An Introduction to Summer Finance: The top 10 Protocol with over $2.7b in TVL

Summer Finance is a top 10 protocol by TVL, with over $2.7b of assets secured.

However, contrary to other big names on the list, many are not familiar with this protocol.

Summer Finance was previously named Oasis and was one of the first projects developed by Maker DAO to allow one-click hyper-leveraged positions.

Following the process of decentralization of Maker DAO, Summer Finance transitioned into an individual entity.

What is Summer Finance?

Summer Finance is a money market protocol where users can seamlessly deploy capital in DeFi, using three main products and an extensive suite of automation features.

Borrow

Multiply

Earn (Lending)

Thanks to the wide range of assets available on the platform, one of the most interesting use cases for Summer Finance is to leverage LSDs, which have a much lower risk of liquidation compared to other forms of collateral.

Summer Finance products leverage 4 main protocols:

Aave

Anja

Maker DAO

Spark Protocols

Product Suite

On Summer Finance you can:

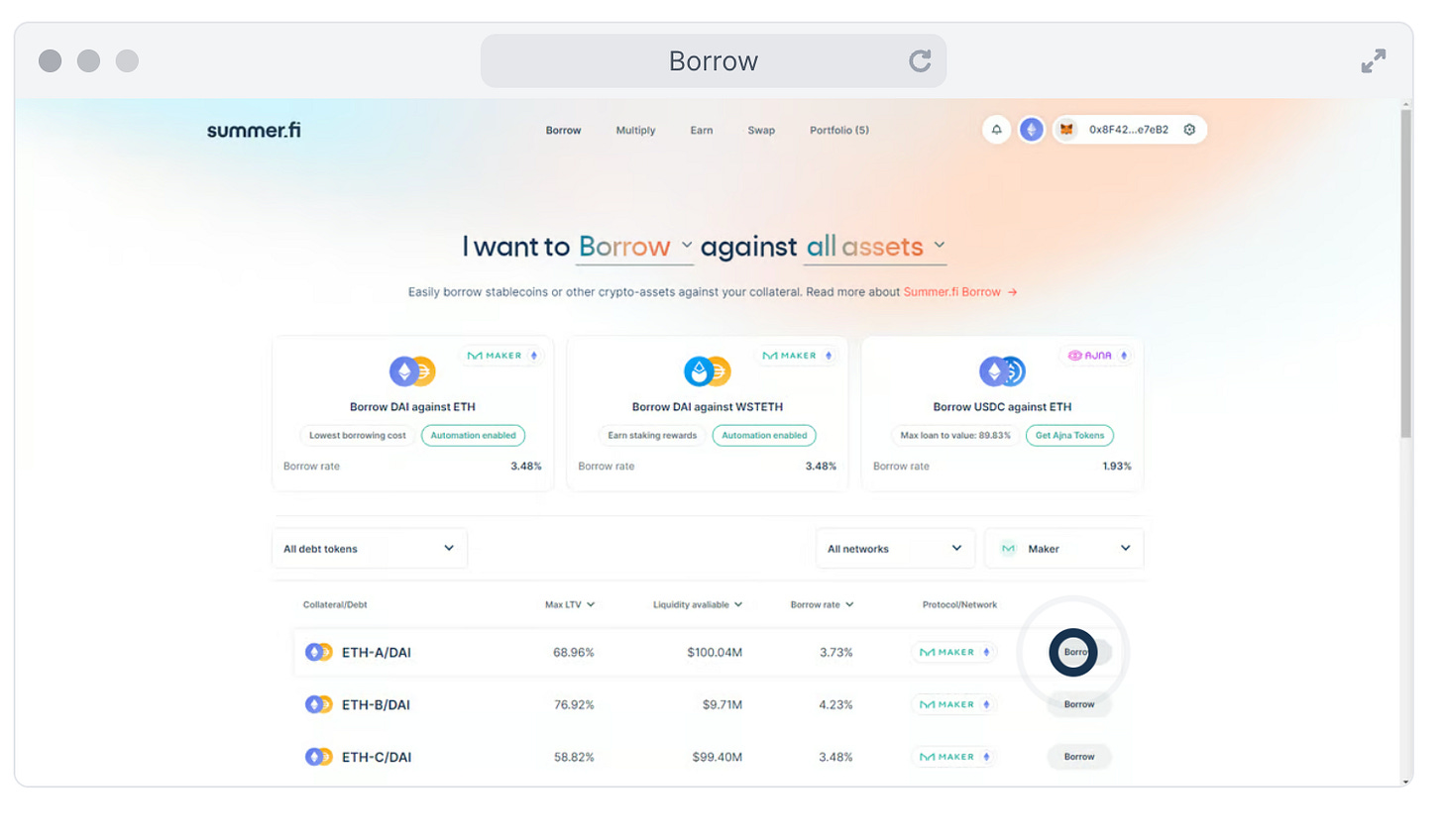

1. Borrow

Borrow any of the supported assets, to instantly unlock liquidity.

Users can select different types of collaterals, rates, and ratios, according to specific risk profiles.

By using Maker DAO and Spark Protocol, Summer Finance also provides extra liquidity for users choosing to borrow $DAI.

Last but not least, users can repay at their own pace as long as their vaults are collateralized, as there’s no fixed repayment schedule.

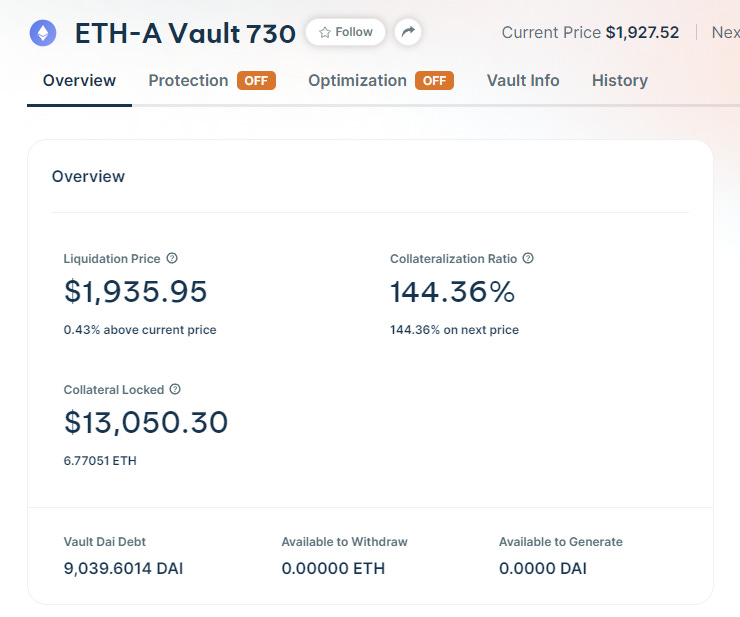

Make sure to be fully collateralized when opening a borrow position, to maintain your Vault at a stable Health rate.

How to avoid liquidation:

Keep note of the Vault ID numbers

Bookmark your Vault ID

Maintain adequate access to the Vaults

Set up price alerts for the collateral asset(s)

2. Earn

Lending assets on Summer Finance is similar to placing limits orders, where users create an order and select a price at which they are willing to buy the assets.

This is also how liquidations work: users lending are effectively signaling that if the price of the asset hits a certain threshold they are willing to swap (USDC for ETH) at that price.

Leveraging this design, Summer Finance operates without the need for oracles. In this way, the protocol is protected from Oracle exploits, one of the most common exploits for money market in DeFi.

Furthermore, Summer Finance only pays interest to the assets that are actually used, instead of everyone loaning. By only paying interest rates to the liquidity used they are able to keep interest rates low.

This also incentivizes users to place liquidity where it is most likely to be used in order to make yield.

Currently, users on Summer Finance can take advantage of:

1. Strategies leveraging Maker DAO DSR rate

Strategies leveraging AAVE and looping LSTs. For example, the StETH/ETH AAVE yield multiple is a strategy that allows you to increase the yield received from StETH by increasing your exposure to it by borrowing ETH.

3. Multiply

On Summer Finance, users can “multiply” (increase or decrease), their exposure to collateral assets in one transaction.

That is, they can leverage their borrowed tokens to buy more collateral without performing multiple transactions or resorting to third parties.

users can use ETH, wBTC, stETH, rETH or other supported tokens across available protocols to create a multiple position and take advantage of upward trends of the supplied collateral.

To use a more familiar term, Summer Finance facilitates these flesh loans from the most liquid protocols, guaranteeing the cheapest execution and price.

How to open a multiply position:

Deposit collateral

Select a loan to value

Execute in a single transaction and open a position

Flash loan the required amount to swap for collateral

Lock collateral into position

Generate debt to pay back flash loan

Users can get up to 5x their exposure, depending on the collateral chosen.

Furthermore, thanks to the automation users will be able to adjust the position with just one transaction.

In fact, it’s really important to monitor your positions and manage them to avoid liquidations, including:

Adjusting position (collateralization ratio)

Deposit/Withdraw collateral

Withdraw/Deposit DAI

Adjusting multiple factor

Closing the vault

Be mindful that all multiply swaps incur a 0.2% fee, and all ongoing multiply positions pay a borrowing rate to the respective protocols (changing with utilization).

Food for Thought

To conclude, Summer Finance offers a money market protocol with isolated pools, where there’s no exposition to other pools.

By only paying interest rates to the active loans, the protocol is able to keep its interest rates much lower than other protocols. Furthermore, this design also allows the protocol to fulfill liquidations without the need for an oracle, with a design similar to an order book, where all lenders specify their price, de facto creating limit orders.

The flexibility of repayments, coupled with the high amount of assets available make Summer Finance one of the best places where users can farm yields on their LST, ETH, or stablecoins.

The simplicity of deployment and position management, coupled with all the features we have mentioned above, explain why the protocol has over $2.7b in TVL.