Introducing Initia: The Full-stack Solution for Interwoven Rollups

Scaling Ethereum with L2 led to fragmentation of liquidity and user experience (UX), which impacts both application users and developers.

While appchains were created to offer more customization - they have heightened this problem, as every chain is siloed and operates in isolation. Appchains are also expensive and time-consuming to maintain. They require validators, block explorers, wallet integrations, and dev ops.

This results in incredible UX pains:

For users: such as bridging assets multiple times across app chains

For developers: having to spend considerable effort integrating all necessary infrastructure to launch an app chain with the potential to attract new users.

Initia is solving this issue by focusing on “interwoven rollups”, a unified framework to build interoperable rollups. It aims to allow customizable app chains to launch, solving fragmentation by coordinating liquidity and security among multiple rollups.

This is a different design than traditional Ethereum rollups, as it provides additional:

Built-in interoperability

Enshrined liquidity

Initia is a modular L1 that goes beyond the traditional rollup design with “Minitias”, offering all the necessary infrastructure without the need to deploy an L1 or L2 from scratch.

- 500ms block times

- 10,000+ TPS

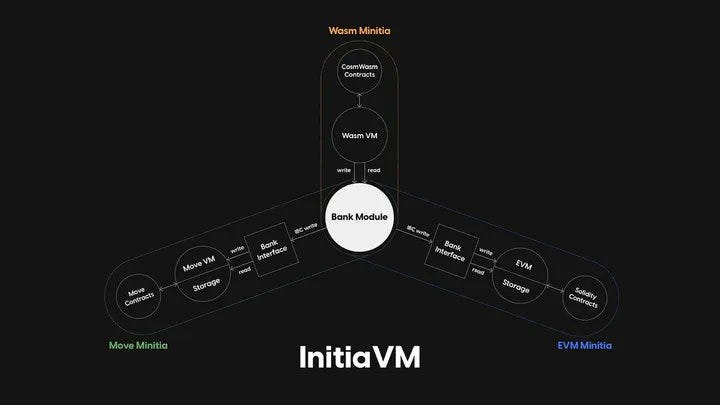

- Multi-VM support (EVM, Move, CosmWasm, etc.)

- Out-of-the-box tooling (native bridging, wallets, block explorer)

- Cosmos + Celestia integration

To be attractive, new app chains must launch with critical infrastructure and services available to users. This includes oracles, bridges, explorers, indexers and more. Nonetheless, this is easier said than done.

Initia provides a full-stack solution (Omnitia):

Modular L1 (Initia): in charge of security, governance and coordinating liquidity across Minitias.

L2 Rollups (Minitias): fully customizable, with all the benefits of app chains and without limitations in terms of isolation, scalability, and interoperability.

Infrastructure tooling: supporting multiple VMs (VM-agnostic), leveraging Celestia DA and Cosmos IBC, native DEXs (InitiaDex, Minitswap), native name service, native portfolio dashboard, multi-ecosystem wallets, oracles, explorers and more. This way, developers can integrate any third party tool as simple plug-ins when building a rollups

Thanks to this approach, developing app chains on Initia is incredibly easier, with developers able to leverage the native features of Initia's integrated ecosystem and focus on product development and testing.

Initia will also launch with a complete ecosystem from inception:

Minitswap & Enshrined liquidity to prevent fragmentation

Shared token standards (LayerZero OMF) for unified assets

IBC-native bridging for seamless asset movement

Fast confirmations (SSF, 500ms) for rollup coordination

Developers have everything they need to create applications, which will in turn bring users and liquidity.

Let’s now dive into the features that make Initia unique.

Enshrined Liquidity

Initia is a true liquidity hub, ensuring that every new rollup created contributes back to the ecosystem instead of fragmenting it.

Enshrined liquidity is a new way to secure the network and build a liquidity hub for any Minitia to access.

This is enabled by InitiaDEX, the native DEX, which is also the main engine for routing cross-rollup swaps:

All tokens are paired with the native INIT token (e.g., INIT-wstETH)

Tokens are then staked with validators on the Initia L1

While users usually have to decide whether they want to provide liquidity and earn fees or stake tokens with the validators for staking yield and governance, InitiaDEX allows them to do both.

When users provide liquidity to whitelisted pairs, they can stake those LP tokens with validators to simultaneously:

Secure the network

Provide Liquidity

Vote on governance proposals

Enshrined Liquidity also improves capital efficiency by incentivizing LP assets and the INIT native token, “that would’ve otherwise been sitting idle in liquidity pools contribute to the network’s security”.

However, to get whitelisted, a pair has to get approved from Initia governance and have a pair with the INIT token.

To further reduce fragmentation among its interwoven rollups, Initia users Minitswap as a “Unified Liquidity Pool”, allowing near-instant bridging.

Omnitia Shared Security (OSS)

Launching as an interwoven rollup means they inherit the security from Initia L1.

In fact, L1 validators act as a last resort in case of inconsistencies at the L2 level, effectively securing all interwoven rollups.

Furthermore, through MilkyWay's Modular Restaking, rollups can boost their security by tapping into additional economic stake.

https://x.com/initia/status/1892042280862916890

By leveraging Celestia data availability and light nodes, they can always verify data independently without pulling information containing the contested transactions.

VIP

EVM rollup lack incentive alignment between the L1 and the L2 layer. This results into:

Fragmented liquidity

Redundant applications

Misaligned incentives

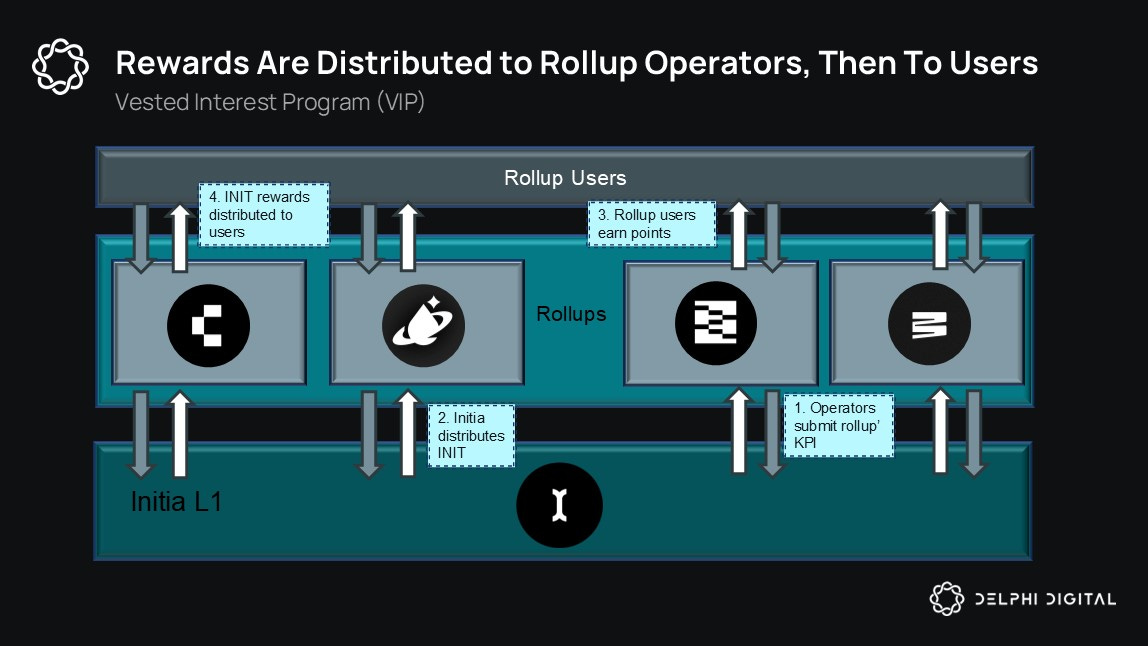

Initia focuses on aligning interests between users, intervowen rollups and the L1 through the Vested Interest Program (VIP), creating positive-sum economic alignment across the entire ecosystem.

Any rollup launched on Initia receives rewards based on onchain metrics including TVL and user engagement. Users are rewarded on their governance participation and on chain activity. A native gauge system running eery 2 weeks ensures the efficient capital allocation of incentives to the applications providing the most value.

VIP-led feedback loop:

1. Holders with voting power need to carefully evaluate which rollups deserve support

Rollups need to prove their worth to these voters, and can offer direct rewards to voters, as “an additional layer of economic alignment” - through Cabal for instance.

Like other ve systems, the longer users commit their tokens, the more influence you wield.

Why build on Initia?

Rollups can customize:

Execution by choosing their VM

MEV Policy: Protocol-Owned Builder & ProtoRev modules allow communities to decide MEV extraction rules.

Data Availability – Celestia as the default DA layer provides high throughput and unlimited bandwidth.

Sequencing – Teams can choose between centralized sequencers or implement sequencer rotation as rollups are built with CometBFT. Shared sequencing integration is planned in the future.

Gas abstraction via JIT that lets users pay with any token, not just INIT

Examples of builders and why they chose Initia:

https://x.com/stokasz/status/1894046187340050740

https://x.com/stokasz/status/1885121172146385005

Zaar gg: https://x.com/initia/status/1887169416259154120

The Initia Ecosystem

Everything that happened this week on Initia: https://x.com/ItsAlwaysZonny/status/1892928048493887836

Cabal $3m raise: Cabal is the hidden hand behind Initia's VIP rewards. Cabal amasses governance power by allowing users to deposit INIT and Enshrined Liquidity positions for liquid, yield-generating assets. Interwoven rollups can bribe Cabal depositors to allocate them a greater share of VIP incentives each epoch. Cabal maximizes yield outcomes for $INIT holders while boosting liquidity, visibility, and rewards for rollups.

https://x.com/CabalVIP/status/1889479280146653298

Rave, enabling “quanto” futures: lets you trade perpetual futures using almost any token as collateral. Users can go long or short on major markets like BTC-USD using your altcoins as margin, without worrying about your collateral’s own price volatility. https://x.com/0xJESSIE_/status/1895315058185711919

Echelon, a MoveVM lending protocol & appchain in partnership with Ethena with $125m+ in TVL, building on networks like Aptos, Movement, and Initia.

https://x.com/EthenaNetwork/status/1894425209169649917

deINIT: an LST for staked INIT-USDC LPs staked in Enshrined Liquidity, making them usable across the “interwoven economy”. https://x.com/dropdotmoney/status/1892626903158419540 https://x.com/mityaxyz/status/1892632061632020805

Interwoven NFTs: https://x.com/initia/status/1886821325416833172

More ecosystem Projects:

For more insights on interwoven rollups you can use this helpful dashboard:

https://x.com/Minity_xyz/status/1895383654702162100

If you are looking for more opportunities in the Initia ecosystem you might want to try getting in their Echo group: https://x.com/initia/status/1893707409534968291

Food for Thought

Initia aims to solve the main challenges currently experienced by Ethereum rollups.

Thanks to Initia, creating app chains is much easier:

They provide a full stack ecosystem where app chains can integrate third party services as plug ins

No fragmentation thanks to native interoperability and enshrined liquidity, shared security

VIP ensures rollup operate in a win-win environment, each of them benefiting instead of fragmenting the L1

This is great