IntentX: a new paradigm in AMM bringing CEX trading on chain

IntentX is an innovative addition to the world of decentralized finance (DeFi). It's a next-generation over-the-counter (OTC) derivatives exchange specializing in perpetual futures trading, redefining the landscape with its intent-based architecture and cross-chain functionalities.

IntentX has currently an open-beta since November 15th, 2023, with a full launch planned for Q1 2024, where they promise over 180 tradable pairs at launch, with deep liquidity.

IntentX is a combination of technological innovations:

LayerZero, a cross-chain communication protocol

Account abstraction

Intent-based architecture that addresses critical challenges in delivering on-chain derivatives.

Arguably the major innovation of IntentX lies in its intent-based architecture. This approach moves away from traditional order books or automated market maker (AMM) models.

Instead of relying on order books or AMM models, where traders execute orders against committed capital, IntentX traders can express their trading intentions, which are then executed by external solvers (market markets), who can plug in centralized exchanges (CEX) liquidity, ensuring competitive quotes and minimal slippage.

In this way, this model allows for more liquid, efficient, and scalable on-chain trading, bridging the gap between decentralized trading and CEX liquidity.

By simply tapping into this liquidity, IntentX's architecture enables competitive offerings in the perpetual futures space, such as trading over 180 top crypto pairs with significant leverage and providing incentives for traders.

It also emphasizes self-custody, permissionless and trustless trading, and an intuitive user experience with one-click trading and integrated on/off-ramps for DeFi users.

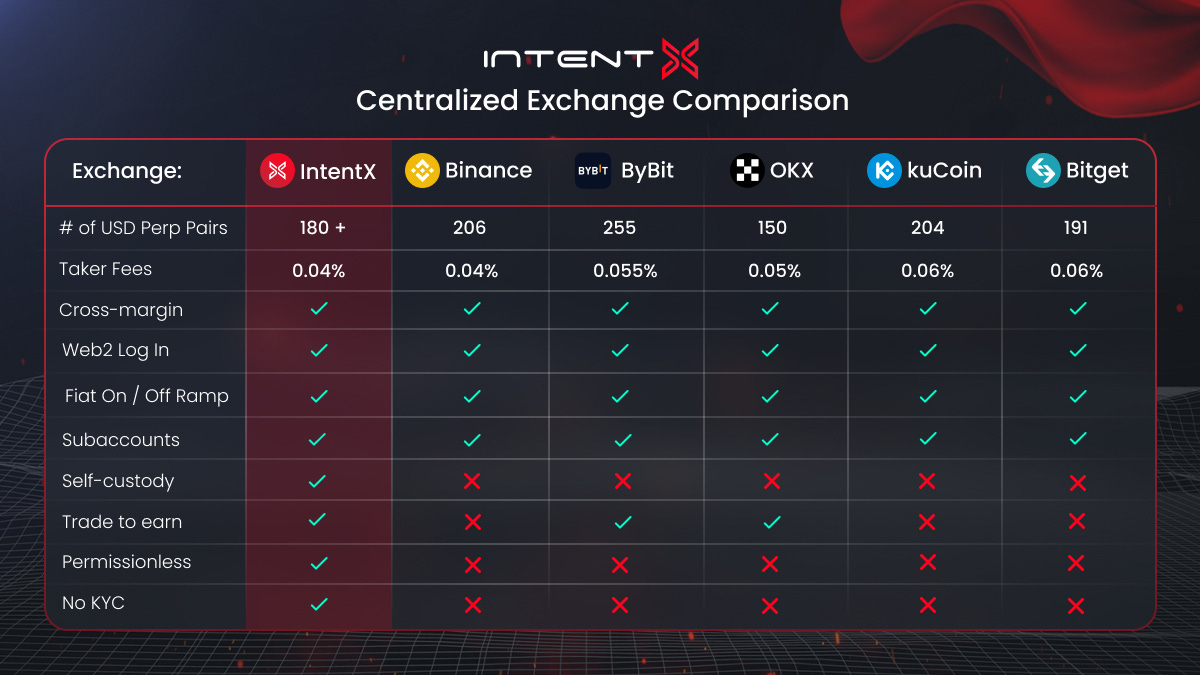

The final objective of IntentX is to bridge the gap between centralized and decentralized exchanges by offering competitive products with familiar features and user experience.

The platform's competitive edge comes:

Unique intent-based architecture

High leverage (up to 60x)

A wide range of pairs (>180 at launch)

Multichain deployment with sub-accounts

Competitive fees and incentives (trade to earn)

The value proposition of IntentX includes:

Deep liquidity, bridging liquidity from centralized exchanges to on-chain

Capital efficiency through a just-in-time liquidity architecture: eliminates up-front capital commitment by solvers to stream quotes, offering much higher capital efficiency based on the OI/TVL ratio (No idle liquidity)

Lower fees due to the absence of a liquidity provider as a counterparty: move value to token holders and stakers

Less reliance on oracles for quotation, using them only for rare dispute resolutions, thus enhancing security against oracle manipulation exploits.

Self-custody and permissionless, with no KYC

Rapid multichain deployment: no need to bootstrap liquidity

As a consequence, IntentX is able to offer traders the best price execution with minimal slippage on a DEX, efficient price discovery, and CEX-like liquidity and execution, while maintaining the self-custody typical of a DEX.

Additionally, IntentX manages position risks through bilateral agreements that isolate derivative contract risks and guarantee solvency with rule-based liquidation (stipulated with MM). This ensures trustless operations and a fair, scalable, and risk-free environment.

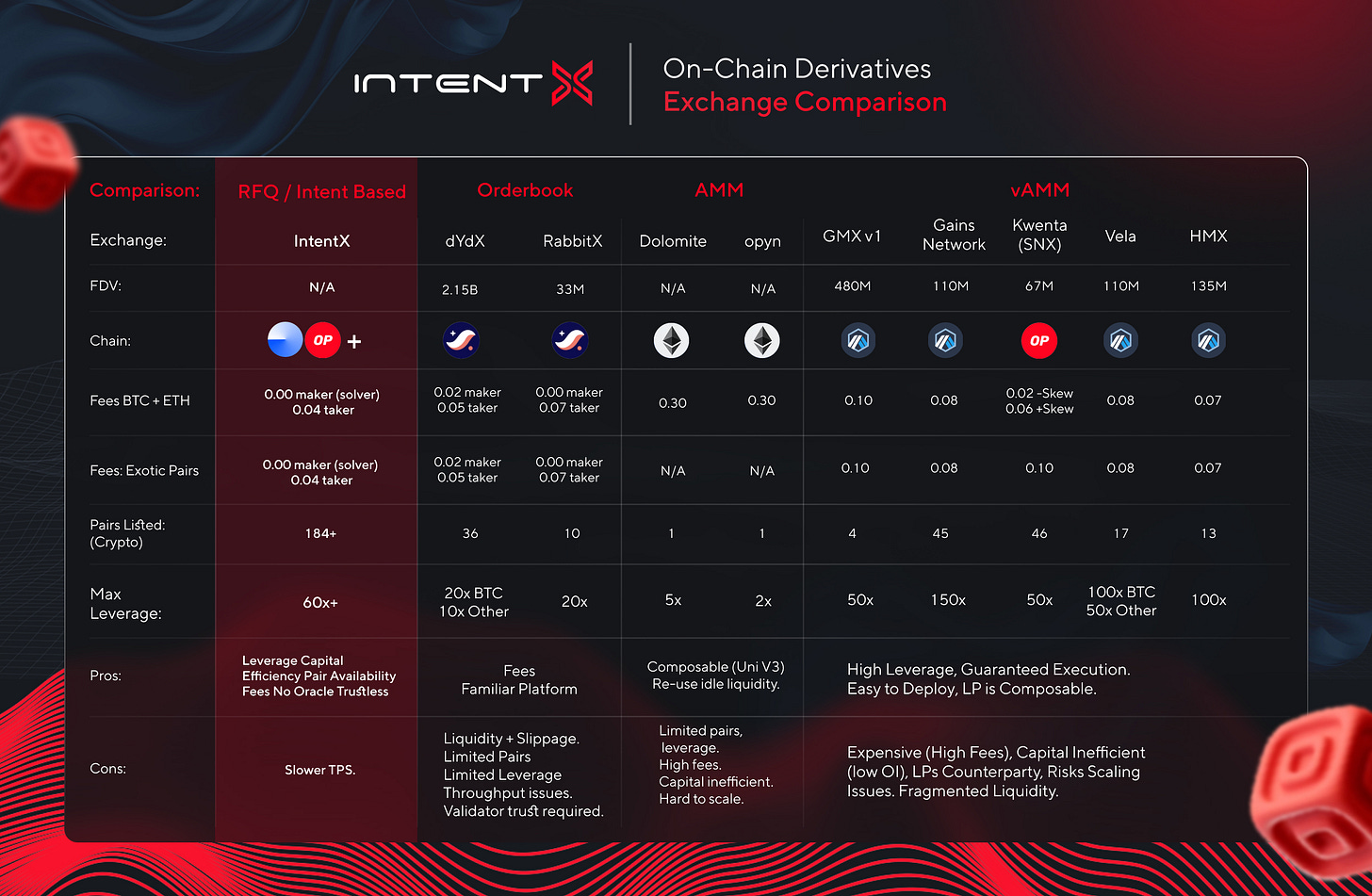

Here’s a practical comparison with other protocols in the space:

Given its features, comparing IntentX with its centralized counterparty is not too much of a stretch.

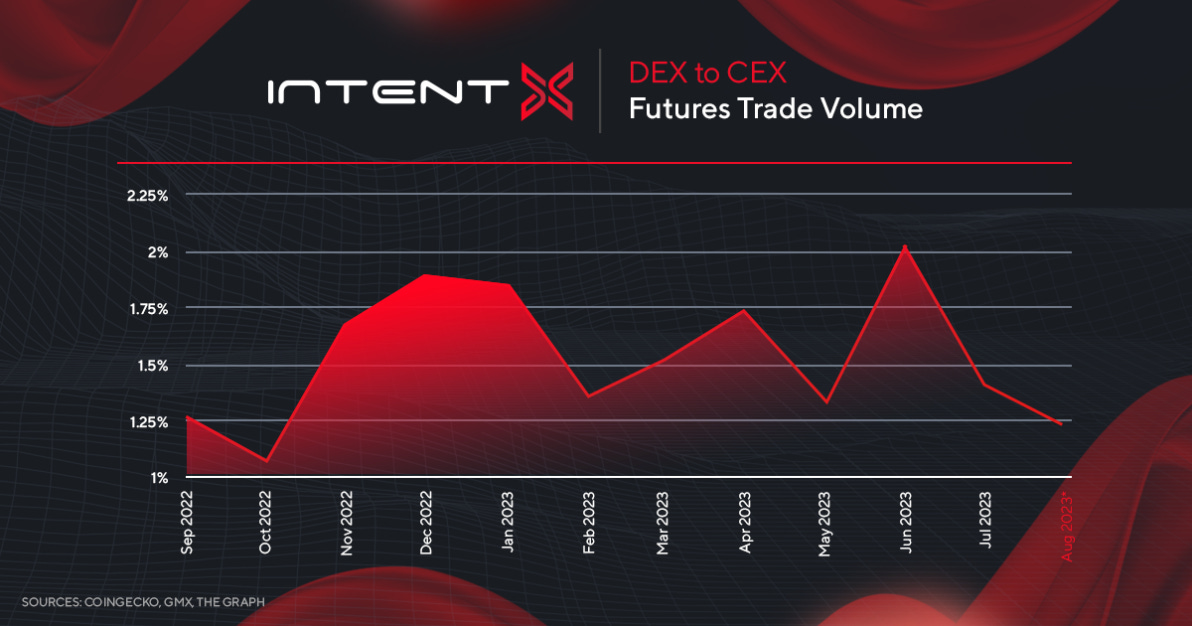

IntentX's mission is to lead the next evolution of DeFi by migrating derivative trades from centralized to on-chain exchanges. It aims to offer a technically competitive trading environment with significant user experience advancements.

This includes complete account abstraction, gasless trading, and breaking down barriers in DeFi to foster a transparent, autonomous, and decentralized trading environment.

On Market Makers, RFQ and Latency

One issue that can be raised with regard to IntentX is the degree to which they rely on off-chain CEX-based MM, in the form of solvers.

While this model plugs into CEX liquidity and thus provides better quotes, the issue arises on how this reliance on Market Makers (MM) will play during hard times.

However, even though MM might not be incentivized to provide a quote during periods of high volatility, IntentX will still be able to plug into other aggregators thus offering competitive quotes.

How do quotes work?

On IntentX, MMs are always on the other side of your trades.

MMs constantly get quotes from where they hedge (a CEX) and continuously stream these quotes on the IntentX front end (including a small spread), reducing matching time for orders.

Once the trader sees the quote, then they can put their RFQ and the trade is pending.

During this short period, MM can start their hedge at their off-chain venue, so that they are delta-neutral on the trade.

To this point, it is very important to reduce the delay (or latency) between order execution and fill, to avoid stale quotes. In fact, by this time the quote might have already moved on the CEX, thus altering the MM quote.

IntentX solves this by allowing them to execute the off-chain order prior to the on-chain order, in case of any meaningful price divergence, this allows MM to be fully delta-neutral from the beginning of the trade.

Omnichain by Design

IntentX is built to be an omnichain DEX by design, leveraging its architecture. In this way, it can deploy liquidity across multiple networks, without technical constraints or the need to bootstrap liquidity for each pair.

For those interested in having a look at IntentX cross-chain architecture:

For non-native chains, users will be able to leverage account abstraction to trade seamlessly, by creating an abstracted account and depositing from any Layer Zero-supported chains. With this solution, users won’t even need to bridge gas or take any further steps, as they can simply deposit and withdraw liquidity, and then trade.

A Better UX

IntentX provides a simple UI, with the goal of providing a CEX-like user experience on-chain.

Account Management dashboard: overview of all trades and positions, for easy trading and consolidated metrics

Account Abstraction: abstracting complexity, providing a smoother UI, additional security measures (2FA, account recovery)

Analytics: informed decision-making, historical data

1 click trading

Easy on-ramp and off-ramp to FIAT

Food for Thought

IntentX is a much-needed innovation that promises to make on-chain trading similar to a CEX-like experience. This comes with its own trade-offs.

Nonetheless, we believe the positives outweigh the centralization of the design.

Currently, IntentX has no funding rates, so if you are planning to give it a try, this is the right moment — also given the context of a possible retroactive airdrop to users.

At the moment, the platform has a 12h fraud-proof withdrawal limit, necessary to prevent re-org attacks. IntentX is already at work to reduce this time, such as by introducing third-party bridging solutions.

Future plans for the platform include the integration of more verticals. In fact, the sky is the limit, as IntentX can integrate any derivative a MM is willing to provide collateral for. Imaging tapping into Deribit options volume.

Last but not least, future plans involve the creation of the IntentX in-house market maker.

More on IntentX

https://twitter.com/Slappjakke/status/1724886707361956247

https://twitter.com/contangojosh/status/1727020114963255473

https://twitter.com/imCryptoGoku/status/1725677990795772387

https://twitter.com/IntentX_/status/1726974540063162779

https://twitter.com/Ren_gmi/status/1725920175885574478

https://twitter.com/0x_Umeshu/status/1726916864981475825

https://twitter.com/BanklessHQ/status/1720481859467898953