The Hyperliquid Playbook

not just another dex. what sets hyperliquid apart?

First and foremost, I apologize to my readers for this long break!

Sometimes life gets in the way…

But here we are again with another research piece that dives deeper into Hyperliquid (HL).

HL has been the talk of the town since the launch of its point program in November 2023. Crypto narratives are often short-lived; however, while other competitors have come and gone already, HL has managed to remain relevant and craft its narrative.

What’s their secret sauce?

What sets HL apart?

This article will explore HL in greater depth, highlighting its performance and playbook: a mastery of incentives, narrative hijacking, and simply… building a good product.

What is Hyperliquid?

HL is a Layer 1 (L1) blockchain initially based on Cosmos Tendermint consensus. It boasts impressive performance, reaching about 20k Transactions per second.

HL eventually migrated to its own custom consensus mechanism, Hyper BFT, optimizing its stack and reducing latency.

The HL vision is ambitious: to create a whole on-chain ecosystem where others can build decentralized applications (dApps) on top of the HL tech stack without compromising performance or user experience (UX).

The first component of HL was a derivative exchange based on an on-chain and decentralized order book model, with spot trading launching in March 2024.

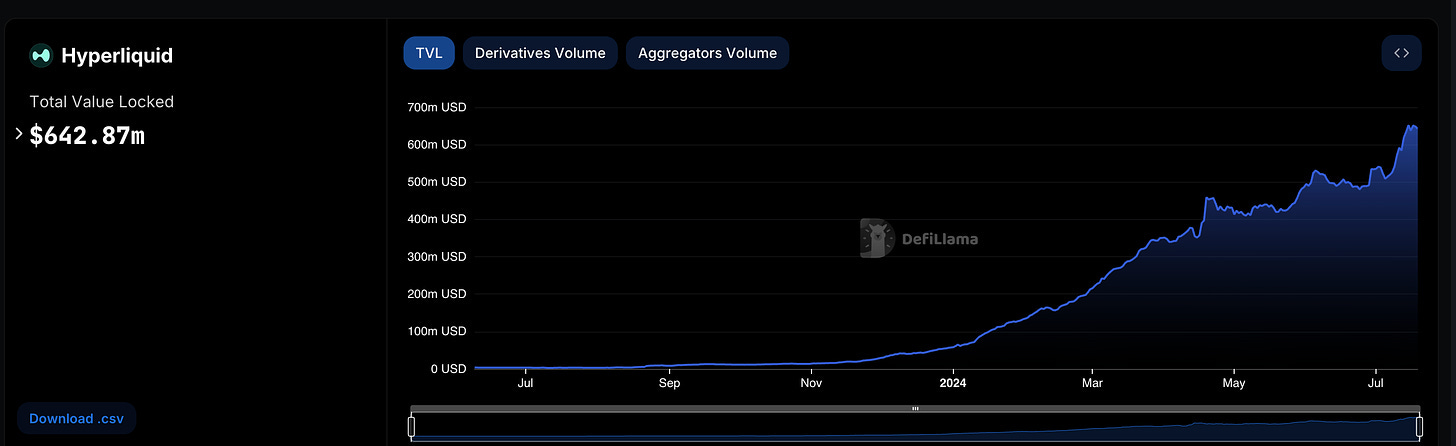

Since its launch, HL has consistently positioned itself in the top 5 Derivatives platforms by volume and has over $600m in TVL (top 50 dApps across all ecosystems).

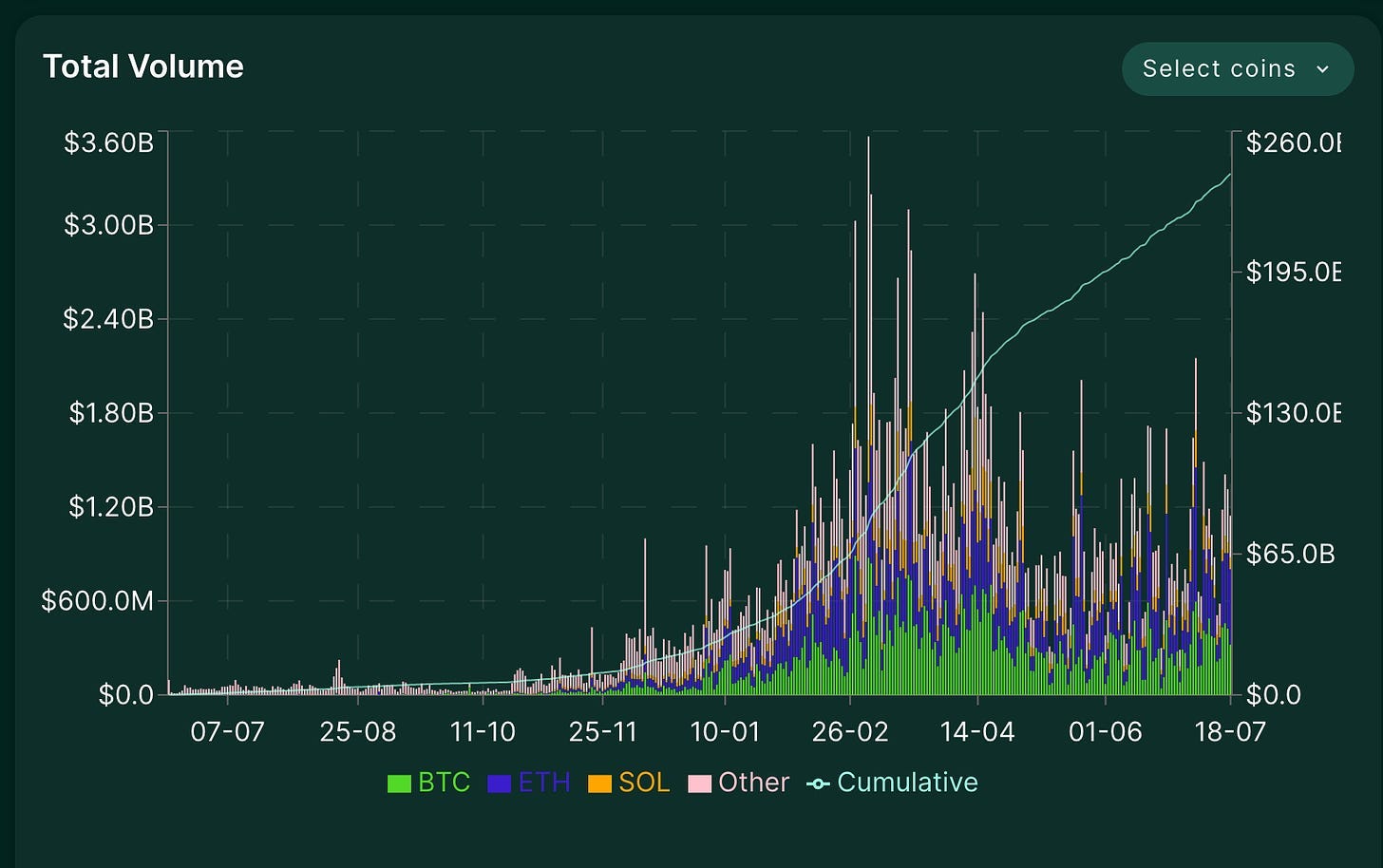

HL's success is also reflected in its steadily increasing Total Trading Volume. Even after the initial spike in February 2024 and the end of the first Phase of the Point Program in June, HL now trades over $1b on its platform daily.

Even though DEXs are a very saturated market, HL managed to carve a premium spot within this niche.

How did they do so? It’s hard to pinpoint a single element, but rather, their strategy has to be analyzed as a whole, as a combination of:

No VC funds

Strategic Incentive Program

Framing: HL is NOT a DEX, but a new Layer 1 (L1)

Narrative Hijacking

HL tokens

Pre-launch tokens

Let’s go through them individually.

No VC Funds

HL bootstrapped its product without VC funds, which is quite an anomaly in today’s market, where most companies are raised from multiple tiers of VCs.

This is significant for several reasons:

Freedom from Investor Pressure: The HL team doesn’t have to “please investors” or compromise their roadmap.

Flexible Tokenomics: They can distribute a higher percentage of tokens to the community, avoiding the low float typical of VC-funded tokens.

Stronger Point Program: Both of these factors boost the attractiveness of the HL Point Program, with users expecting higher rewards than any other program.

Even without VC funds, HL didn’t compensate by introducing high fees, showcasing their long-term vision over short-term gains.

Strategic Incentive Program

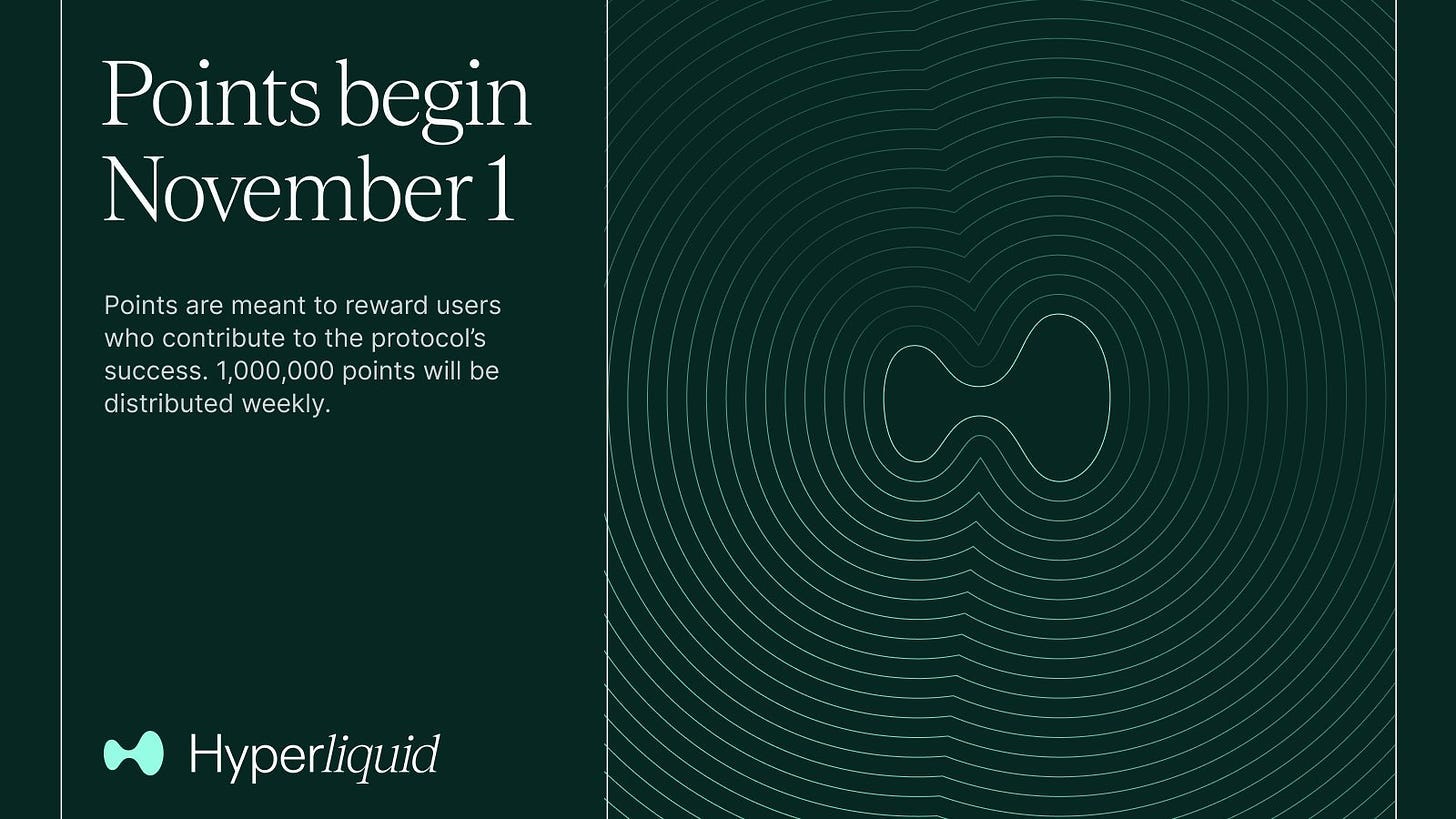

The HL Point program will go down in history books as one of the most successful point programs. At a time when everyone is striving to be relevant, and most point programs fail to attract sticky capital and users, HL has become a household name.

There is a general agreement that HL is THE PLACE to farm now due to expectations of a very valuable airdrop.

It’s worth adding that DEXs, in general, are one of the products that best fit the design and nature of point programs. DEXs and point programs are a match made in heaven: traders love to trade, and with point programs, they get rewarded for it.

The HL point program ran six months from November 2023 until April 2024, with 1 million points distributed weekly. The second phase, L1 Launch, kicked off in late May and is currently running, distributing more than 700k points weekly.

They also had Alpha points for those who used HL before Season 1 (November 2023) and points for May 2024 (2m/week, total 8m) that haven’t been distributed yet for people who continued using HL during May.

The program evolved to incentivize different aspects of HL:

Initially, the team focused on perpetual volume, but with the launch of spot HL tokens, the allocation of points shifted towards spot volume.

HL also avoided boosts, multipliers, or partnerships with other projects. This was a deliberate strategy to limit “mercenary” capital and airdrop farmers who don’t add long-term value.

Contrary to others, who make it all about their point program, HL points were great at attracting users to try HL, who then decided to stay because they liked the product.

Framing: HL is NOT a DEX, but a new Layer 1

HL is not just about building close enough to CEXs, but creating new innovations.

Sky’s the limit to crypto projects valuations, but not if you are a DEX.

In fact, DEXs are crypto primitives that can be evaluated similarly to a Web2 business based on the fees they generate and a traditional P/E ratio.

Recently, we have seen that more and more projects have opted to launch their app chain or Layer 3 (L3) instead.

Doing so, projects give away some of the network effect and inherent security of the network they currently rely on in favor of more flexibility and customization of the tech stack and the possibility of capturing fees on their own blockchain.

Since its inception, HL has been more than a DEX: it is a general-purpose L1 infrastructure where users can permissionlessly launch their tokens, and more, thanks to implementing the Hyperliquid Improvement Proposals (HIP).

In this way, HL goes beyond being a plain DEX and becomes an infra play, with the necessary infrastructure to introduce further innovations on the Virtual Machine on top of it, such as native staking and the Hyperliquid Vault primitive.

Narrative Hijacking

HL has masterfully captured mindshare and market share in the crowded perp scene.

Point programs can only get you so far. They work well to initially attract users, but they are traditionally ineffective at retaining sticky users and liquidity by themselves.

When it comes to retention, users ask themselves a simple question: Do I like the tech? Is there any other reason to be here other than to farm points?

Within this context, HL’s product has proven to be more than just a point farming platform.

HL has been great at providing an alternative to incumbents and capitalizing on its strengths by filling a specific market gap. Current DEXs often fail to retain users due to bad UI and UX, a small pair offering, low liquidity, and bad tokenomics.

While each protocol has its own competitive advantage in terms of fees, liquidity, or slippage, this leads to a fragmented user experience (UX).

HL has been able to capitalize on this by launching a whole ecosystem of native tokens, pre-launch tokens and launching as an app-chain where others can build on top of them, as Rage Trade and others are already doing.

Why launch on HL?

The HL ecosystem:

The final HL vision is to grow its own ecosystem, with more dApps and use cases built on it, to consolidate users.

I am sure we will see more of this “shopping mall” trend, where projects develop their ecosystem, integrating different primitives and verticals so that users don’t have to leave their ecosystem.

Hyperliquid Tokens

(throughout this paragraph, I use HL tokens and HIP-1 tokens interchangeably)

Arguably the most successful implementation of HL just yet.

HL tokens have managed to become a new narrative with a very loyal following.

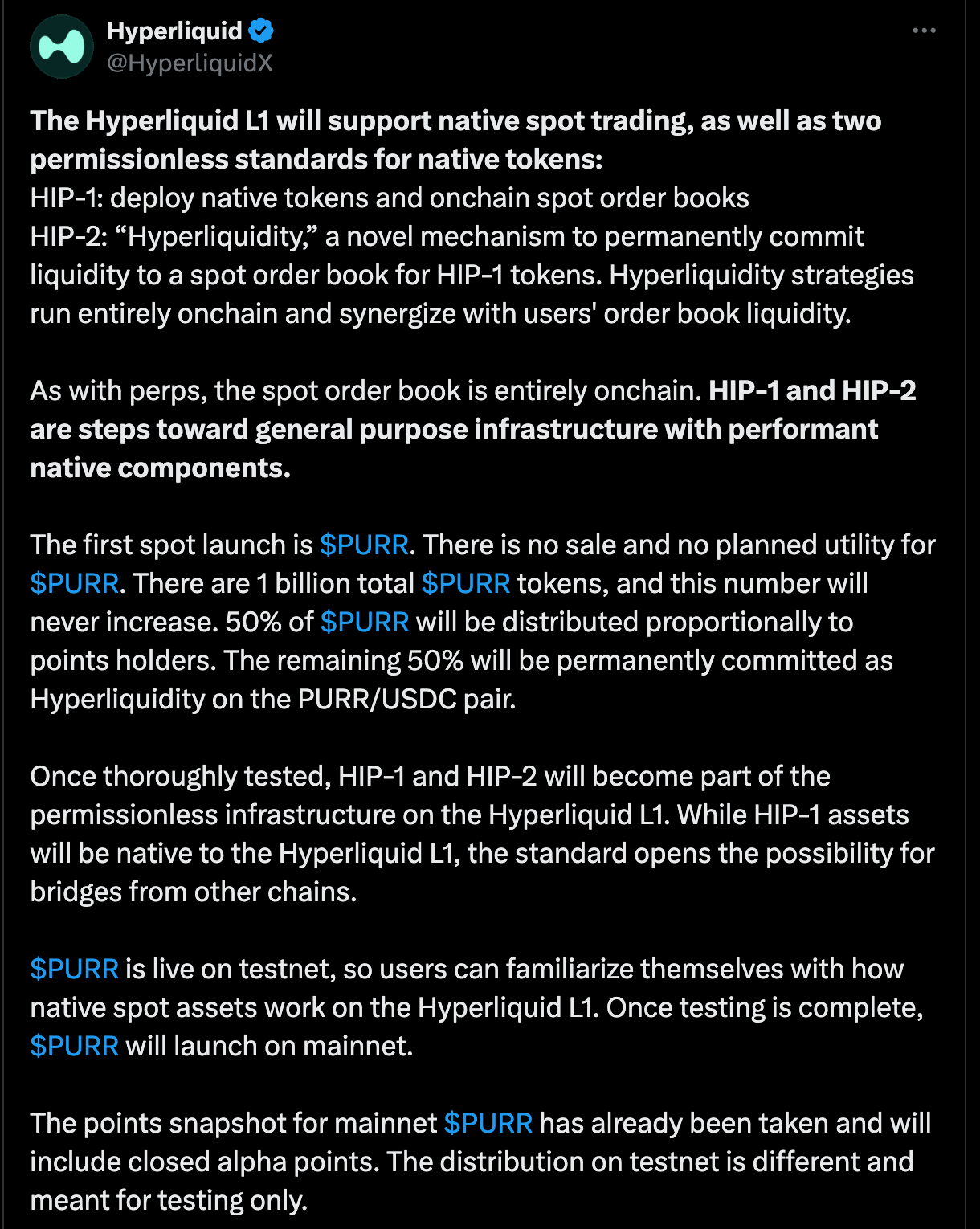

They are enabled by the HIP-1 and HIP-2 standards:

HIP-1: is the HL native token standard, also allowing spot order books between HIP-1 tokens. Transactions fees are paid in HIP-1 tokens.

HIP-2: defines “hyperliquidity”, HL mechanism to democratize how HIP-1 tokens bootstrap liquidity at launch. Contrary to traditional automated order book strategies, there are no traditional Market Makers, but anyone can participate in market-making strategies and get profits or losses based on their contribution to the vault.

The HL token ecosystem has been inaugurated with $PURR, the native memecoin, created by HL and airdropped to its users.

PURR is doing exceptionally well, testament to users' loyalty and community involvement in HL.

To date, there are four main HL tokens, for a total market capitalization of about $150m.

Creating one’s isolated trading environment helps retain liquidity within the HL ecosystem and yet provides another value proposition to those users who are more degen and want to trade new and high-volatility tokens.

Here’s how you can launch a spot token on HL:

https://x.com/0xPasteke/status/1808222822772195452

Soon, HL is expected to enable atomic swaps between HIP-1 tokens and ERC-20, making HL tokens effectively composable with Ethereum tokens, as well as decentralizing its validator set.

Interested in running a node? Feel free to refer to the official guide:

https://github.com/hyperliquid-dex/node

Pre-launch Tokens(Hyperp)

Listing prelaunch tokens in a timely manner is incredibly effective in attracting volume due to the high interest and mindshare of tokens right before launch.

People want to buy shiny new things and need a place to do so.

Aevo is one of the pioneers of pre-launch tokens, which has proven this model to be successful.

Pre-launch tokens cater to catalyst traders and everyone who has been airdrop farming to hedge their exposure. For this reason, they represent an important addition to HL's suite of products.

Mors tua, vita mea.

Where is the money coming from?

There are only so many funds in crypto, which is a zero-sum game.

In practice, this means that the increasing volume to HL must be directly coming from somewhere else experiencing a contraction.

Where is this volume coming from:

Blast: after the end of the Gold distribution, Blast TVL has shrunk from over $2.5b in June to the current $1.5b, losing over $1b in TVL.

Blast volume has also suffered a contraction, going from a peak of $300m in June to slightly above $50m nowadays.

Nonetheless, it’s hard to argue a correlation between the two, as HL has been live since November 2023. However, it is fair to say that once the Blast farming was over, some moved to HL, as the most hyped point program in the sector.

Solana: are HL tokens an alternative to Solana coins? Well, to some extent.

However, data shows no evidence of Solana users or volume moving to HL.What’s more likely is that the recent market uncertainty has particularly impacted the broader SOL ecosystem (especially memes), slowing it down. In such times, degen users are wary and avoid trading as usual.

Furthermore, the meme narrative has been over-saturated, and the ETH ETF news has also slowed down sentiment on SOL.Other perps: Using GMX as the leading representative of other perps, can we identify a decrease in DEXs volume that can be directly attributable to HL growth?

We can see that GMX has struggled slightly since November 2023 and has registered volumes similar to the current ones.

This might be attributed to increased perp competition in the sector and the initial reassessment necessary after the launch of GMX V2.

Furthermore, as the incumbent in the sector, GMX has already softened its dominance in favor of other challengers that came up.For this reason, a better comparison might be between HL and Vertex, as Vertex was previously the upcoming challenger to GMX and was trying to cut its corner in the market.

The data from Defillama shows that Vertex volumes have deflated since the token's launch and the end of the incentive program.

Did all the Vertex farmers move to HL?

It would seem fair to argue that the launch of HL has put increasing pressure on perp incumbents, who are now under more scrutiny to innovate their offerings and compete with HL.

Are we going to see others follow the HL playbook and develop their own trading-focused L1s?

From CEX to DEX to Ecosystems

Habits take a long time to change, especially in crypto.

However, during the past few years, we have observed one of the most significant trend shifts: the total percentage of DEX/CEX volume has been increasing.

Users are slowly moving to DEXs from CEXs like Coinbase or Binance.

This is no surprise, given the post-FTX aftermath and continuous incidents highlighting CEX's malpractices in user fund management.

Not your keys, not your coins.

Consequently, users are ever more wary of the avenues where they transact.

At the same time, the emergence of so many platforms and protocols leads to fragmentation and a less-than-ideal UX.

We can foresee user fatigue from navigating so many protocols and their willingness to actually prefer finding a single place that offers all of the services they need.

For this reason, the one-L1-captures-them-all vision of HL fits very nicely within this trend.

Hyperliquid has made a name for itself by being more than just a DEX. It has strategically positioned itself as a new Layer 1 blockchain with high performance and low latency, attracting a loyal user base through innovative tokenomics and a successful incentive program.

By avoiding VC funding, focusing on a strong narrative, and offering unique products like pre-launch tokens, HL has managed to carve out a niche in a saturated market.

HL made a strategic decision that was very brave and has proven to be successful.

As users continue to move from centralized to decentralized exchanges, HL is well-positioned as a suitable alternative.

Whether they are going to make it or not, will mostly depend on their last hurdle: Are they going to be able to sustain this growth post-airdrop?

Only time will tell.

The HL playbook:

No VC funds

Incentives to attract, good products to retain

Expansion beyond a perp dex: L1 to capture and retain users

A comprehensive suite of products: users don’t ever need to leave HL