Hot Narratives: OTC Crypto Trading with OT Sea

OT Sea has more than 10x during the last week only, the only thread you'll ever need on it

There’s a new narrative in crypto these days and is about OTC Trading.

While OTC trading is an extensively established practice within traditional finance, it’s only starting to pick up pace within crypto.

Why do we need OTC Trading?

One of the first innovations in DeFi was Uniswap, which kickstarted the use of liquidity pools to facilitate decentralized cryptocurrency trading.

Nonetheless, liquidity pools have their own limits, especially for coins with lower capitalization and liquidity.

As a consequence, these swaps can have a strong impact in terms of price difference and slippage. In fact, trading coins with a lower capitalization suffers from:

High volatility

High Slippage

Low Liquidity

Token Taxes

MEV

We’ve all been there: you try to exit a market fast, due to a negative price action, and you forego all of your profits in fees and slippage.

You thought you made a good trade?

That 50% slippage is going to take it all back.

Solving Market Inefficiencies

Protocols like OT Sea can provide traders with an alternative venue for selling and buying tokens (only limited to ERC20 currently).

They allow peer-to-peer (P2P) and trustless OTC trading.

In this way, traders could bypass liquidity pools, slippage, and price impact by simply trading P2P.

What are the main use cases for OT Sea?

1. Avoid Token Taxes

Many ERC20 tokens introduce a buy/sell tax to discourage extensive trading.

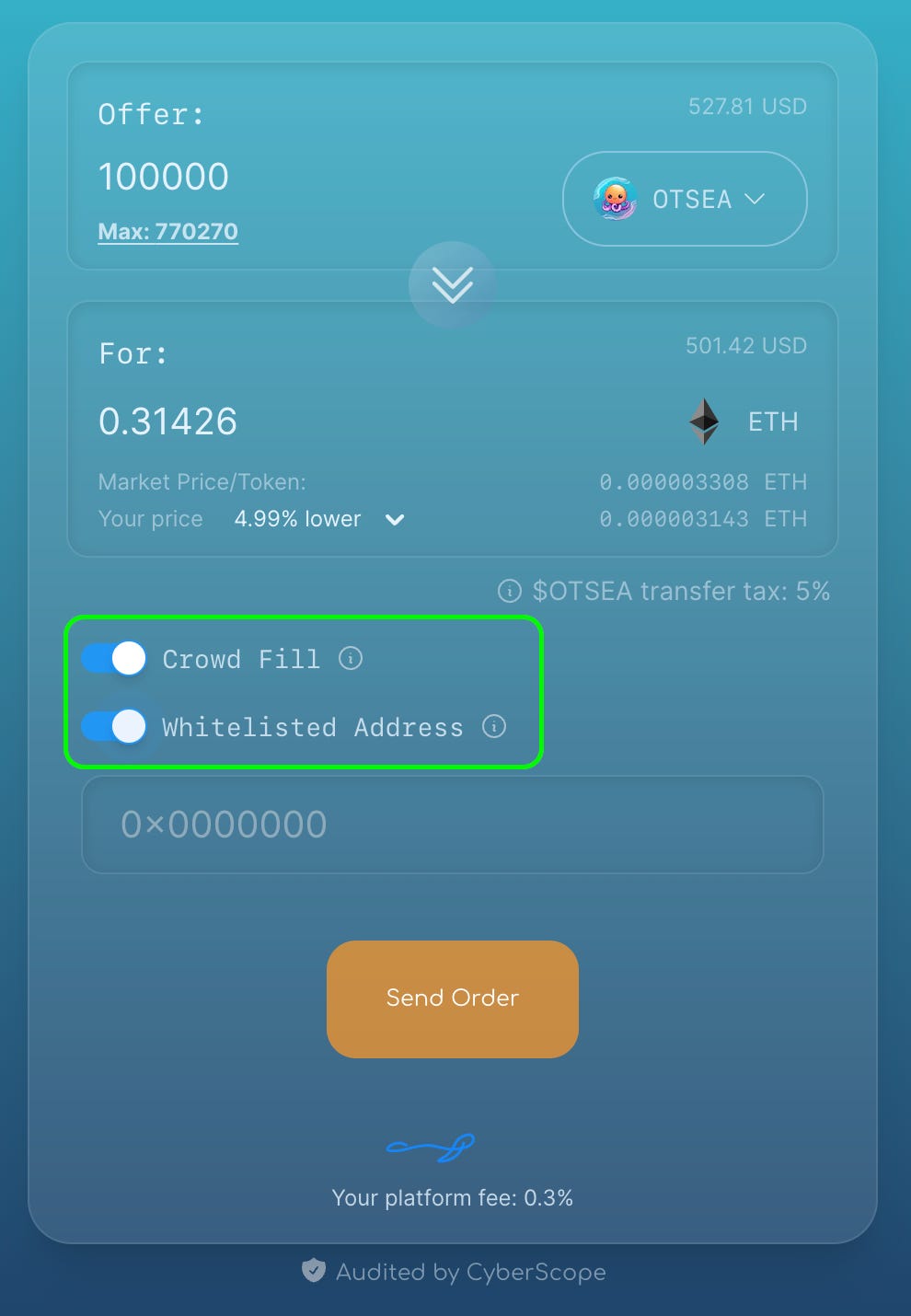

Within OT Sea, the absence of liquidity pools and the use of a “transfer” function (instead of a buy/sell) whenever someone buys or sells tokens allow users to exchange tokens P2P without taxes.

2. Safeguarding Whales

OT Sea also benefits whales.

Nowadays, whales have a hard time selling their tokens, as they are often tracked and front-run and their holding size can depress the price.

One possible solution to this is to resort to P2P trading.

Nonetheless, how can you trust your counterparty to be honest and send you the right number of tokens, without playing games?

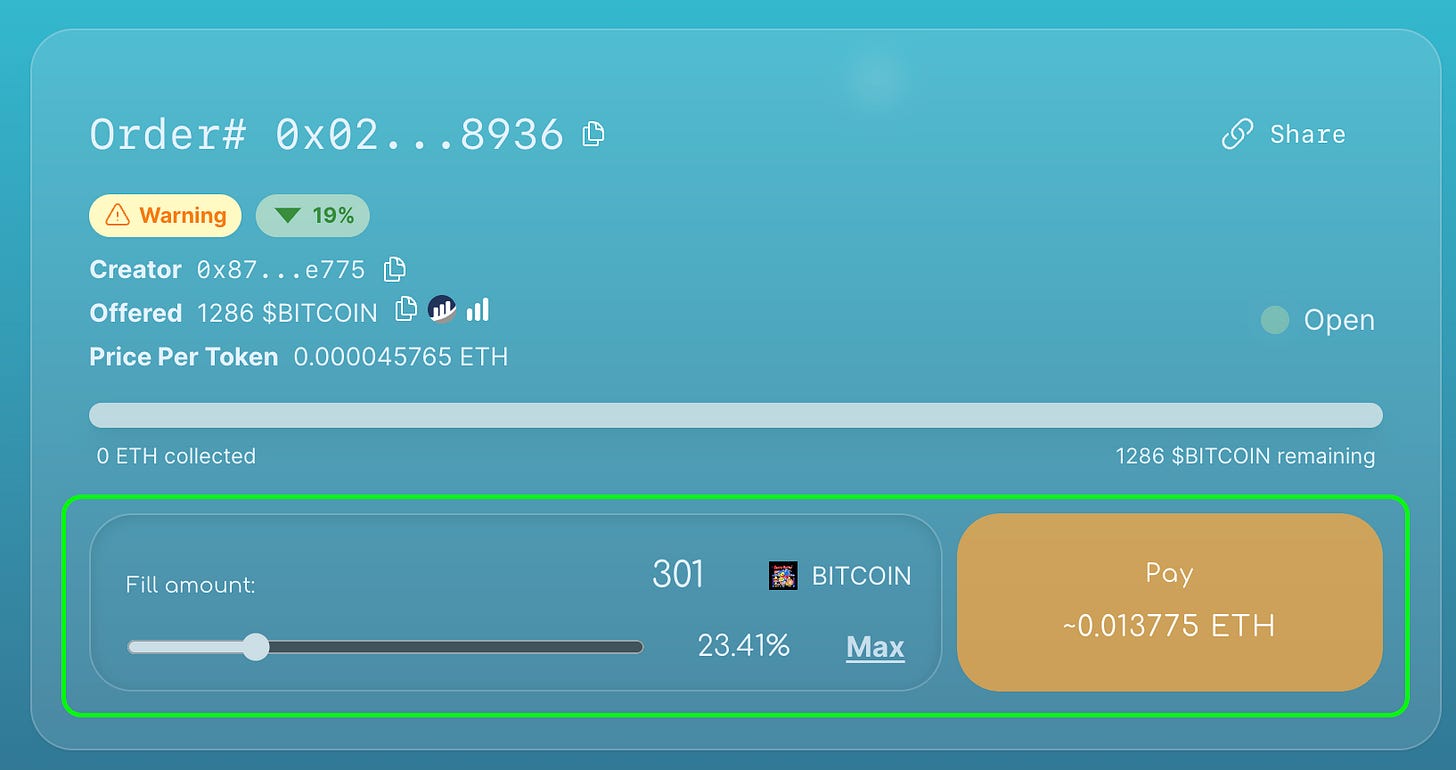

On OT Sea, whales can simply leverage the OT Sea smart contract as a P2P intermediary to create an order displaying their intentions to sell those tokens.

Furthermore, the OT Sea “Crowd fill” feature also allows whales to sell their holdings to several small holders.

Any user will be able to fill the order according to the quantity desired.

In this way, they are able to exit their positions without having a big impact on the token chart.

3. Low Liquidity Tokens

If you have ever traded low caps you are familiar with the small size of liquidity pools for these tokens. A large sell order in such liquidity pools translates into a huge price drop, as the size of the pool cannot absorb the impact of the order.

As such, any holder would take it for granted that they will lose a portion of their funds due to the high price impact of their order.

This doesn’t happen in OT Sea, where they can freely find a buyer, create an order, and get their whole sum, without price slippage or any token tax.

To sum it up: OT Sea allows users to maximize their returns when selling tokens. In some ways, it can be conceptualized as a step back, to a mechanism similar to a “barter”, where users can match their needs.

How does it do so?

OT Sea Features

1. Mini Markets

OT Sea recently released its Mini-markets feature.

Mini-markets are conceptualized for projects that are looking to have OTC trading capabilities. They will play a major role in boosting volumes on the platform and allow the creation of decentralized OTC pools for any ERC20 token.

In turn, this will:

Allow large holders to offload without impacting the chart

Allow holders to sell at a discount compared to the market price

Avoiding token taxes

Mini-Markets take the form of embeddable widgets and are as such very easy to integrate.

Copy-paste a few lines of code and voilà, you just created your own OTC market.

From there, you’ll be able to create OTC orders for your token.

2. Mev Protection

Bypassing conventional orders and liquidity pools, OT Sea trades are protected from MEV.

In fact, the P2P trades are private and happen using the “transfer” function, thus avoiding the mempool and being subject to MEV bot attacks.

Nonetheless, the protocol specifies that is the users’ responsibility to utilize MEV protection when using OT Sea.

Some include: Mev Blocker, Flash Bots RPC

A New Primitive

OT Sea is leading the creation of a new primitive.

OTC trading for low caps can improve market efficiency and their price action.

Furthermore, this can spur a new best practice behavior for large holders, which will be able to trade without affecting the price or being hunted by bots.

The value capture mechanisms of the $OTSEA token are well established, with holders’ incentives aligned through a redistribution of the majority of fees to the token holders.

However, as a new primitive OT Sea has to establish itself and make sure there’s enough demand and supply to ensure sustainable trading volumes.

Will they manage to generate sustainable volumes?

Currently, it seems that the volume is picking up, with over $56k in volume since launch, with more than 185 orders filled.

More data on usage and fees can be found at: https://dune.com/whale_hunter/otsea