$CORN: BTCFI powered by Arbitrum

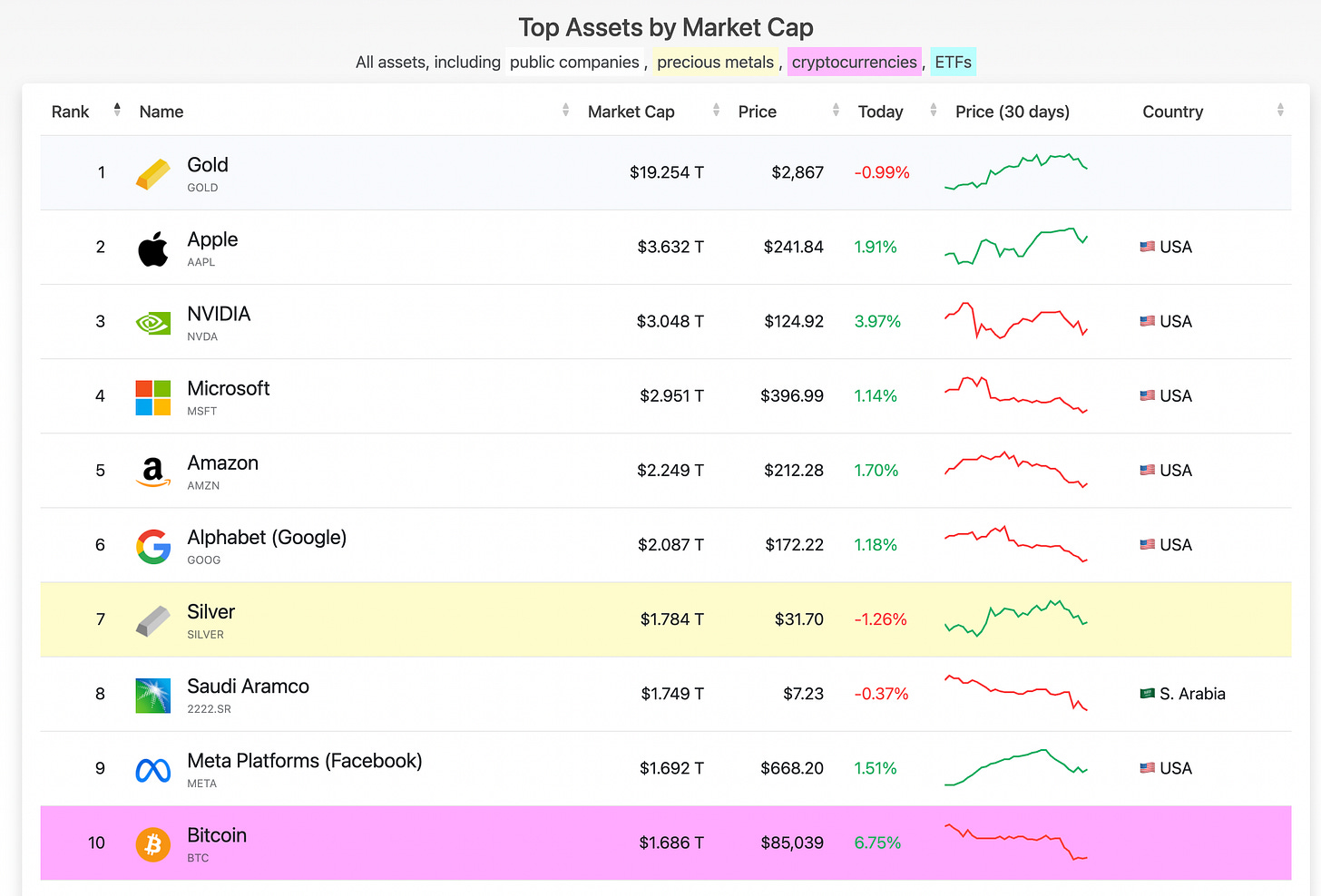

Bitcoin is a top 10 asset worldwide by market capitalization.

Nonetheless, only about >0.8% of BTC circulating supply is currently used in DeFi (as of November 2024):

59% WBTC on Ethereum (about $10b)

22% native BTC locked on new Bitcoin staking protocols ($3.3b)

10% is native BTC sitting on Bitcoin L2s. ($1.5b)

These numbers highlight the need to unlock BTC potential in DeFi, leading to the emergence of several Bitcoin Layer 2 (L2).

https://x.com/spadaboom1/status/1886772889958937076

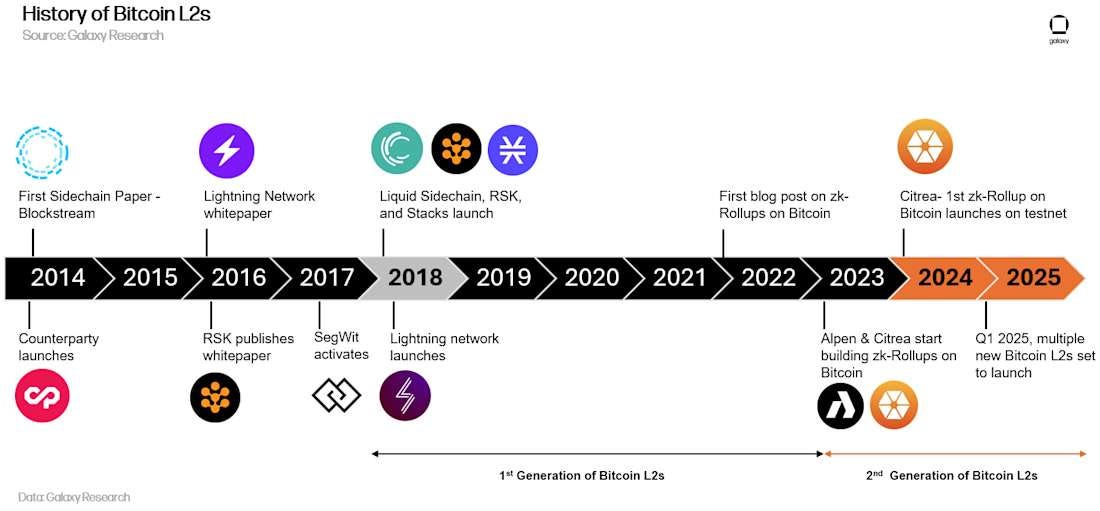

This is a trend that started already in 2014, with ambitious plans for Lightning and RSK.

With much unexpressed potential - new protocols are deploying trying to solve this problem and give users the possibility to leverage their BTC assets to farm yields.

In particular, this article focuses on Corn, a new blockchain network which is designed to maximize the efficiency and potential of Bitcoin assets.

Corn

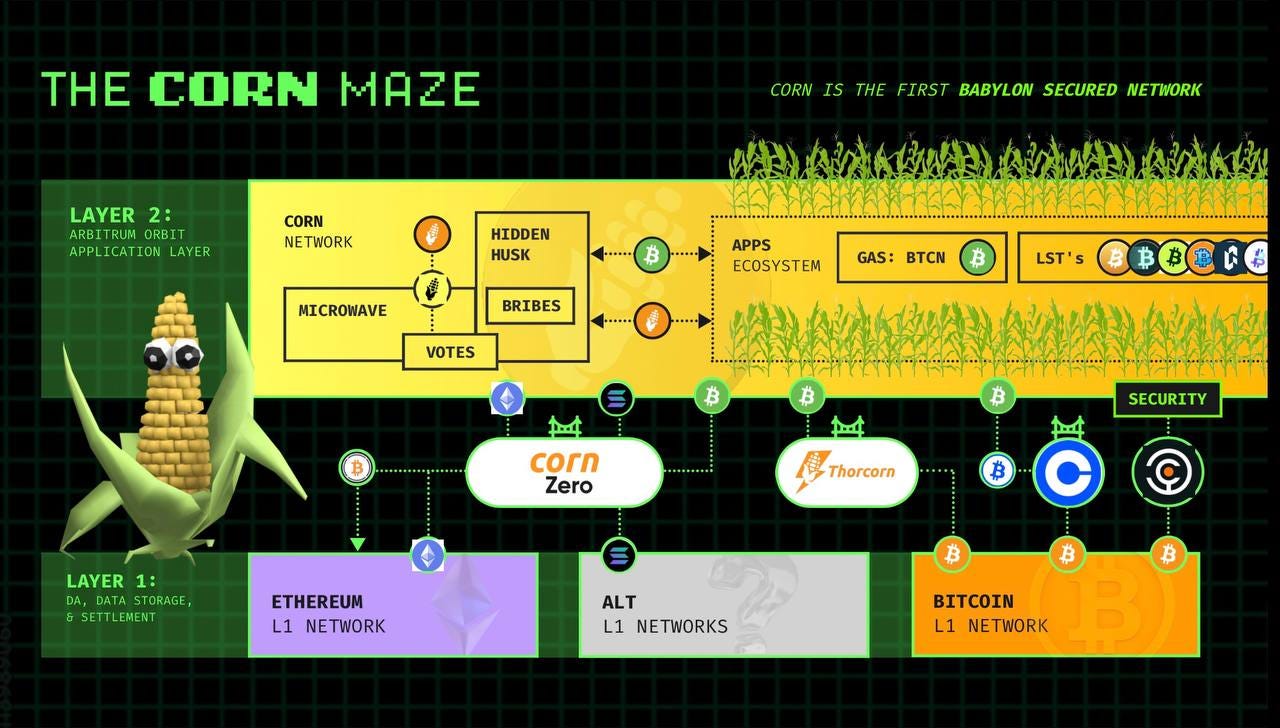

Corn is an Arbitrum Orbit allowing users to bridge their BTC assets and earn yield on them, with a whole suite of new and innovative BTCFi products.

Welcome to the Corn Maze.

Corn has a native gas token, Bitcorn (BTCN), which is pegged 1:1 to Bitcoin using cbBTC and wBTC and custodied through Coinbase and BitGo.

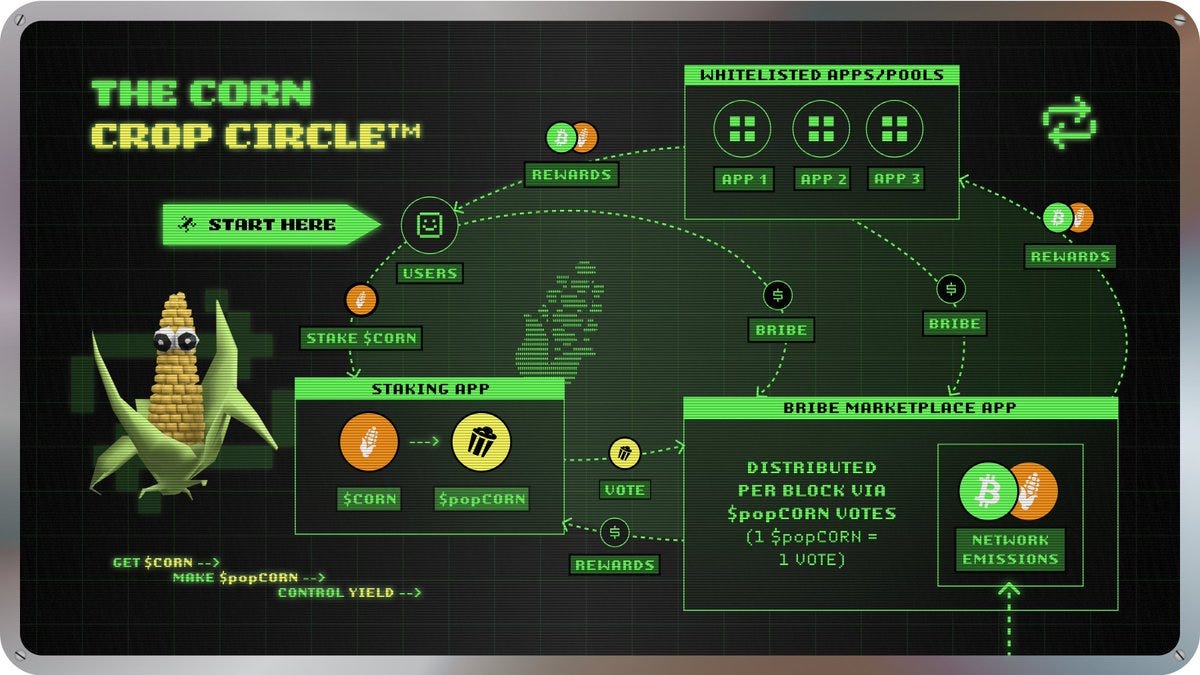

Corn also leveraged the popCORN system, an incentive mechanism based on vote escrow tokenomics (veTokens like Curve, Convex, Solidly) to ensure long term alignment between users, Corn and BTCFi protocols.

A permissionless bribe market, the Hidden Husk, will enable a yield market where CORN holders will be able to lock their CORN tokens into popCORN and decide which protocols they want to vote to direct yield (in exchange for incentives e.g. native tokens from the protocols that want to get votes).

Corn also focuses on improving the mechanisms to secure its network and minting BTCN:

Bitcoin-Secured Network (BSN): Corn leveraged Babylon Bitcoin staking for a dual-layer protection, using both Bitcoin and Ethereum. Babylon allows Bitcoin holders to secure other networks, such as Corn, in a permissionless manner. This is poised to go live after Mainnet.

Advantages of being a BSN:

Faster Finality in seconds: safer cross-chain transactions and faster on/off ramps.

Stronger Security: enganced network security.

Decentralization: allows future decentralized sequencing and verification.

Bitcoin Clearing House: permissionless mint of BTCN by depositing whitelisted collateral assets (cbBTC and wBTC). In the future, the Clearing House will transition to a permissionless marketplace with seamless swaps for different BTC derivatives.

BlueCorn: in partnership with Coinbase:

An educational hub where users can learn more about BTCFi

A dashboard aggregating yield opportunities for BTCFi assets.

Through cbBTC, users holding idle BTC on Coinbase can use it in the Corn ecosystem and mint BTCN in one click.

To truly enable its system to work efficiently, Corn focuses on native asset interoperability.

By leveraging Layerzero ($CORN and $BTCN are OFT) Corn supports native cross-chain interoperability between BTC assets enabling seamless transfers with one-click.

On the other hand, Thorchain enables native BTC bridging: Corn users will seamlessly swap their BTC for one of the synthetic BTC assets backing BTCN.

For this reason, Corn currently supports most BTCFi assets, with more coming soon:

Users can bridge their BTC assets and deposit them on vaults, to earn yield.

Currently, vaults are in the seeding phase in preparation for the CORN tge.

The Corn TGE is expected in March 2025: https://x.com/use_corn/status/1895550445420192119

However, the token is already available in pre-market on Bybit: https://x.com/Bybit_Official/status/1891699163143819332

Users can deposit BTCN, LBTC and eBTC in the harvester vaults for different rewards:

Native strategy yield

CORN apy

Points for other BTC apps, such as Lombard, EtherFi, and Veda

Users can also leverage BTCFi pools on other protocols.

These pools provide CORN rewards and points from Concrete, Avalon and Zerolend.

The receipts from these can then be leveraged in Pendle or Corn for more yield.

Community Raise

In line with the current narrative, Corn has conducted both a Legion and a Echo community raise.

Corn’s Legion sale raised $8.3m from 675 investors and was 7x oversubscribed (over 4200 applicants requesting $69 million).

Their Echo sale raised over $1.5m, from 337 new investors - for a total of over $16.5m raised (including other investors) and 1052 investors.

https://x.com/use_corn/status/1886456115011125734

On-chain data: How is Corn doing?

TVL growth steady since launch, now focusing on retention before TGE.

A good percentage of users appear to be converting into returning users and using the platform consistently.

This is evident in the % of retained users, which has been consistently above 40% until the last month when it decreased with the new users.

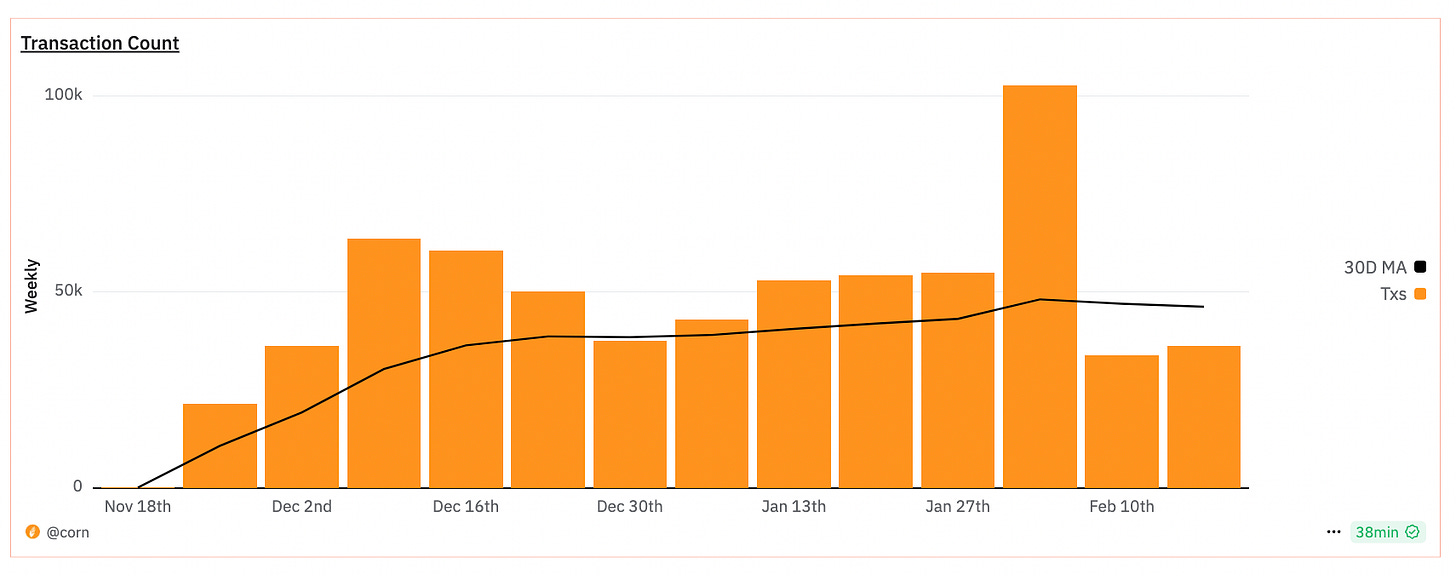

Nonetheless, the network has consistently executed over 50k weekly transactions, with a peak of over 100k during the first week of February.

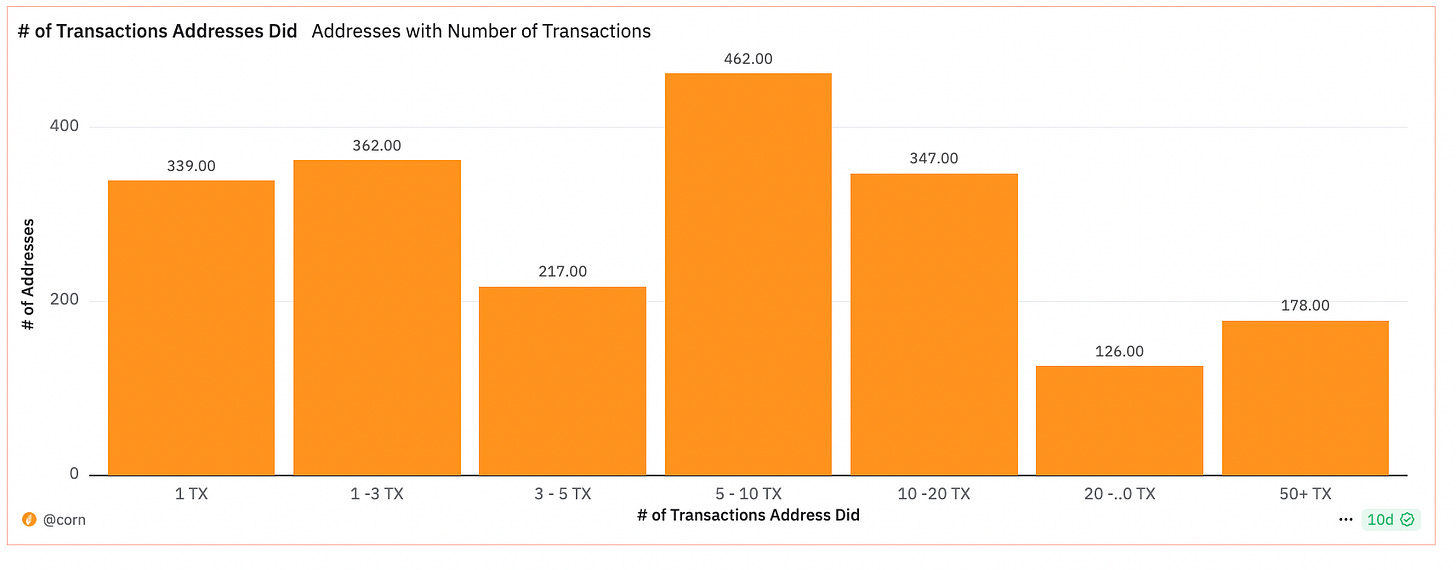

The majority of addresses appear to conduct between 5 and 20 transactions, followed by users who only conduct one transaction. This is expected, given the set-and-forget strategy of vaults.

Food for Thought

Corn brings forward a different model than others within BTCFi, by leveraging the best tech from Arbitrum, Babylon, Thorchain and Layerzero.

Bribing market for incentive alignment across participants

Native Bitcoin security

Interoperability

BTCFi yields, both native and with other protocols

The good use of incentives and the hybrid role as both a protocol for yield and a tool for other protocols position Corn uniquely within this landscape.

Bringing Bitcoin within DeFi is one of the biggest opportunities within the space. Rather than working alone, Corn is focusing on tapping into a broader layer of incentives where it can both help and benefit other ecosystem participants.