This article introduces Mode network and it pivot to AI.

While Mode did not have exactly the best launch, they are one of the most interesting examples of resilience, being able to re-invent themselves and bet big on future trends.

The Importance of Reinventing Itself

Mode was initially launched as a Defi-focused layer 2 (L2).

However, it was not easy to differentiate itself in such a crowded landscape. While many L2 struggle without much fight, one must admit that the Mode team has always been honest about Mode and openly accepted feedback on improving.

This prompted Mode to act early on and define a path that would make it unique compared to other L2. In January 2024, Mode was already focused on developing open-source tools to bring “on-chain AI agents to the network”.

Fast forward a few months, and AI agents are the talk of the town.

With foresight, this bet appeared spot on.

Here’s how Mode is uniquely positioned to capture this narrative.

Mode: the L2 Network for AI Agents

How did Mode stimulate the growth of AI agents on its network?

AI-focused grants: 5 projects funded

Launch of AIFi Accelerator with 9 teams

Launch of “Synth”, a Bittensor Subnet

AI Agents App store: with agents deployed by Giza, Olas, and Amplify

How does the Mode stack focus on AI agent developments? What makes it unique?

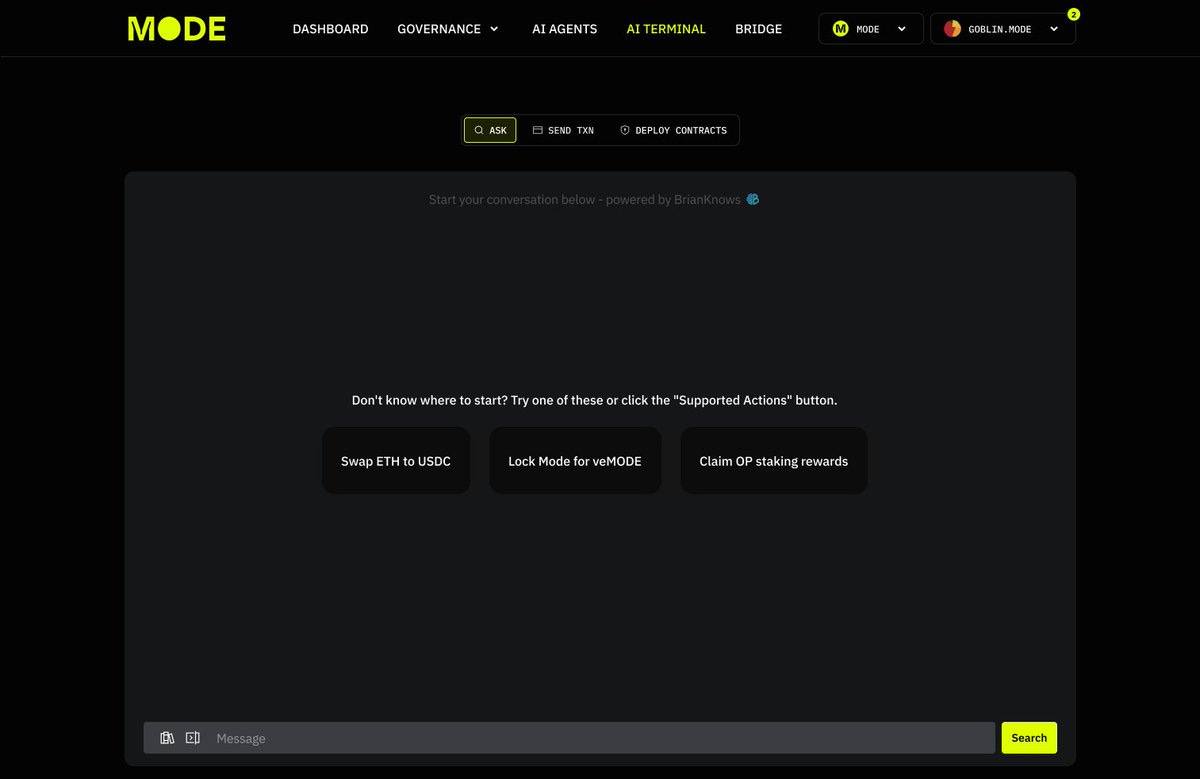

1. The AI Terminal for Human<>Agent interactions

With the launch of the AI terminal, users can interact with DeFai agents using a simple chat interface and stack together DeFi transactions on Mode.

Besides executing transactions, anyone can deploy contracts through the terminal. The capabilities of the AI terminal are constantly evolving and linked to other developments in the Mode ecosystem.

For once, the terminal integrates data from Synth, the Bittensor Subnet developed by Mode, allowing it to accurately “answer probabilistic questions on market data”.

Let’s now dive into Synth.

2. Synth: Mode’s Bittensor Subnet

With so many agents, one defining factor behind them is the data they can leverage.

https://x.com/modenetwork/status/1864302255979020765

The development of the Synth Bittensor Subnet will allow all agents to leverage “synthetic price data” for financial forecasts to have “probabilistic reasoning capabilities.”

This will start with BTC data and gradually include more assets. All historical data is sourced through Pyth oracle.

Subnets are sub-networks operating on Bittensor using AI for different scopes.

Generates 100 simulated price paths for BTC every 5 minutes

Miners have to model the probability distribution of future pricesto encapsulate realistic price dynamics, such as volatility clustering and skewed fat-tailed price change distributions.

Validators use a detailed scoring methodology to score miners by comparing their outputs to Pyth’s historical price data.

The Synth whitepaper has just been published:

https://x.com/modenetwork/status/1884556194838114482

The Synth data became available to all agents on the 30th of January 2025, improving their “forecasting and probabilistic reasoning” when it comes to BTC price predictions.

https://x.com/modenetwork/status/1885030182773281254

After improving the data accessible by agents, the next step is to make them accessible to anyone.

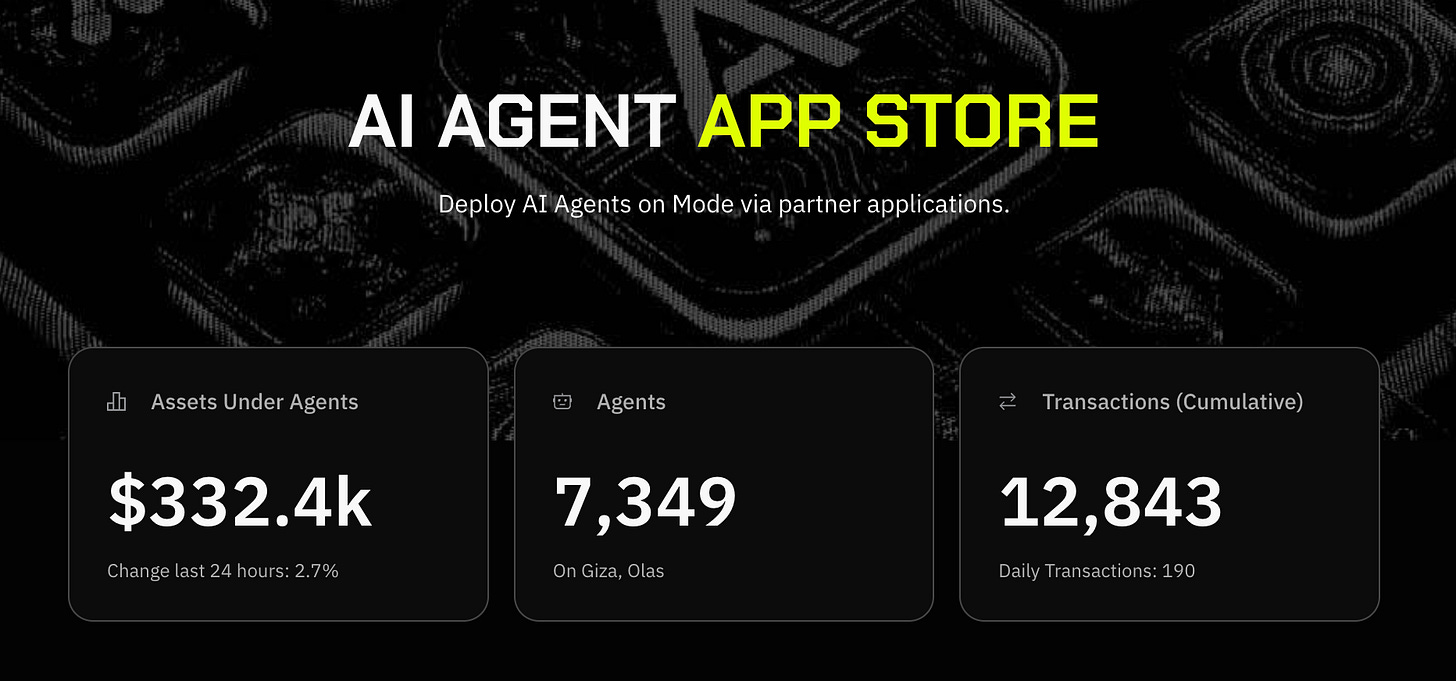

3. The AI App Store

Anyone can access automated DeFi strategies on the AI agent app store.

Some of the agents currently available include:

ARMA from gizatechxyz: used to earn a yield on USDC

Amplifi: yield-earning strategies on BTC

Brian: executing DeFi transactions using an LLM interface

Modius by Autonolas: to manage LPs on Balancer

Sturdy, a Bittensor subnet for yield-bearing strategies focused on lending

Quillai Network: a security-focused network where users can access security agents, such as the one in the image below.

7. Axal: powering customizable verifiable agents, showcasing its technology with Autopilot, its onchain trading agent that can be leveraged for:

8. Mozaic: focused on intent-based trading and advanced vault strategies

9. Magnet Labs: focusing on programmable agents for any task

4. Beyond the Tech: Bootstrapping the Ecosystem

Besides betting on the tech, Mode is also building the infrastructure to attract and welcome new founders.

The AI founder school launched a 3-week bootstrapping program for wanna-be founders, with over $100k in prizes: https://x.com/modenetwork/status/1879577365854265636

Another similar initiative is the DeFai accelerator for early-stage AI projects:

https://x.com/modenetwork/status/1881357103484502112

The first cohort happened in October 2024, with over $10m in seed funding provided:

Selections for Round 2 have started, with a demo day on January 20th.

Some of the verticals the accelerator focuses on include:

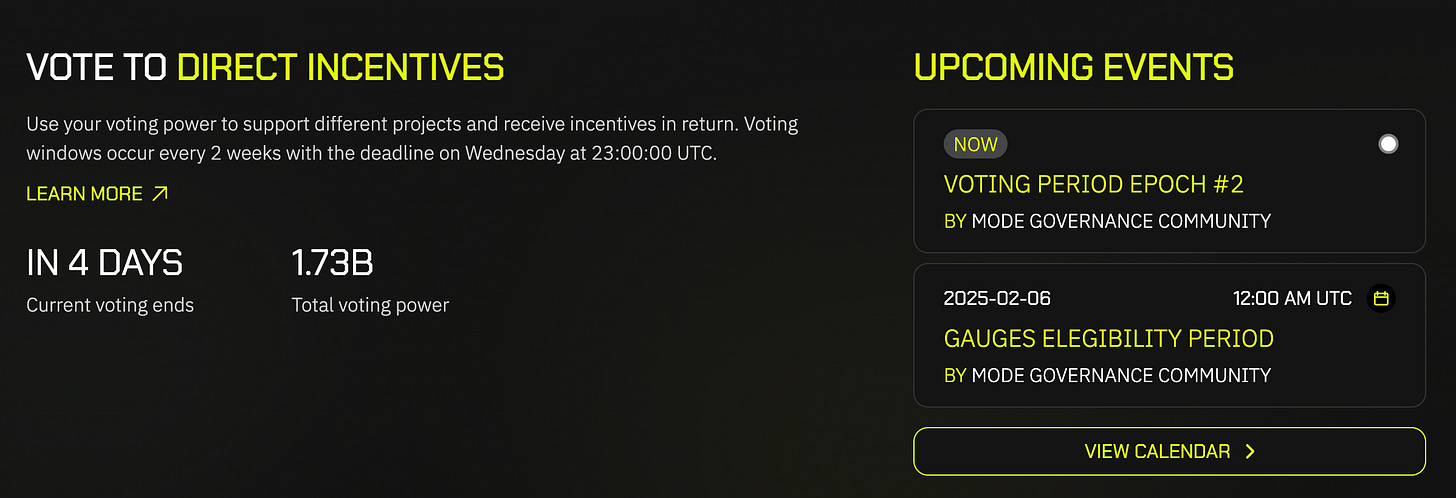

This week, Mode users can also vote to direct incentives to protocol in exchange for incentives. Just like in the good old Solidly days, users can get bribed to vote on projects where to direct liquidity.

Over 2m in OP incentives are up for grabs:

https://x.com/modenetwork/status/1879613821079466376

Food for Thought

Aside from a list of features, this article is essential as it showcases the extent to which Mode has focused on AI agents and could be considered an interesting case study.

There is no single playbook on how blockchains, especially L2, can adapt to new narratives. By focusing early on AI, Mode has capitalized on the sector's growth with the right infrastructure to accommodate agents.

This stands out as a pragmatic approach, blending technological developments and focusing on nurturing high-quality projects and builders within the ecosystem.

Mode has reinvented itself and its focus, bootstrapping its community from scratch and venturing into a previously unexplored narrative.

It's a good one for the books - we’ll see how this will play out.

https://x.com/ionicmoney/status/1886794417270317159