In about 4 hours Chainlink will conduct its v0.2 upgrade and introduce the Chainlink Staking Platform, with a pool of 45m LINK.

This update comes after the initial beta version of Staking in v0.1 was released last year, with a 25m LINK staking pool.

How will Staking v0.2 work?

Chainlink v.02 will be a fully modular and upgradable Staking platform providing:

Unbonding Mechanism (instead of locking up staked LINK) providing greater flexibility for stakers while maintaining a non-custodial design

Slashing of node operator stake, introducing new cryptoeconomic security for the oracle services and the Chainlink protocol

Modular architecture to support future improvements and updates iteratively

The unbonding mechanism introduces a 28 days cooldown period to withdraw staked LINK, and is introduced to make sure:

Staking pool is stable over a long period of time

Ensuring there is sufficient staked LINK to be slashed in case of a valid alert

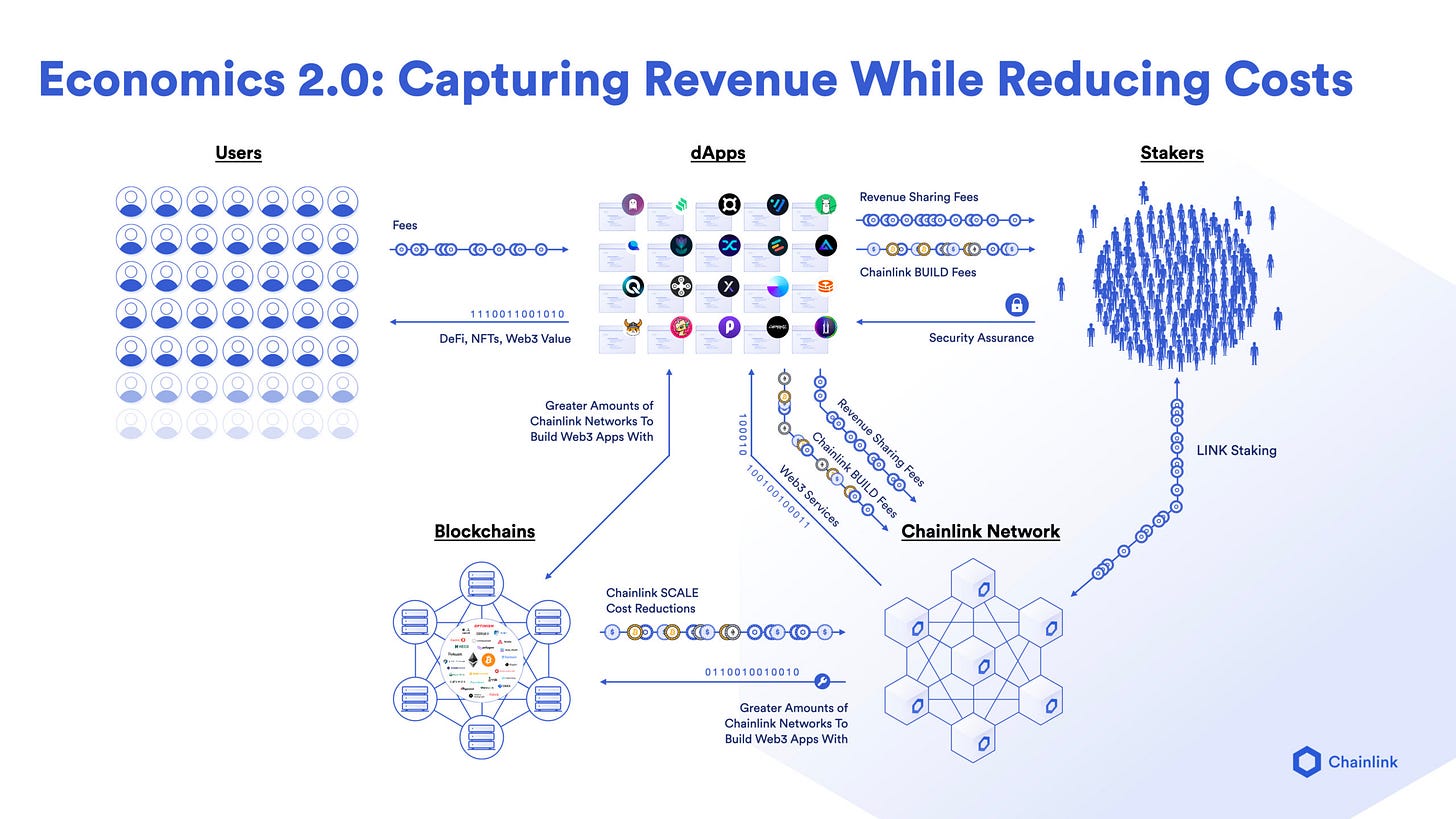

Driving Value to Token Holders

This is THE most awaited upgrade from Chainlink, providing more utility to the LINK token, and driving value back to token holders.

Below is a picture of a LINK holder waiting for staking since 2017.

Staking enables ecosystem participants to earn yield for helping to secure the network and back the oracle services provided by Chainlink with staked LINK.

The introduction of staking in Chainlink represents a significant development for LINK token holders for several reasons:

Enhanced Network Security and Trust: staking contributes to increased cryptoeconomic security by having node operators lock up LINK as collateral, ensuring they have a vested interest in the network. In case of any malicious or incompetent action by node operators, the Chainlink staking protocol supports the ability to slash a portion of their staked LINK. This alignment ensures that stakeholders are working towards the common goal of enhancing the network's value and efficiency.

Incentivization for Participation: staking allows LINK token holders to participate more actively in the network. This active participation is often rewarded, usually in the form of additional LINK tokens or other incentives. This reward mechanism can drive the value for token holders as they receive more tokens for their participation.

Reduced Circulating Supply: by staking LINK tokens, node operators reduce the circulating supply, leading to scarcity. With the demand for LINK poised to rise with the increase in services and node operators, the reduced supply could be a positive factor for the token value.

Risk Mitigation and Network Stability: by having node operators stake their tokens, Chainlink can potentially reduce price volatility and speculative trading of LINK. Moreover, an increased % of tokens in staking, reduces the possibility of large and sudden sell-offs, contributing to price and network stability.

DeFi Composability: DeFi platforms may offer innovative ways to utilize staked LINK, such as collateralization options, further enhancing liquidity.

Currently, access to Chainlink Staking v0.2 is restricted for existing v0.1 stakers and early access-eligible addresses, with public access on December 11, 2023, at 12 PM ET.

The introduction of staking is a game-changer for Chainlink.

It contributes to creating stronger cryptoeconomic security around the network while improving the token utility of LINK.

A case can be made with regard to the broader effectiveness of the latter, but regardless this update has to be received positively.

The introduction of staking was on the roadmap for a long time and is finally going to be live, leading to the fulfillment of the Chainlink 2.0 roadmap.

Soon, Chainlink will be free from the crypto Twitter stereotypes surrounding the value of LINK and its need to drive value to token holders.

The unbonding mechanism introduces a 28 cooldown period to withdraw staked LINK, and is introduced to make sure:

28 what? Days?