The DEX for Pro Options Traders, Aevo is Officially Live on Mainnet

Trade Options like a pro on a dedicated OP Rollup

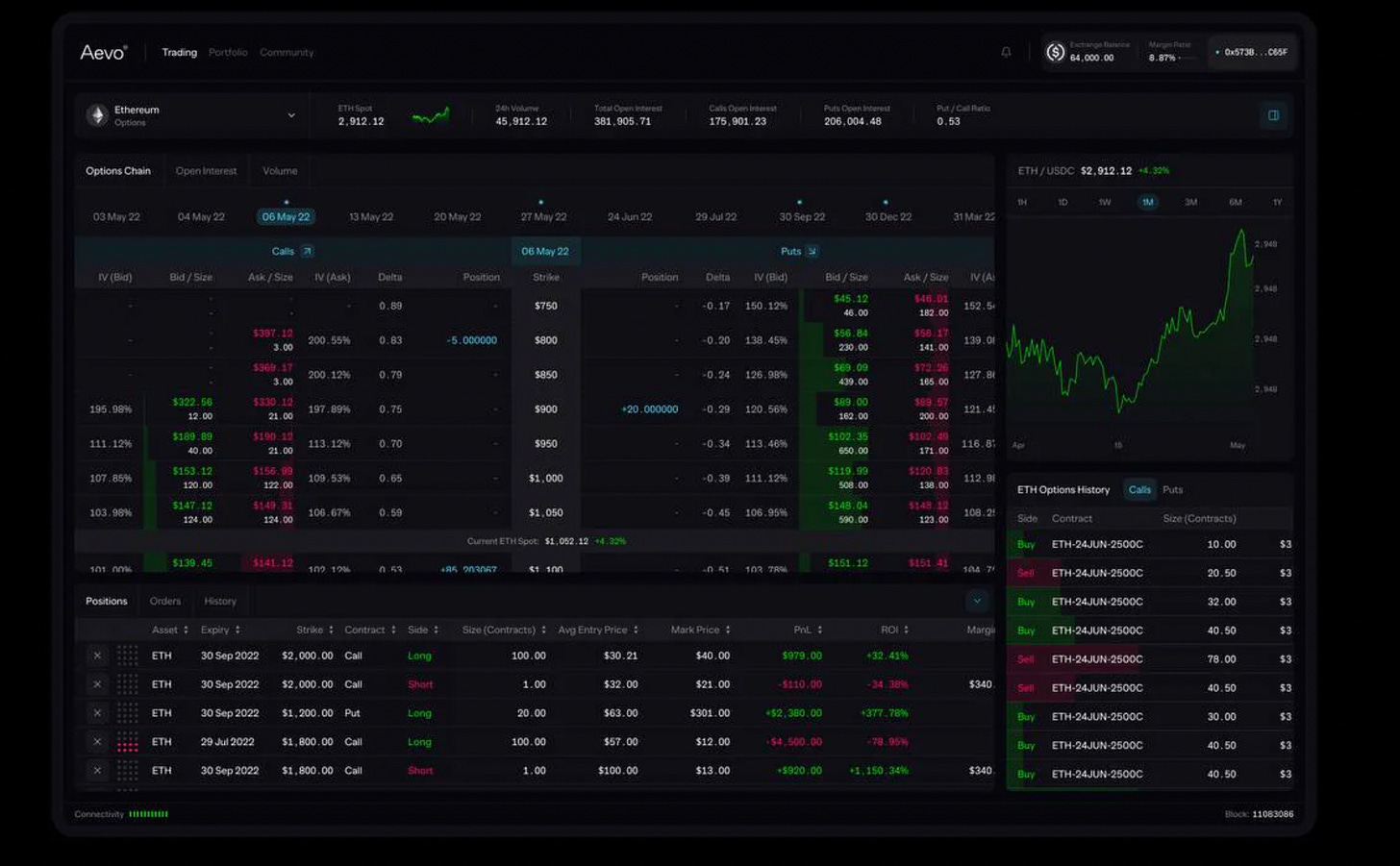

The Aevo Exchange is officially live on Aavo mainnet, where users will finally be able to trade with mainnet USDC and real on-chain settlement.

Aevo is launching on a dedicated new Optimistic Rollup on Ethereum, based on the OP Stack and supported by Conduit.

These are the current stats, taken from Aevo block explorer:

What is the Aevo Exchange?

It is an order-book-based decentralized exchange for options targeted to pro options traders: they argue that current Option Vault strategies are too simple and inflexible and aim to provide more opportunities for complex and flexible option products.

Some of its features include:

A suite of add-on instruments, with many strikes and expiries;

Deep liquidity;

Instant onboarding by depositing USDC from any EVM chain.

At the moment both the risk engine and the order book are off-chain: orders are matched off-chain and settled on-chain.

How Expensive is to Trade on Aevo?

https://twitter.com/antonttc/status/1644582970156806144

How does Aevo Make Money?

https://twitter.com/hansolar21/status/1645253811903295488

Aevo and Ribbon

Aevo works closely with Ribbon, as the settlement layer for Ribbon options contracts.

Thanks to this partnership, Aevo can benefit from a consistent flow from Ribbon, while Ribbon can benefit from more sophisticated vault structures to build on top.

Users can hedge their Ribbon vaults by buying options on Aevo;

Ribbon users won’t need to lock their funds but will be able to exit their vault seamlessly on the Aevo exchange: taking profits or cutting losses on their position (similar to what Lyra allows);

Auction participants will be able to trade vault positions as real positions in the Aevo exchange, greatly improving the composability and liquidity of the Ribbon system.

They envision more protocols to deploy options strategies and take advantage of the Aeavo exchange liquidity to use Aevo as “the underlying venue for where these options contracts clear”.

How to Access Aevo?

Access to Aevo Exchange will be initially gated, due to the novelty of the product.

Users will be invited via the Aevo PASS, an NFT granting access to the platform.

Initially, only 1000 PASS will be dropped, mainly to existing Ribbon users, VIPs, and Aevo beta testers.

Food for Thought

Aevo is an options exchange built on a custom Optimistic Rollup, guaranteeing flexibility and scalability;

It is, still centralized, given that transaction matching happens off-chain;

The development of application-specific L2s will provide an unseen level of improvement and flexibility over existing applications;

The TVL of DeFi Options is increasing, and so is the sophistication of investors. Several protocols could benefit from the flexibility and customization offered by Aevo in order to offer different strategies tailored for pro options traders.

The previous DeFi limitations, such as costs, scalability, and flexibility are slowly being worked and solved on. Aevo is positioning itself to lead the DeFi Options 2.0, which leverage the underlying options strategy to improve liquidity and scope

A good primer on Aevo by ser HanSolar: