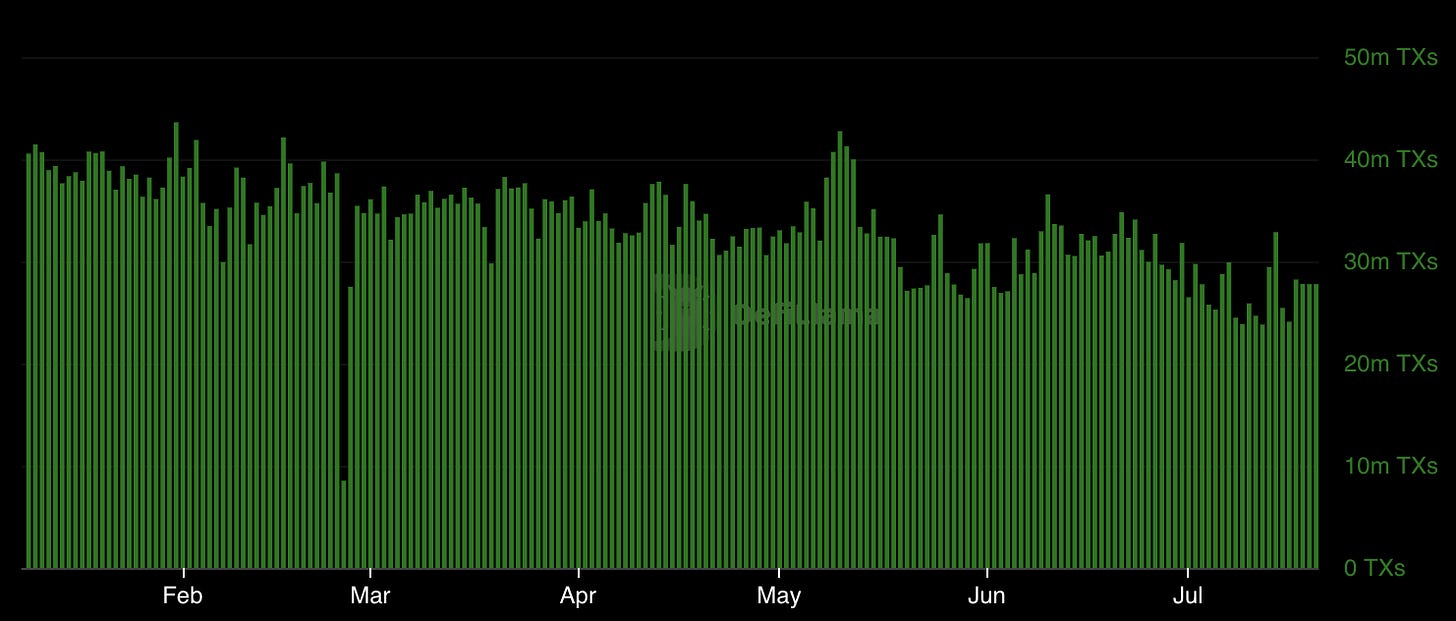

Nonetheless, transactions are still struggling to pick up.

All the top 4 protocols in Solana have experienced major TVL growth during the last month, in a period where the market wasn’t particularly rosy.

Many in fact are betting on the resilience of SOL, even arguing that the demise of FTX is a net positive for the network, which can finally detach itself from its evil daddy.

During this time, the development community on Solana has put forward several much-awaited upgrades, greatly improving the positioning of Solana as well as making it easier to develop contracts on the chain.

The decision of building Solana as a non-EVM has brought about several limitations in terms of scalability and interoperability of dApps in other ecosystems.

This is why you can’t use Solana to connect on Uniswap, and why most dApps on Solana are unique.

Nonetheless, given the recent context where interoperability and a multi-chain world seem to be the future direction, this had become more of an obstacle than a feature.

How is Solana going to improve its interoperability and scalability?

Solana Labs just announced the launch of Solang, a compiler that would allow developers to write smart contracts on Solana in Solidity, which is the language used by Ethereum.

Solana is trying to be more accessible, allowing developments with Solidity, aside from Rust and C languages typically used for Solana development.

This development is very significant, as it helps to bridge the gap between the Solana ecosystem and EVM developers and dApps.

Furthermore, this is an important incentive to attract development talent to build on Solana, coming a year after Seahorse, which enables smart contracts to be written in Python.

What can Solang do?

Compatibility with Ethereum Solidity 0.8

Ability to call other Solana smart contracts

Supports Solana SPL tokens

Supports program-derived addresses

Enables development with Anchor

Builds native Solana smart contracts

Access to native Solana built-in functionality

Aside from Solang, the direction taken by the Solana community is evident from another tool that was recently launched.

NeonEVM just launched its mainnet on Solana to support Ethereum dApps.

Neon EVM works by allowing the deployment of Ethereum Virtual Machine (EVM) code.

Ethereum developers will leverage Neon to move their projects to Solana.

This could potentially reduce the costs of their applications, as well as introduce novel features and functionalities by leveraging the Solana EVM (e.g. parallel execution).

Conclusion

In crypto is not a miracle when a dead body comes back to life, even after everyone took a shoot at it and left.

See the Pudgys, for instance, where the new team and DAO have brought new life to the NFT project.

We could be in the middle of something very interesting happening on SOL.

The entanglement of good sentiment, new DeFi development to allow functionalities aside from simply staking SOL, and especially the launch of new compilers to support and scale developments could end up leading to a new renaissance for Solana.

It’s important to mention that another element that prompted people to be wary of Solana (and that memefied the reputation of the chain) was the recent network outages. This has to do with the way Solana handles development by introducing solutions and then making changes along the way.

Several times Solana has acknowledged this issue and the team is back at work to improve on this aspect as well.

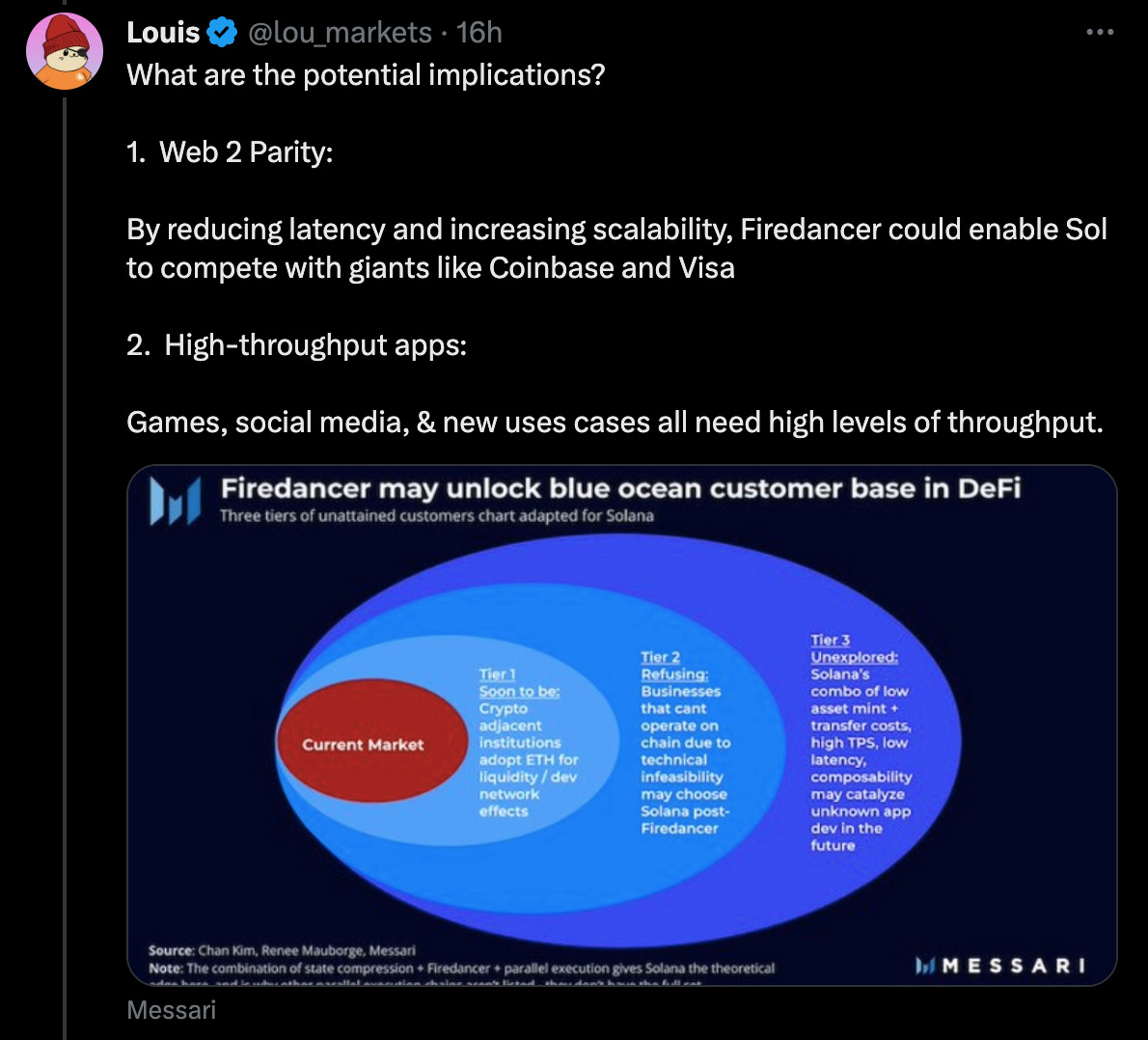

One such solution is Firedancer, an independent SOL client validator developed by Jump Crypto. Up until now Solana only had one client.

Client diversity is fundamental to reducing centralization and eliminating network outages and software issues.

The aim of Firedancer is to reduce transaction fees, minimize outages and meet the goal of over 1m transactions per second!

This is by no means an inconsiderate shill of Solana, nor a sponsored post.

I think it’s really interesting to follow these developments for any other non-EVM chain, that could leverage the Solana playbook should it be successful!