AVAX is experiencing an incredible moment.

The whole ecosystem as a whole is thriving and advancing its roadmap and developments.

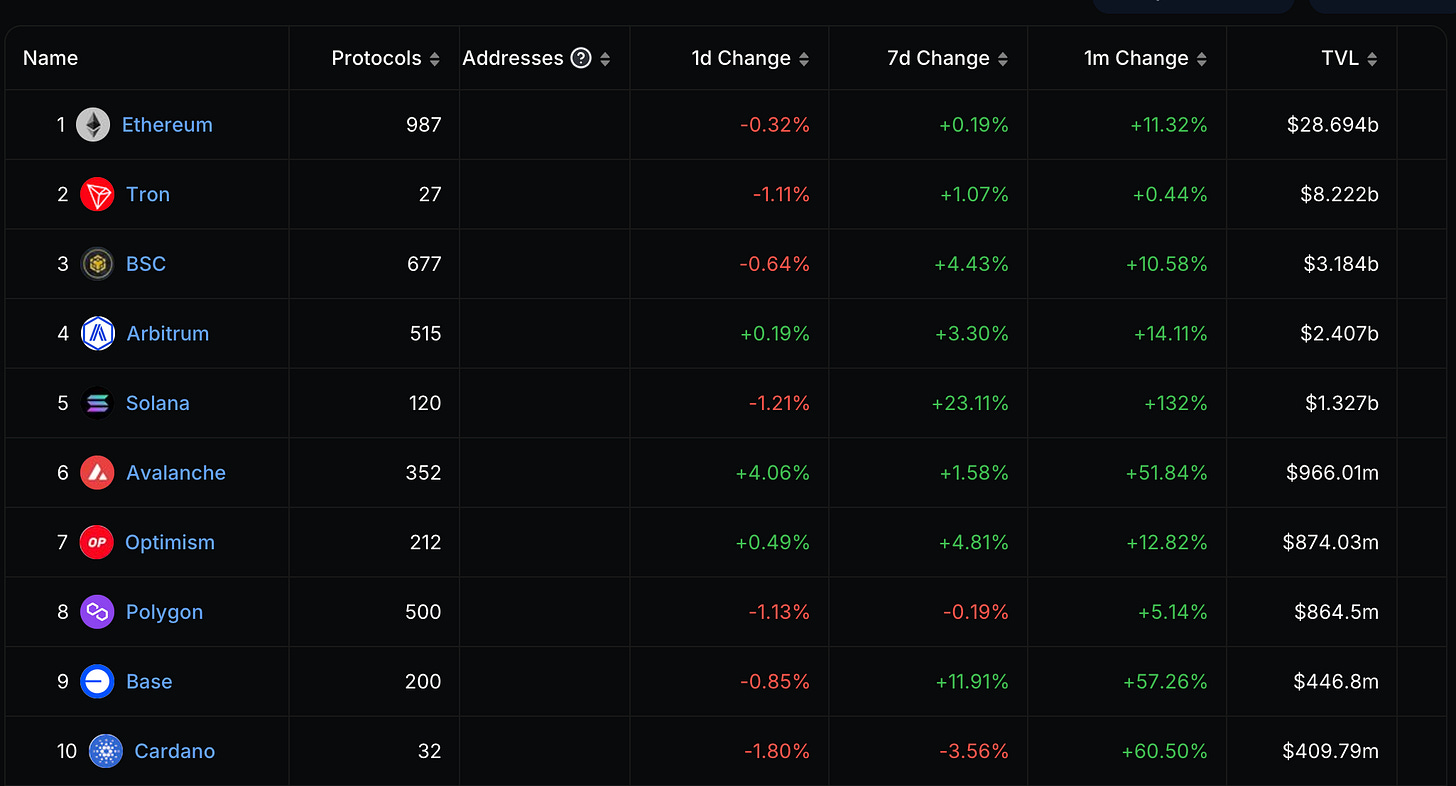

Currently, it is positioned as the 6th ecosystem by TVL, with almost $1b in TVL, a 50% increase during the last month, second only to what was experienced by Solana.

This positive moment is reflected in the top 5 protocols on AVAX, which have all experienced great TVL capture during the last month. In particular, Trader Joe is now one of the most profitable protocols, with over $440k in fees during the last 24 hours (as of December 23rd).

AVAX has been experiencing similar growth to SOLANA, as it is possible to observe from the chart below about Daily Active Users - from 23k in September 2023 to over 80k in December 2023.

The memecoin mania of the past few weeks has also contributed to a huge increase in Daily Transactions, which have gone up from slightly over 100k to almost 10m daily.

As foreseeable, most of this increase in daily transactions has been captured in the form of increased DEX volumes, further establishing Trader Joe as one of the key pillars of the AVAX ecosystem.

The chart below is self-explanatory, with AVAX's price going up over 400% in a relatively short period.

And, of course, bringing the TVL back up, to almost $1b.

What’s particularly good for the ecosystem is that even considering the Solana rotation or other networks getting increasingly heated, stablecoins deposits on AVAX continue to outsize outflows, thus showing the potential for this momentum to last much longer and not be just a mercenary wave.

What’s setting AVAX aside from its L1 competitors is its hybrid approach: on the one hand the chain has been at the center of CT with memecoins and tokens like $COQ picking up. On the other, AVAX has always carefully curated its ecosystem and established subnets as sandboxes to test new ways to incorporate off-chain assets on-chain.

AVAX’s plan has been clear since the launch of Vista, a $50m project for wider asset tokenization.

This is exemplified by their last RWA pilot together with Citibank, using AvaCloud and Avalanche Warp Messaging to create a “new on-chain pricing solutions to track real-time streaming of price quotes fo Forex Contracts, as well as recording trade executions on Avalanche”.

By offering an easy way to be compliant for institutional AVAX is proving to be one of the best-positioned partners for institutional developments within DeFi.

Coupled with being one of the first avenues for the launch of EUROC, Circle’s stablecoin backed by Euro, AVAX is poised to have one of the most interesting ecosystems for institutional investors.

EUROC contributes to differentiate stablecoins collateral and offers European citizens an alternative to US-dollar-backed stablecoins.

To conclude, AVAX is experiencing a proper reinnassaince.

What was once a calm and stable ecosystem is now seeing new developments from all fronts. I am personally in favor of the shift of AVAX towards a more institutional-compliant ecosystem, filling a market gap that can prove to pay off immensely given the recent developments in the market.

The ETF approval is expected to be a major green light for further institutional participation within DeFi, and AVAX is set to benefit immensely from it, given its positioning.

Last but not least I believe it’s important to mention that AVAX could benefit from an airdrop wave, just like Solana is currently doing.

There are, in fact, a lot of tokenless protocols.

Don’t get lazy, get the top 50 protocols on AVAX and go through them, as it may pay off massively.

More great threads on AVAX:

https://twitter.com/wacy_time1/status/1708546116361531471

https://twitter.com/wacy_time1/status/1725184613880893797

AVAX Tokens:

https://twitter.com/matrixthesun/status/1738211857712943201

on Avax and Gaming:

https://twitter.com/Flowslikeosmo/status/1730980222655484219

https://twitter.com/Flowslikeosmo/status/1738363821738414328

https://twitter.com/Flowslikeosmo/status/1737898585415381179