Getting Ready for the launch of MegaETH

A recap of what happened in 2025 in preparation for testnet

It's been a few months since my last update on MegaETH.

With testnet coming in a few weeks, it's time for a refresh.

As more gets unveiled about MegaETH, I'm summarizing some of these updates, including some interesting projects from the ecosystem.

1. What is a real-time blockchain?

As this is one of the main value propositions of MegaETH, the concept of “real-time blockchain” has been clarified.

For an EVM network, being real-time means focusing on reducing the block time and having the right tools to allow nodes to keep up with it.

How is MegaETH expected to perform in this regard?

MegaETH block times are expected to be below 10ms and perceived as instant.

Throughput is expected at over 100k transactions per second

2. How does MegaETH score against Web2 applications?

By championing this focus on speed, MegaETH goes beyond comparisons with other blockchain networks by comparing its speed with other Web2 applications:

MegaETH is in between Netflix Seek and Discord messages.

Benchmarking blockchains against Web2 products is not exactly something we are not strictly used to, butit is something we hope to see more of in the future.

3. The main Takeaways from 0xResearch podcast

The North Star of MegaETH: "leverage the security of Ethereum to maximize for performance and bring a new wave of experiences onchain”

Why a real-time Blockchain?

There are several limitations with current EVM L1 architectures:

Current block times are slow and don’t provide instant finality, which impacts user experience.

MegaETH focuses on extreme tradeoffs to create a real-time blockchain that offers near-instant transaction confirmation.

This opens up a new design spaces for developing decentralized applications (dApps), financial transactions, and gaming requiring very low latency..

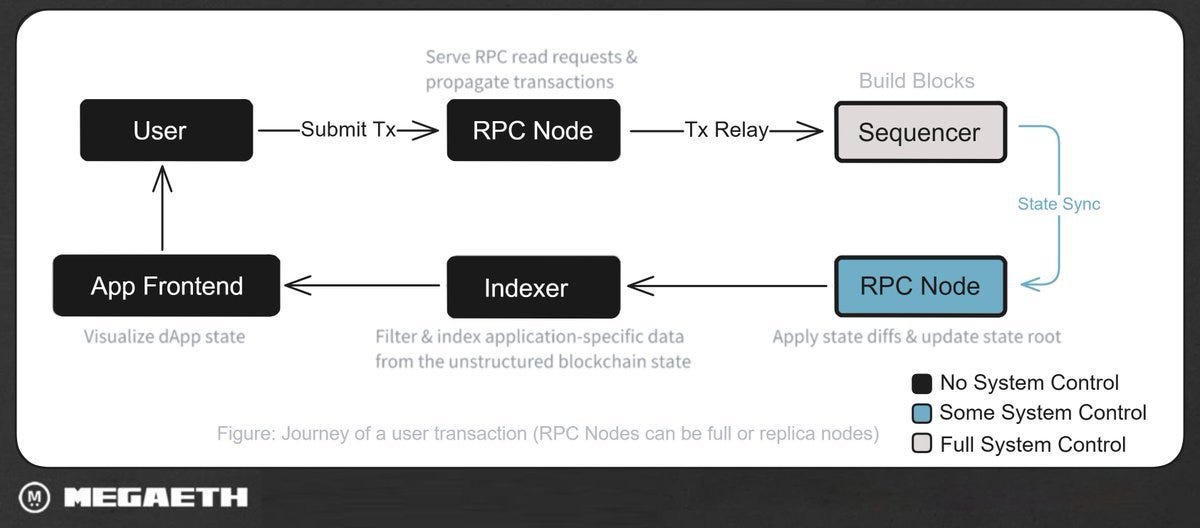

Ultra minimum blocktime due to node separation

Decoupling consensus is essential to optimize block time

Within MegaETH all these different layers are optimized individually

On L2s Solutions (L2s)

Lei and Namik share their perspectives on how L2s like Optimistic Rollups, ZK-Rollups, and sidechains have evolved:

Are current L2 good enough? Tradeoffs of having consensus limit chain performance.

L2 solutions improve Ethereum’s scalability but often still introduce delays in transaction finality.

Rollups require complex proofs that slow down withdrawals and increase costs.

MegaETH aims to leapfrog these issues by offering a different technical solution that focuses on real-time processing: separate all the executions that slow down block time, to preserve the hardware capabilities

MegaETH focus on vertical scaling, focusing of taking extreme tradeoff to scale performance while maintaining EVM security

On the MegaMafia and Echo

MegaMafia is a community-driven initiative within MegaETH, focusing on building a strong developer ecosystem to bootstrap native applications.

Important role of Echo in bringing 3200 new investors on same terms ad Vitalik, VCs etc.

Their goal is to attract developers, users, and investors who believe in Ethereum’s future but need real-time execution.

Some interesting projects include:

Interesting Stablecoin implementations

Improved game usability and UX thanks to MegaETH performance

Challenges, Lessons, and Competition

Adoption is challenging—Ethereum’s ecosystem is massive, and shifting developers/users to a new infrastructure is difficult.

Less bickering on Twitter is necessary to act more professional

Biggest competitors: Solana

With Testnet launching just in a few weeks, what projects can we expect to be live on MegaETH? Let’s dive into some of them.

4. Ecosystem Projects

In January only, four more MegaETh protocols went out of stealth:

https://x.com/megaeth_labs/status/1885032829480034342

Here are some of my favourite protocols:

GTE (Global Token Exchange)

A vertically integrated DEX focusing on offering the best UX by bringing the best of both worlds, combining CEX-like speed with decentralization and transparency of Defi.

They use a central limit order book (CLOB) for high-volume assets and an AMM for other assets to maximize their performance.

As part of their offer, they also provide two ways for projects looking to launch on the platform:

GTE Launchpad: for established projects looking to do their TGE.

GTE Takeoff: permissionless token launcher (like pump dot fun).

The flow of tokens launches on GTE is as follows:

Launch on Takeoff

Reach bonding market cap: migrate on AMM

When the asset matures further: launched on CLOB

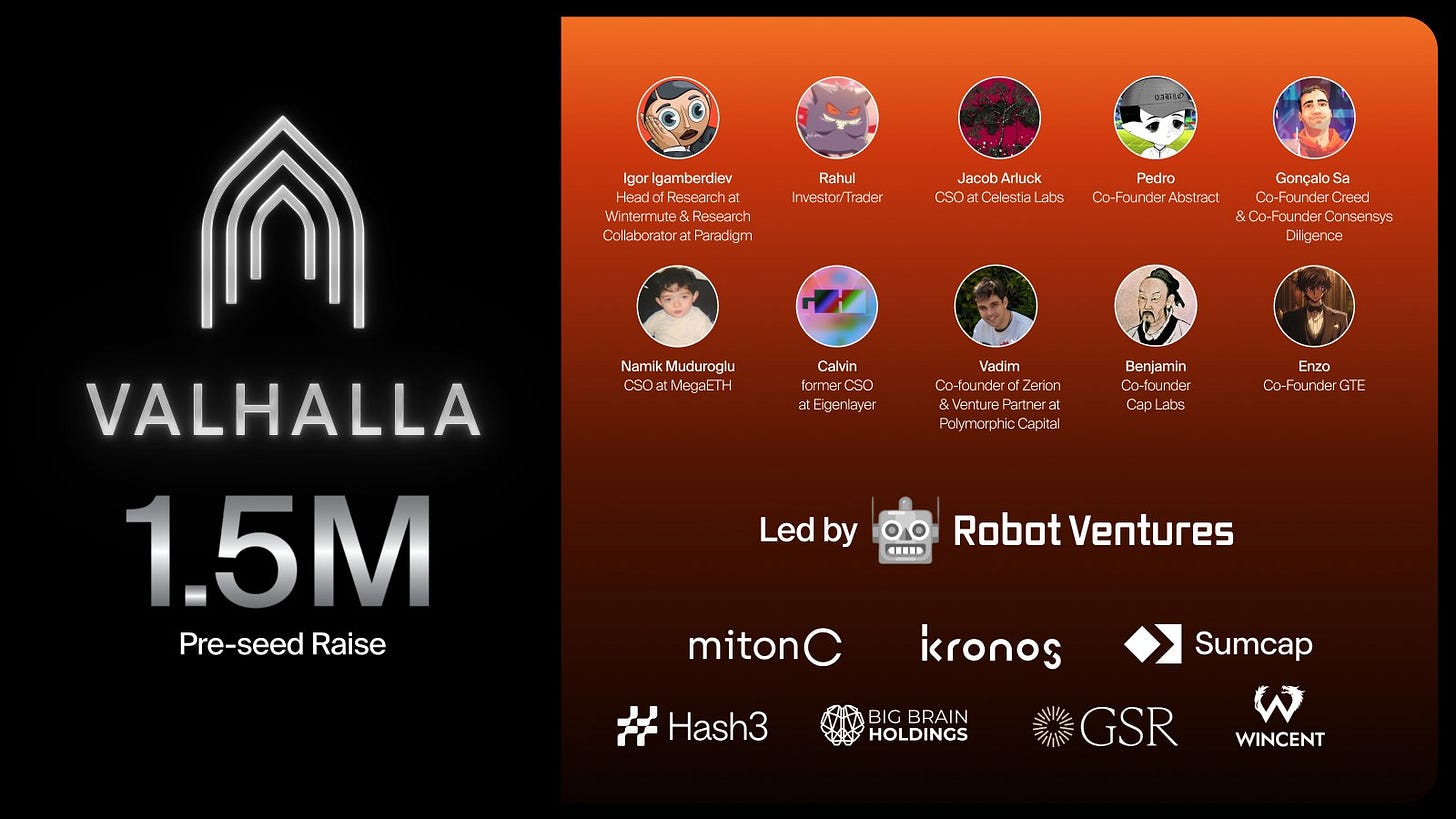

Valhalla

An onchain perpetual DEX, creating new primitives, and advanced yield for users.

What are these new primitives?

Valhalla enables “protocol level composability”, as smart contracts are composable and responsible for risk management, position management and more. For instance, users could leverage “flash loans” to execute funding rate farming strategies: buying a token on the spot and shorting on perpetual.

Asset-composability: users can leverage yield-bearing stablecoins as collateral to trade perpetuals while continuing to earn yields from their collateral. USDT and capUSD will be the primary assets.

Unique Selling Propositions:

Completely on-chain

Totally composable

UX: leveraging MegaETH extremely low latency

Ecosystem synergies with GTE: by listing GTE tokens on perpetual.

Seed rounds: market makers and LPs to bootstrap initial liquidity, hence why they decided not to do an Echo round. They use a CLOB.

Liquidations:

Anyone will be able to participate in liquidations, no market makers

Positions can either be “partially” or “fully” liquidated

Multiple oracles, and manual price in case of issues

Initially off-chain model, shifting on-chain

More on Valhalla:

https://x.com/Mega_Ecosystem/status/1872730250590789810

Euphoria

The place to trade derivatives on MegaETH. Euphoria focuses on a mobile-first approach with elements of gamification and SocialFi.

Euphoria is here to make trading fun again, and open to everyone.

To do so, they focus on an intuitive interface, community-driven markets, and fun. Enters “One-Tap Trading”, built for the new generation of retail finding about crypto on Instagram and TikTok.

This easier and more intuitive way to buy tokens is complemented by:

Leaderboard and game elements: points, rewards, loyalties

SocialFi elements: connect, collaborate or challenge your friends

Accessibility: no need to know how the protocol works in the backend

Why on MegaETH?

https://x.com/Euphoria_fi/status/1881460876492058640

We all know the first reason is speed.

What else?

Collaborative ecosystem

Focus on community

Tech-first

Cheap for users

Euphoria is set to open to the public in the upcoming weeks!

Join the waitlist using my referral:

https://euphoria.finance/?ref_id=PXO6ZH6KZ

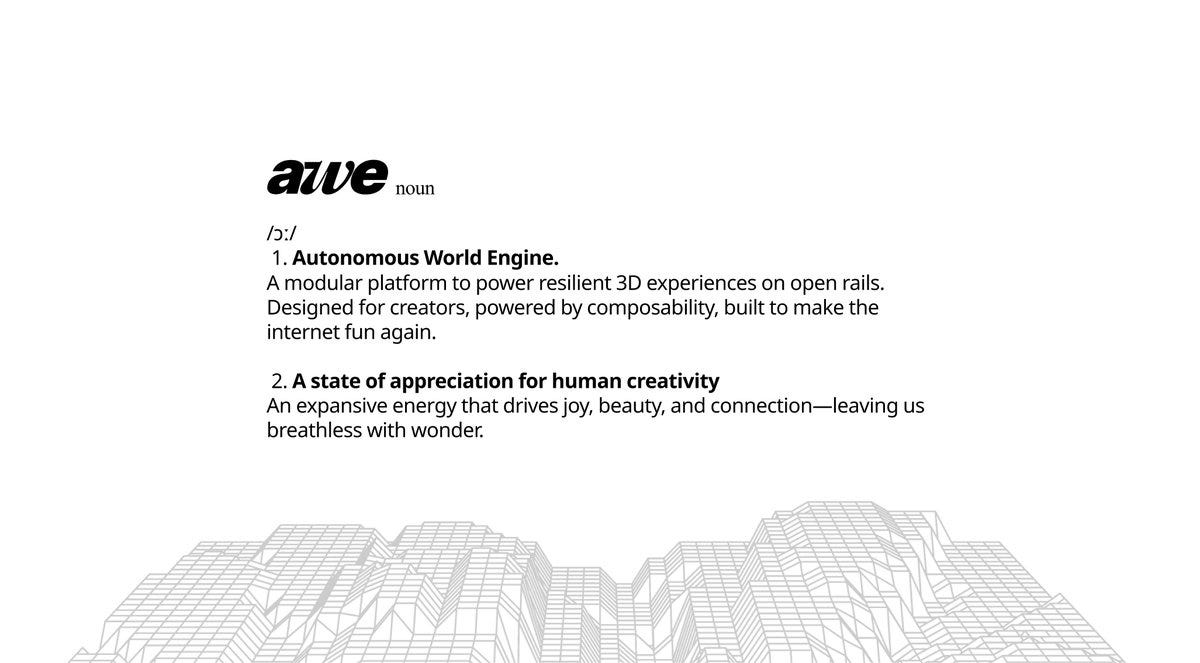

Awe Box (Autonomous World Engine)

What is AWE?

https://x.com/awe_box/status/1874854413573239147

A new engine built by the founders of OnCyber, where anyone can transform their ideas in 3d, including:

Art gallery

Crypto game

AI simulations

Main Features:

Open to everyone: no need to download anything; use it via simple Javascript/Typescript or with no code, utilizing a drag-and-drop approach.

Fast: built to transform ideas into 3d experiences ready for production

Permissionless across multiple platforms: decentralized architecture preventing data loss or censorship

Extremely modular: using models fitting different neds

More on the tech specifications:

https://x.com/awe_box/status/1874854425002397738

Real-time 3d World:

https://x.com/awe_box/status/1874854427787403502

More mockup examples of the UI:

https://x.com/awe_box/status/1874854413573239147

Teko Finance

A money market protocol allowing margin trading, undercollateralized loans, and leveraged strategies.

https://x.com/tekofinance/status/1882095971678761062

Why on MegaETH?

Max capital efficiency on undercollateral loans

Microliquidations can be executed

Users can carry out different strategies according to their risk profile

The pace of MegaETH allows new strategies

What can you do on Teko?

Borrowing and lending

Leveraged strategies: as complex or easy as you want

Margin trading using onchain liquidity

Microliquidations gradually reduce positions protecting users from total liquidations

Deposit liquidity and benefit from shared liquidity (for margin, leverage, borrowing) and enhanced APYs

Teko is also highly composable with other protocols we have mentioned above:

https://x.com/tekofinance/status/1882095977710108822

Want to be one of the first to check the platform?

Join the waitlist using my referral:

https://teko.finance/waitlist?ref_id=Q9FRQIX5K

That’s it for this short update!

If you don’t know much about MegaETH, I encourage you to have a read, as I believe it will become one of the leading protocols in terms of mindshare.

For a comprehensive overview of the MegaETH ecosystem as of January 2025 I recommend this super extensive article:

https://x.com/Mega_Ecosystem/status/1878387242835603550

Building a protocol? Check MegaETH’s builder program out:

https://x.com/megaeth_labs/status/1882829039603470371

More on MegaETH

Ecosystem Map:

https://x.com/_MegaHub_/status/1882413005150810327

More on Ecosystem:

https://x.com/mztacat/status/1873299802710310964

Bonus: New Website

https://x.com/megaeth_labs/status/1877744446554378268

Blockchain Lounge podcast:

https://x.com/global_stake/status/1881717616290484320