Aevo exchange is now Live on Mainnet and Open to the Public! 🚀

Finally, DEXs are ready to support more advanced strategies.

Aevo Caesar!

Finally, DEXs are ready to support more advanced strategies.

Here's how to make the best of the market using Aevo exchange, a new DEX for options, and Perps on Arbitrum.

For those who are not familiar with Aevo, I have already written a short introduction to the protocol;

This post is made in collaboration with the Aevo team for the launch of the Aevo mainnet.

The Aevo Exchange

The main purpose of Aevo can be summed up as allowing users to trade on-chain and

with size, solving two of the pain points of traditional DEXs.

What can you do on Aevo?

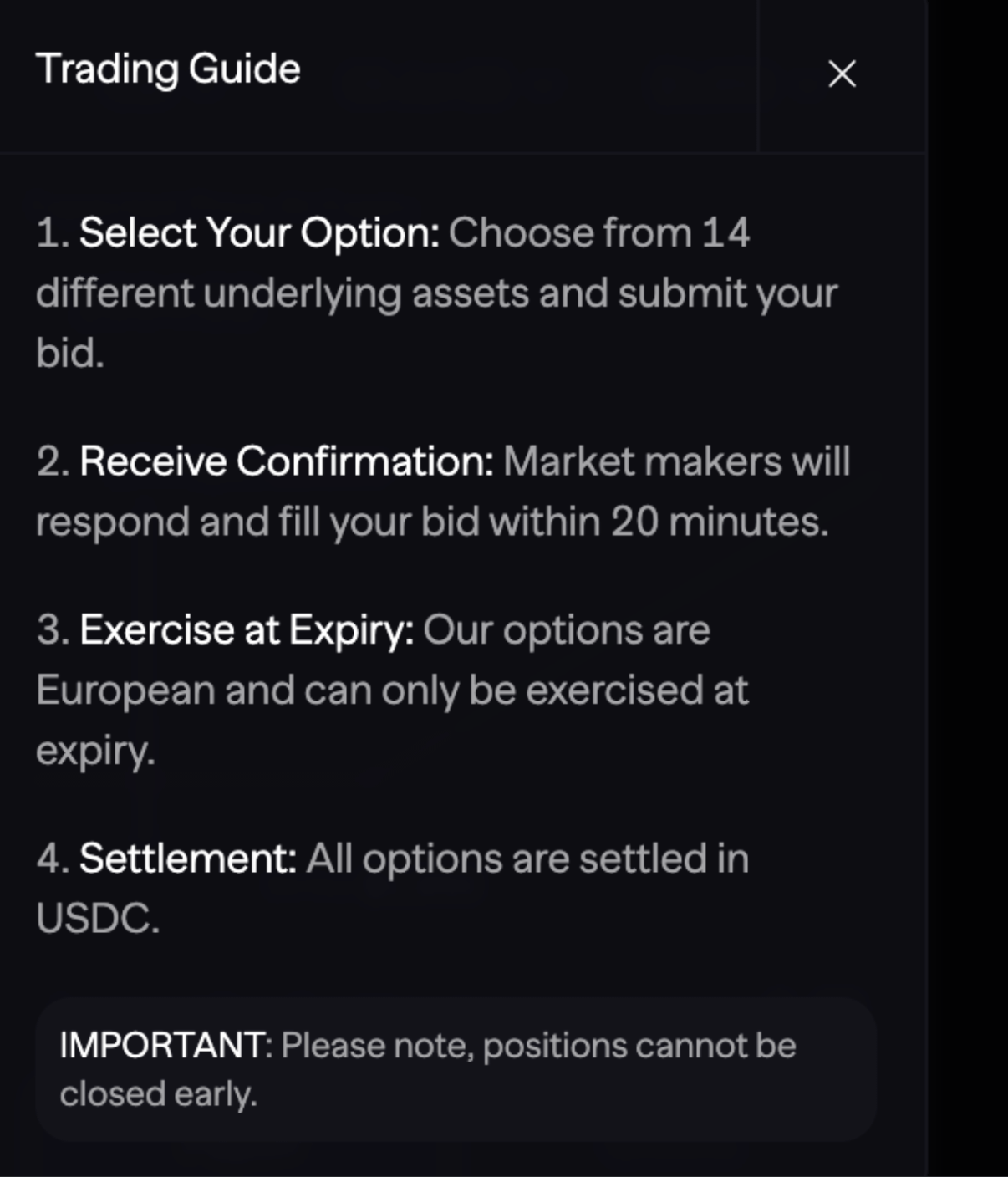

Aevo OTC: an altcoins options platform where users can trade with size and institutional grade liquidity.

This is made possible by two main features in particular:

The RFQ Network, comparable to an off-chain OTC desk connecting to market makers and liquidity providers.

This in turn improves the exchange's capital efficiency and offers real-time pricing and liquidity.

A Dynamic Margin System: requiring a 30% initial margin from liquidity providers, and dynamically adjusting based on the trade’s value.

All margin is securely locked on-chain.

This ensures that options sellers on Aevo OTC are required to post collateral on-chain so that everyone can see it, increasing the security of the exchange.

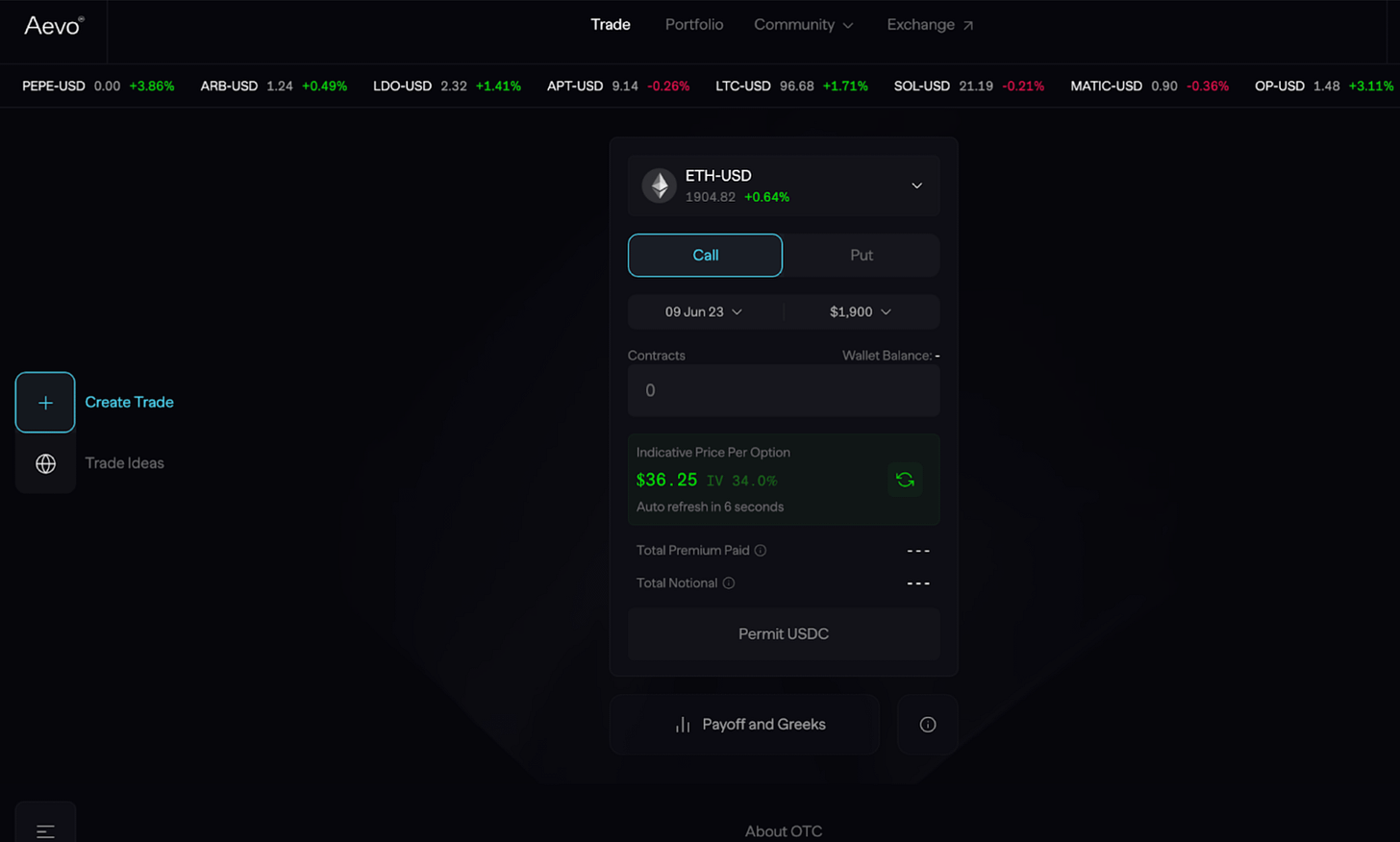

Currently, users on Aevo can purchase BTC options and ETH Options:

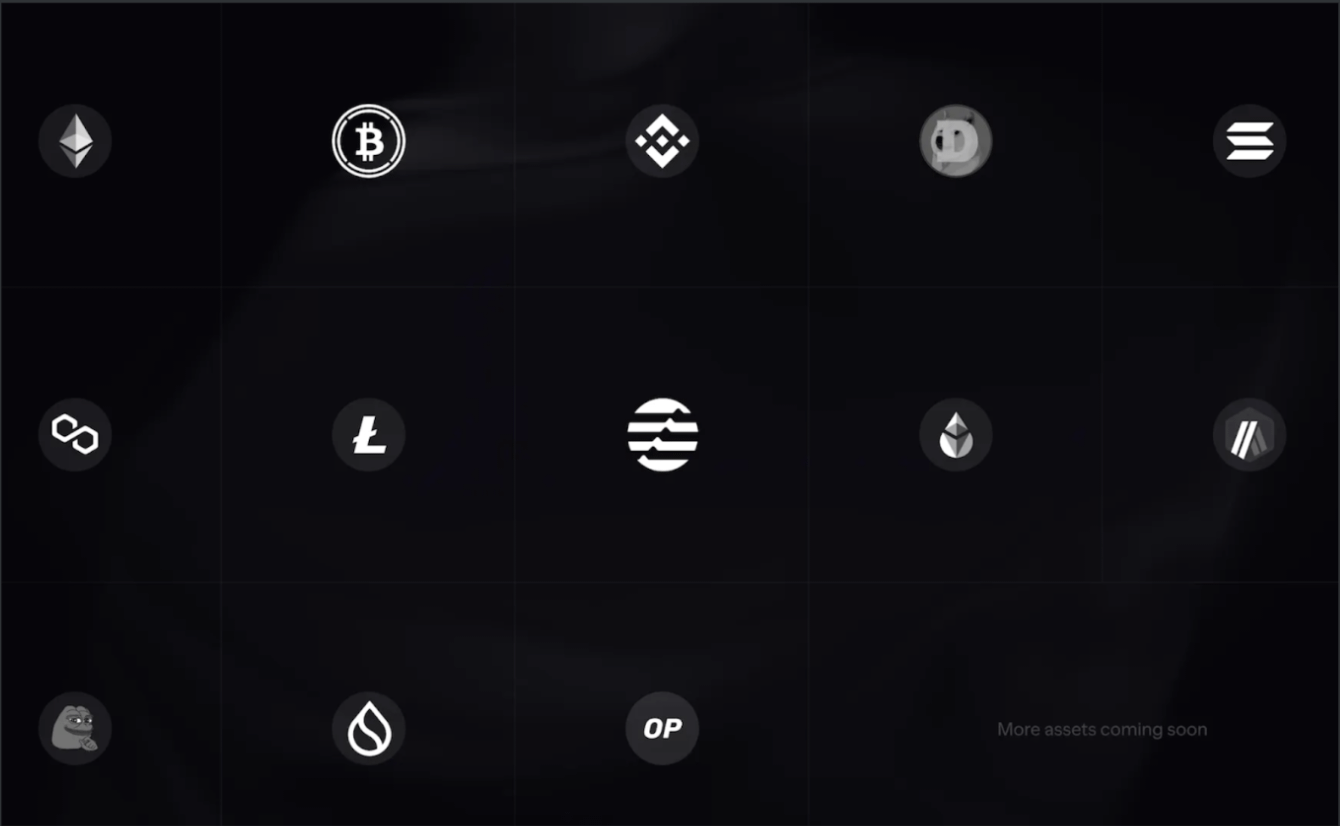

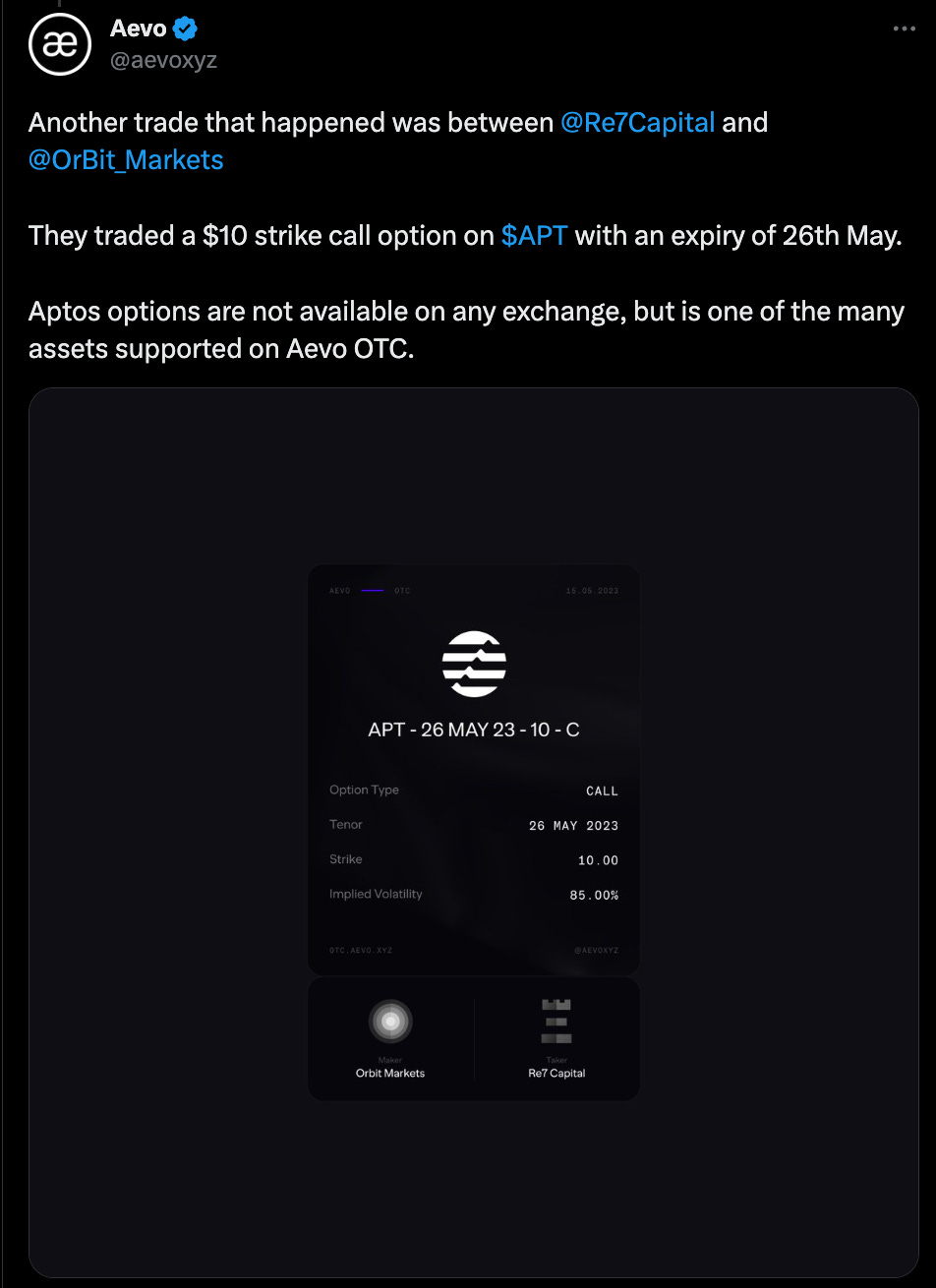

Further on, Aevo will offer 13 different coins, including lesser utilized coins such as Pepe, Sui, and Aptos Options - the latter currently only available to trade on Aevo.

More coins mean traders have more choices and are not only limited to the main assets.

Aevo OTC is already functional and has seen its first trade:

an ETH option with a fully on-chain margin and settlement.

Another example of how to use Aevo OTC:

How would trading Options work on Aevo?

Aevo is committed to adding new assets soon: it currently supports trading for ETH and BTC options and perpetual.

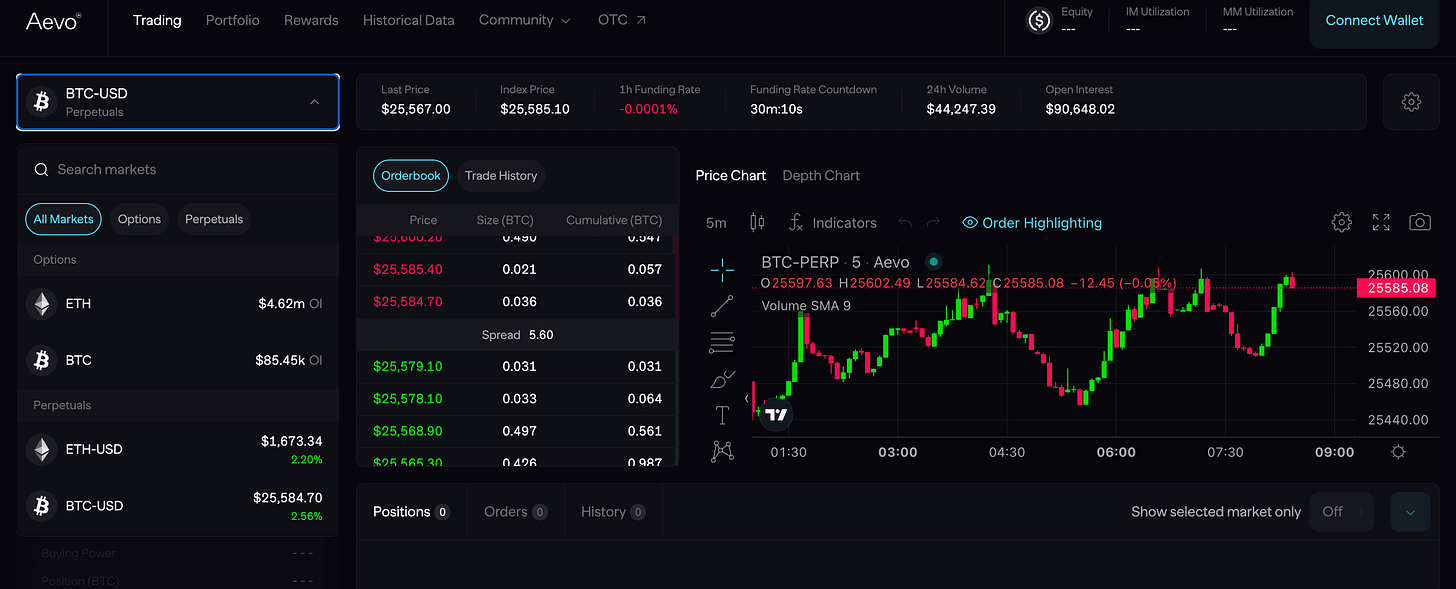

2. Aevo Perpetuals

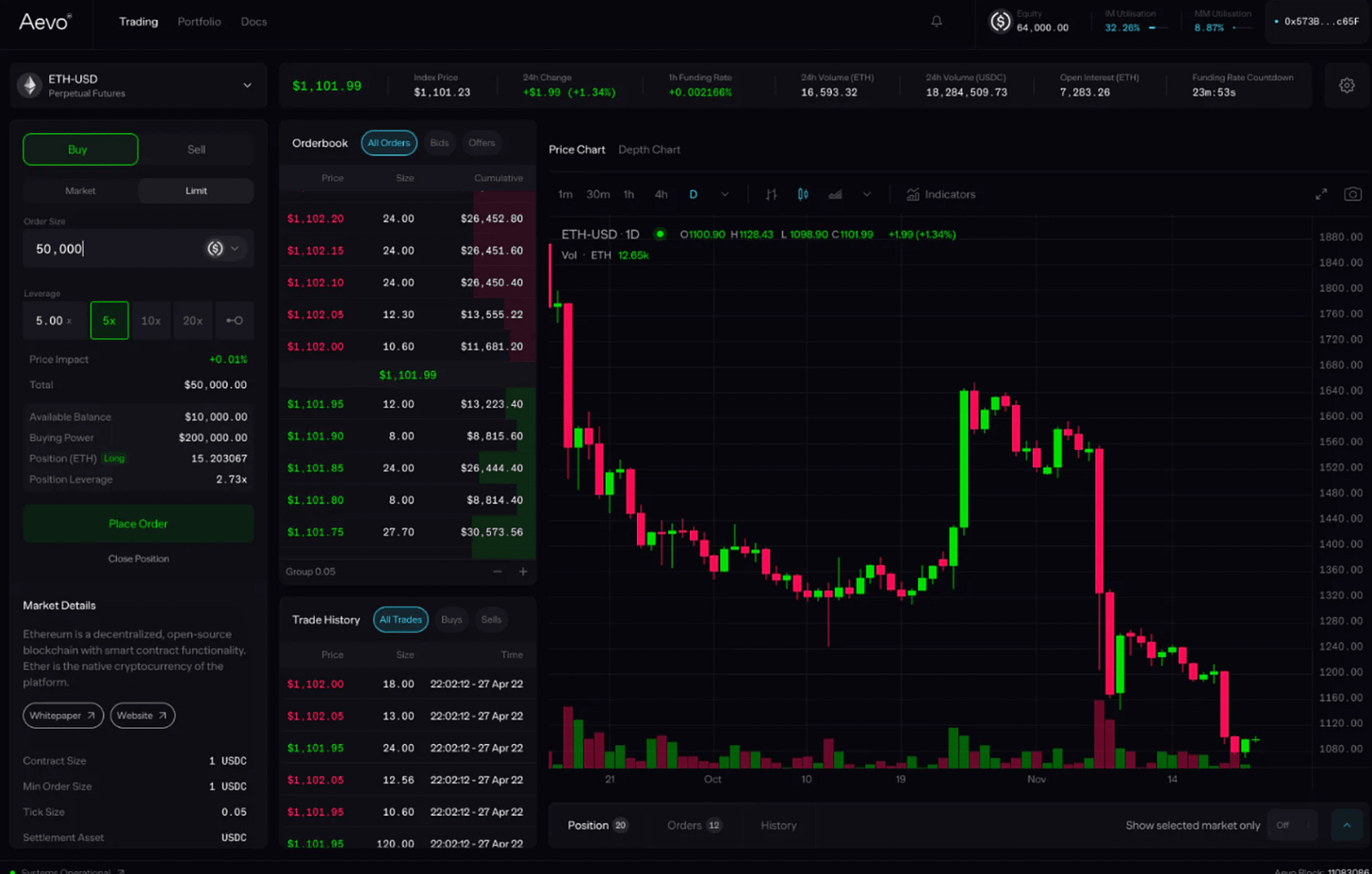

Aevo users can now trade ETH perps with up to 20x leverage.

Why Perpetuals?

Being able to hedge their “delta” is a key component for options traders.

As such, Perpetuals and Options go hand in hand.

Supporting perpetual futures means that Aevo allows them to hedge their risk without recurring to third parties or other markets, improving capital efficiency.

Another interesting feature introduced by Aevo is a “Portfolio Margin” system that encompasses both options and perps, allowing users to trade both at the same time in a capital-efficient manner.

This blog post by Ribbon Finance goes into detail on how you can leverage Aevo to build Volatility and Delta Hedging Strategies.

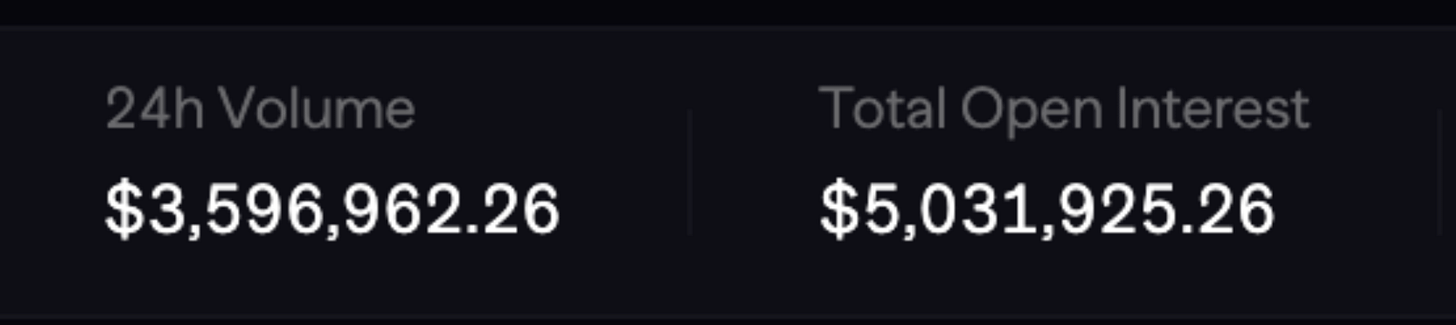

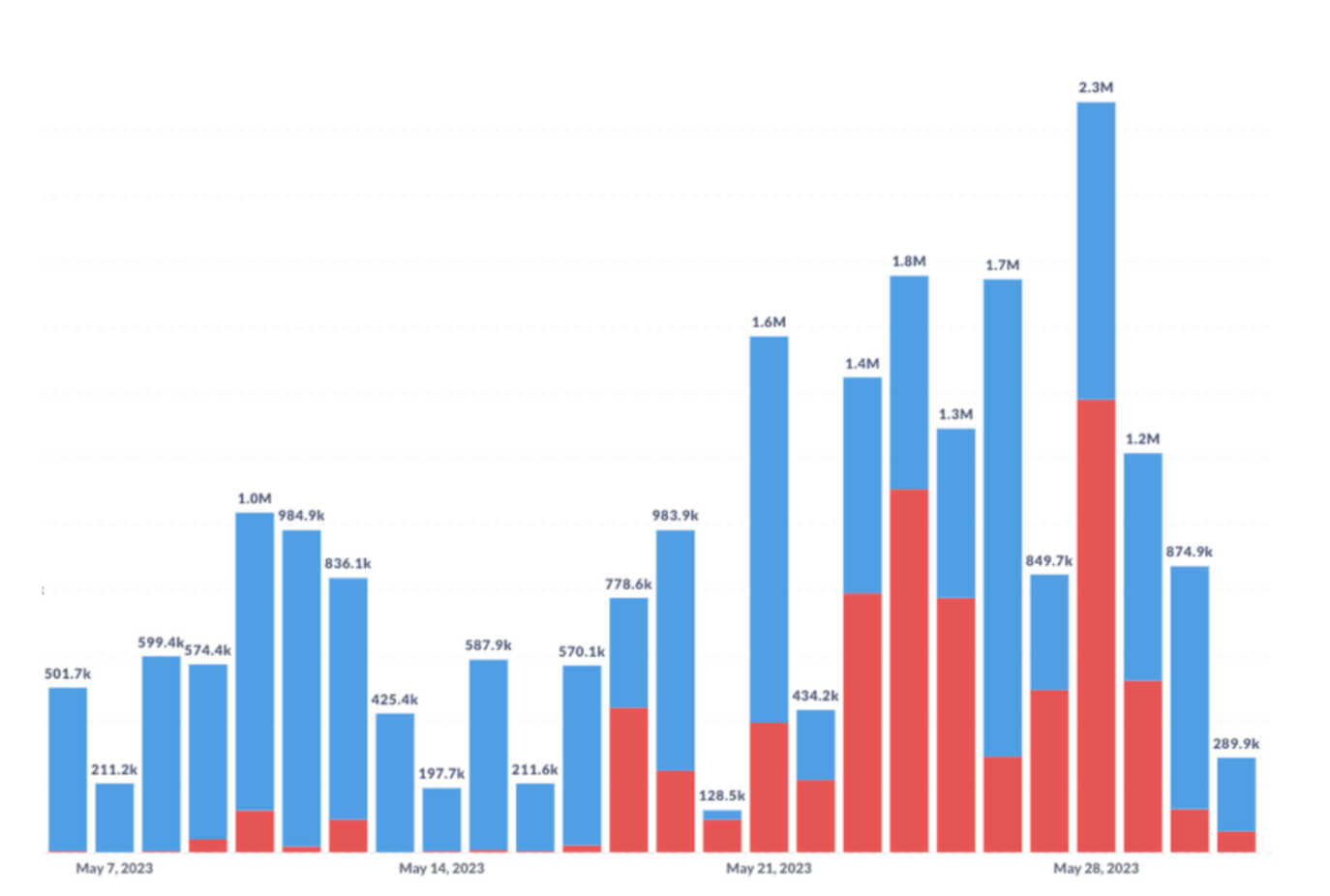

In the last week, Aevo experienced its ATH in terms of volume:

We can also observe how since their launch, Options (in red), have increased their daily notional volume on Aevo.

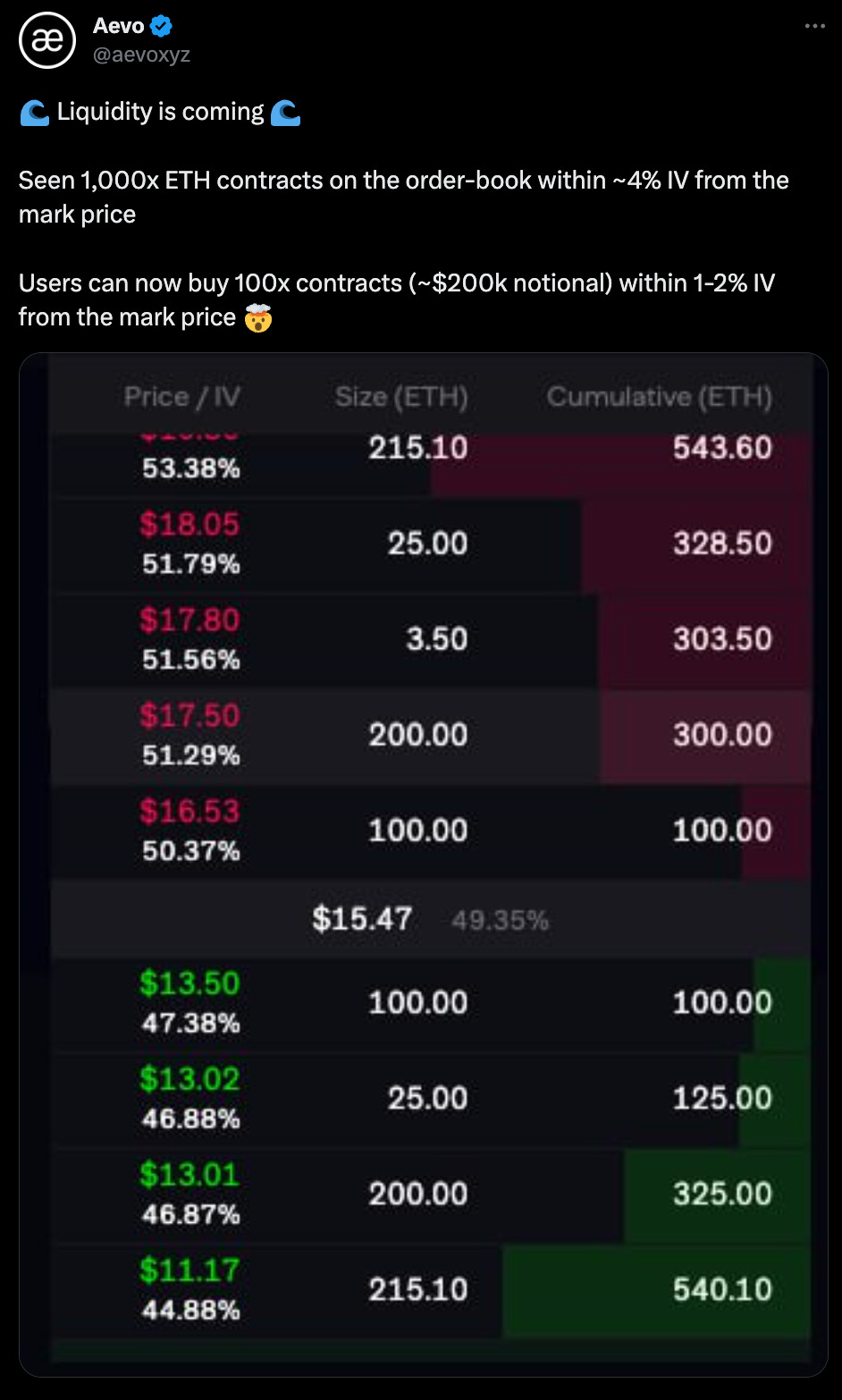

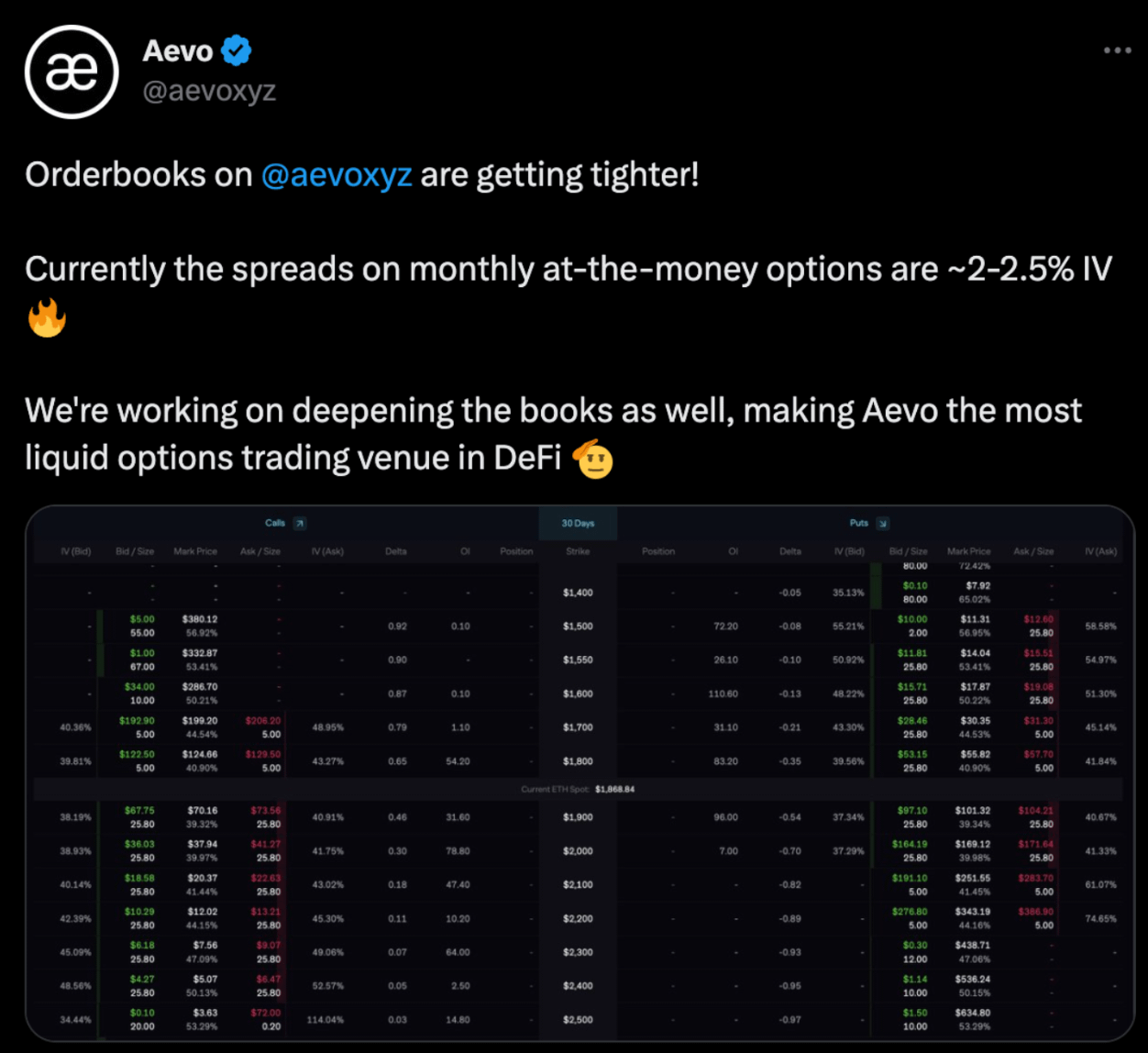

Liquidity is coming too!

More liquidity opens the door for trading with larger size, and further scalability could lead to an increased appeal toward institutional investors

This is a major pain point of current DEXs, which often leads to higher price impact and slippage and thus inconvenient trading.

Aevo Exchange will be an interesting case to observe how a hybrid between an off-chain order book with an on-chain settlement model will work, as there’s a lot of debate around the feasibility of order book DEXs in DeFi.

Aevo is Live on Mainnet.

Make sure to give it a try.

In order to incentivize new users, they are taking a snapshot of all the new users for the first 2 weeks - until June 28!

Furthermore, after the success of the first incentive program, Aevo has announced that they will continue offering Taker rewards - so there are a couple of interesting incentives if you want to try it out.

Food for Thought

The emergence of new DEXs is symptomatic of the switch from centralized exchanges.

Even more these days, that we have seen Binance withdrawing from the Dutch market and closing its Cyprus registration.

I believe this segment of the market will be one of the best performing in both market conditions.

Users will always trade and the development of products like Aevo, which try to step up what can be done on a DEX have to be watched carefully.

Improving both the trading conditions and experience of DEXs will be one of the areas where most innovation will flourish.

The days of CEXs are numbered.