The Cosmos Network is Splitting with a Hard-Fork following Governance Disagreement

When considering models of virtuous governance in crypto, Cosmos may not be the first example coming to mind.

Despite its success, in fostering the development of a vibrant ecosystem of dApps, Cosmos has encountered significant governance challenges and debates about the strategic direction of the protocol.

These issues have been exacerbated by recent events, culminating in a proposed hard fork by one of Cosmos’ co-founders.

Let’s delve into the sequence of events leading to this and examine the potential impact on Atom.

Governance: A Double-Edged Sword

It all began on November 26, when the Cosmos Hub (governance) approved Proposal 848. This proposal, which passed with over 41.1% of the votes in favor, proposed the adjustment of the maximum inflation rate of ATOM to 10%.

In essence, this proposal would decrease inflation from 14% to 10%, and lower the APR for ATOM staking from 19% to approximately 13%.

ATOM employs a dynamic model for inflation, linked to the staked (bonded) ratio of ATOM, with a rate that fluctuates between 7% and 20%.

The model is designed to boost the inflation rate if less than two-thirds of all ATOM is staked, incentivizing users to stake and contributing to increased network security.

The introduction of an inflation cap sparked a heated debate.

On the one hand, a reduction of inflation for ATOM would enhance the token value proposition as a cryptoeconomic security provider for their networks.

Advocates in favor of the proposal argued that the reduced inflation would boost ATOM value as a security asset, particularly in light of Cosmos’ plans to expand its DeFi ecosystem and Atom Economic Zone (AEZ), as more chains will rely on the security provided by the Cosmos Hub.

This argument has been supported by Blockworks Research, showing that Cosmos might be overpaying for security compared to other Layer 1 — and expressing concerns about the constant sell pressure affecting ATOM.

This research also led to a new recommended inflation schedule (in yellow in the chart below), aimed at adjusting the minimum inflation parameters and the rate of inflation change.

Furthermore, a case was made where the inflation cap would still allow nearly all validators to be able to continue their operations — having the last resort option to increase their commission rate as well.

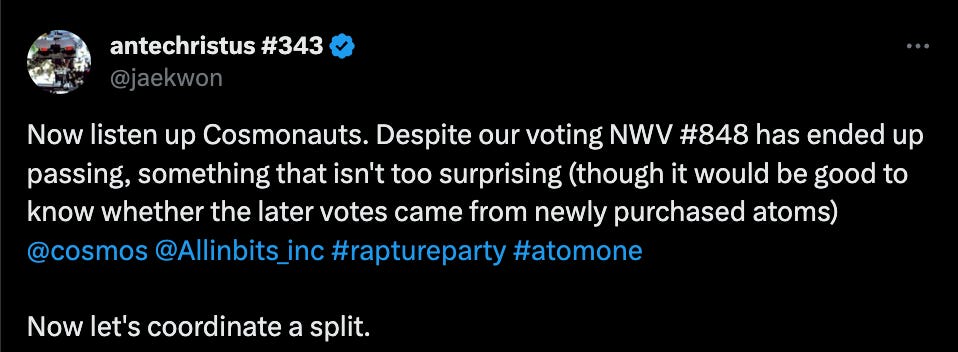

However, the results of the vote did not resonate with Jae Kwon, a co-founder of ATOM, who expressed its disappointment with Proposal 848 and has called for a hard fork of the protocol. In Kwon's opinion, the inflation cap would alter the Cosmos network security framework.

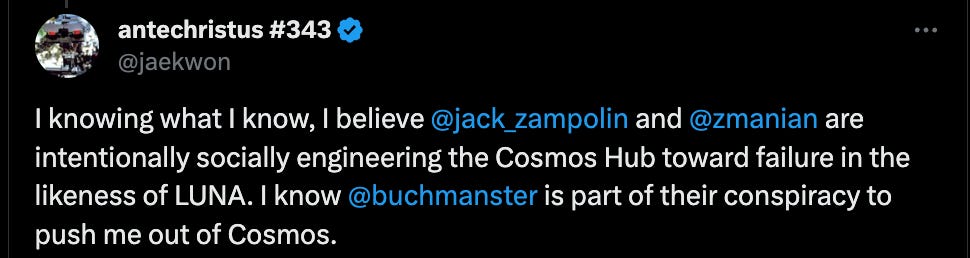

This disagreement has raised concerns about leadership and Kwon’s influence within the community, especially given his attitude and history of conflicts with the Cosmos community.

I remember another guy named Kwon who used to do that.

Kwon has proposed a new token, AtomOne (ATOM1), as a hard fork of the current network.

Part of the reason for his disagreement regards the fundamental conception of ATOM, which according to Jae Kwon, was never meant to be money (but to ensure the security of the IBC hub).

He argues that altering the inflation schedule compromises ATOM's core purpose of securing the IBC hub.

Kwon proposes to maintain the current design of ATOM, without altering the main value proposition and first principle of ATOM, especially with regard to security.

The proposed AtomOne fork will exist separately from Gaia.

“The vision behind this AtomOne fork is to be an alternative minimal fork of Gaia (“cosmoshub4″) running alongside Gaia to prepare for all contingencies, and also to operate as a political party base in relation to Gaia. We strive to complement the broader Cosmos ecosystem while introducing innovative solutions and perspectives. Our goals are not just to resolve current challenges but are also to set a new precedent for adaptive and responsive self-organization in the multichain multitoken universe that we call the Cosmos.”

The main purpose of AtomOne will be “to fix what must be fixed in governance” and develop an “explicit constitution, before launching the full IBC and ICS functionality of the chain”.

The distribution plan for ATOM1 remains speculative, with suggestions that all ATOM holders will receive the new tokens and those who voted “NO” to Proposal 848 might receive a “loyalty” bonus.

Kwon also envisions the integration of ATOM with ATOM1, to prevent a collapse in ATOM’s value:

“I believe that the final plan should include an integration of $ATOM and $ATOM/$ATOM1 so that instead of mass selling $ATOM and collapsing it all, we allow participation from $ATOM, but what is in the README can be improved.”

If you want to participate, the discussion on ATOM1 design is happening on GitHub.

History shows mixed outcomes for hard forks. Forks like Bitcoin Cash have struggled to establish the same network effect as the forked network. Arguably, only Ethereum has managed to be more successful than Ethereum Classic, the forked network — mainly due to the security reasons behind the fork.

The success of ATOM1 and its impact on the broader Cosmos network remains uncertain.

Will ATOM1 manage to emerge as a legit Cosmos network?

Or will this fork accomplish the opposite, and weaken the Cosmos network to the extent that it loses reputation and network effect — and will be sent to oblivion?

Ideally, hard forks should be avoided at all costs.

Once you divide the key community of the network, there is no comeback.

Tribalism within crypto has never led to anything good.

United we win, but divided, we succumb.

In the world of cryptocurrency, forks are often seen as a last resort due to the risk of fracturing communities.

Nonetheless, hard forks also represent a form of democratic dissent where the minority might decide to follow its own course against a perceived majority’s tyranny.

In this particular case, the dilemma is more than a mere disagreement: it symbolizes a deep schism in the strategic development of Cosmos’s future and the token utility of ATOM, fueled by the founder’s dissent with the approved governance proposal.

In fact, many have criticized Kwon for not accepting a governance and democratic decision by the Cosmos community.

Inevitably, all of this has impacted the price of the ATOM token.

Stay tuned for the next episode of Cosmos: Governance Wars, soon on HBO.

More on Cosmos:

https://twitter.com/esatoshiclub/status/1729042584507425058

https://twitter.com/cosmonaut_joon/status/1728585409461199289?s=20

https://twitter.com/Rhuax/status/1728534271109829080

https://twitter.com/jaekwon/status/1729195883982622857

https://twitter.com/jaekwon/status/1723464983370203572?s=20

https://twitter.com/jaekwon/status/1723816927230148912?s=20

https://twitter.com/jaekwon/status/1525154171216834560?s=20

https://twitter.com/sachayve/status/1728527986289172619?s=20