In-Depth on the Tech: Solana's Local Fee Market

Why Solana's fees are always cheap and why Ethereum can't do the same

Today we go in-depth into one cool design feature in particular..

The Local Fee Market on Solana!

In order to modify the dynamics of the fee market on-chain, Solana has implemented a very interesting solution: a Local Fee Market.

This has been done with a simple resolution in mind: if there’s a gas spike due to a new project or NFT mint, this shouldn’t affect the whole network.

The model is designed to “charge an additional fee during times of congestion, but only for the in-demand apps and services”.

How does this model work? And why can’t we just do the same on Ethereum?

A Necessary Development

The development of a local fee market was somewhat of a forced development for Solana, which had experienced a network crash due to a botted NFT mint.

Solana Labs compares the Local Fee market to “neighborhood fees”: if you want to buy in the less busy areas you’ll pay less, but if you wanna go in the best shop at rush hour you’ll have to pay a premium on your transaction.

Solana has a long history of solving issues hands-on once things happen. This is symptomatic of their lean development but comes with its own issues. For instance, this raises the question of chain liveliness: if we have to rely on a blockchain to build our own business or project, the key is that the chain should never, in any circumstance, go down.

The Accounts Model

Solana differs from Ethereum in the way it calculates transaction fees:

On Ethereum, transaction fees are based on the block space used, while Solana uses an accounts model differentiating between read and write interactions with contracts.

With an accounts model a user “pre-define the states their program or contract will interact with”, so that other users can read the same state without having to drive up fees.

When there are a lot of users writing to the same state, the fees will only increase for that specific contract — not for the whole network.

The account model on Solana is enabled by other pieces of the tech stack, namely Solana's parallel transaction execution and multithreading with global state management. For a better understanding of parallel execution:

The reason why Solana is able to process transactions in parallel is that Solana transactions describe all the states a transaction will read or write while executing. This not only allows for non-overlapping transactions to execute concurrently, but also for transactions that are only reading the same state to execute concurrently as well.

The major benefit of the account model and the local fee market is that every contract will have its own gas fee.

This is also why Solana has widely benefited during periods of Ethereum high fees because even though the Solana Network would have sustained and increasing activity, regular small users would always be able to transact on the network for low gas fees (of course when they wouldn’t interact with high demand contracts).

On Ethereum, even staking of claiming yields would be painful during that period, this can help us get a better understanding of what an important development the Local Fee Market is!

By isolating fee spikes to specific programs and offering a more efficient fee model, Solana can maintain reasonable fees for users while still preventing spam transactions and attacks on the network.

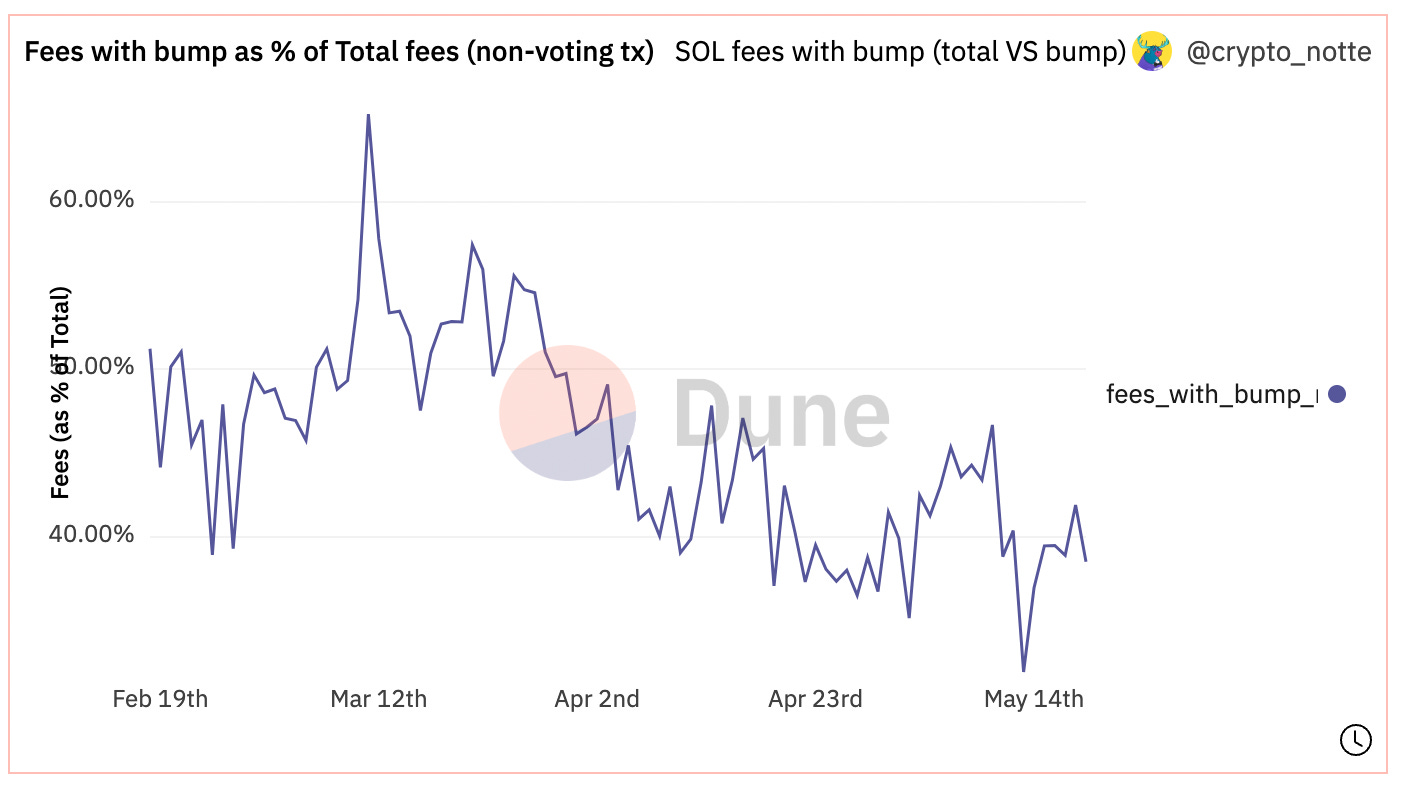

As of today, about 40% of the transactions on Solana are bumped:

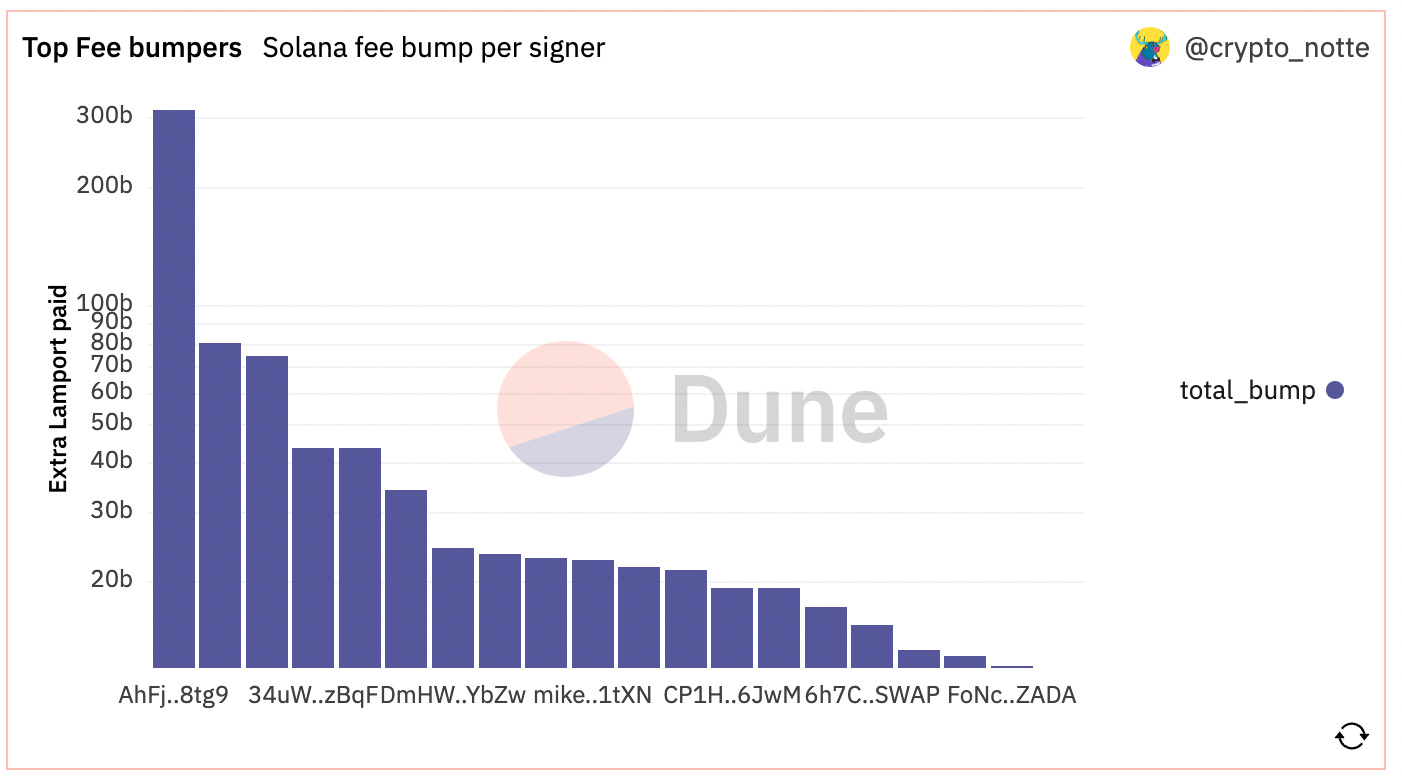

Who are the top fees bumpers on Solana? Why do they do this?

The Top fee Bumper on Solana is: AhFjTUE2DgNFnAfRtFLUmLTLYyhxzz7j1cvKbvP18tg9

This account is very active!

As we can observe on SolScan, the address is from Jump Crypto (which runs a Solana validator).

Here is some of their latest activity on non-SOL tokens:

For an overview of the Jump Crypto Validator and its activity, you can check on:

https://solanacompass.com/validators/CertusDeBmqN8ZawdkxK5kFGMwBXdudvWHYwtNgNhvLu

All Dune dashboards are from crypto_notte:

https://dune.com/crypto_notte/solana-additional-fee-analysis

If you liked this story well you can access 80+ more articles on my Substack, I try sharing at least 2-3 new articles per week, focusing on the most different arguments in the crypto worlds: L2, regulation, on-chain analysis, some alpha, NFTs, DeFi..

Please leave a like if you enjoyed it!

Comment if you have any feedback!

And Subscribe Below!

Thanks